From Dean Baker Peter Coy used his column yesterday to beg President Biden not to use the term “greedflation” to explain the runup in inflation since the pandemic. I am sympathetic to much of his argument, most importantly, the idea that corporations suddenly turned greedy is a bit far out. As Coy notes, corporations are always greedy. The real question is whether something unusual was going on with corporate profits in the pandemic. There clearly was an increase in profit margins in the pandemic. This was largely due to real shortages created by supply chain problems worldwide. We can say this with a high degree of certainty because inflation was a worldwide story. This means that the idea that it was due to Biden’s “excessive” stimulus is silly. While the U.S. is a huge part of the

Topics:

Dean Baker considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Dean Baker

Peter Coy used his column yesterday to beg President Biden not to use the term “greedflation” to explain the runup in inflation since the pandemic. I am sympathetic to much of his argument, most importantly, the idea that corporations suddenly turned greedy is a bit far out.

As Coy notes, corporations are always greedy. The real question is whether something unusual was going on with corporate profits in the pandemic. There clearly was an increase in profit margins in the pandemic. This was largely due to real shortages created by supply chain problems worldwide.

We can say this with a high degree of certainty because inflation was a worldwide story. This means that the idea that it was due to Biden’s “excessive” stimulus is silly.

While the U.S. is a huge part of the world economy, higher demand here could at most only explain a small fraction of the inflation in countries like the U.K. and Germany. The fact that their inflation has been similar to U.S. inflation since the pandemic, undermines the idea that Biden’s recovery package was the main factor in the U.S. inflation surge.

I have made this argument before and been told that people don’t care about inflation in the U.K. and Germany, they care about inflation here. That’s fine, but as an economist I’m trying to explain causation.

Any fool can look out over the horizon and see the earth is flat, the curvature of the planet is not generally visible in our range of vision. But we know the earth is in fact round, and no serious person is going to insist it is flat.

Similarly, we know inflation was a worldwide phenomenon due to the pandemic. If people want to yell at Biden over it, that is their right, but let’s not pretend that complaint is based in reality.

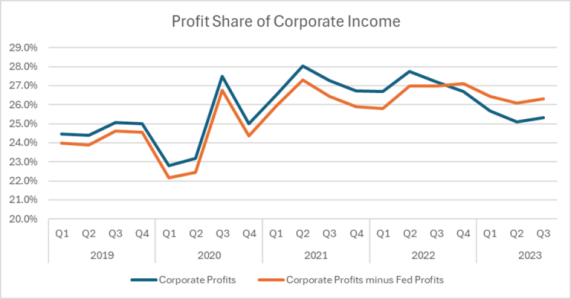

But let’s get back to “greedflation,” or “sellers’ inflation” the term used by Isabella Weber, the most prominent academic proponent of this view. There can be little doubt that there was a big shift to profits in the pandemic. Here’s the picture on the profit share of corporate income.

Source: Bureau of Economic Analysis and author’s calculations, see text.

It goes from just under 25.0 percent to a peak of 28.0 percent in the second quarter of 2021. (This calculation is corporate net operating surplus, NIPA Table 1.14, line 8, divided by employee compensation, line 4, plus line 8.) However, since that peak the profit share has shifted down somewhat to 25.7 percent in the third quarter of last year, the most recent quarter for which we have data. This implies that further rises in profit shares have not contributed to inflation in the last two and a half years, but we are still seeing a disproportionate share of national income going to profit. Corporations are still keeping more than a quarter of their pandemic windfall.

I have included a second line that shows a somewhat less optimistic picture from the standpoint of those who don’t want to see corporations pocket everything. This line subtracts out the profits reported by Federal Reserve Banks (NIPA Table 6.16D, Line 11). These profits are refunded to the Treasury and should not be viewed as part of corporate profits.

Making this subtraction gives a slightly different path of profits over the course of the pandemic. Profits go from 24.6 percent of income in the fourth quarter of 2019 to a peak of 27.3 percent in the second quarter of 2021. This implies a similar but somewhat smaller runup than what is shown without this adjustment.

But we get a very different picture on the other side. The Fed banks are now losing money (short story, they were nailed by the rise in interest rates). This means that their losses are now being subtracted from the profits earned by the corporate sector, causing the published number to be somewhat lower than is actually the case.

Using this adjustment, corporate profits stood at 26.3 percent of income in the most recent quarter. This implies that corporations are still pocketing more than 60 percent of their pandemic dividend.

This still raises the question of whether corporations were taking advantage of their market power to push up profit margins. Keep in mind, it would not be surprising that there is a shift to profits when we see short-term shortages, that is pretty much a textbook outcome. The question is whether there was something more going on due to the greater monopolization of the U.S. economy than in past decades.

I am still agnostic on this point, but I will note three issues.

First, it seems clear that in a context of general inflation, corporations are better able to jack up their prices beyond the increases in costs they actually see. When all prices are rising 7-8 percent, it seems easier to raise your own prices by this amount, or maybe even more, whether or not that reflects actual costs.

The second point is that the rise in margins seems to be surviving beyond the supply-chain crisis. Perhaps we will see further reductions in margins going forward, but supply chains were pretty much back to normal by the start of 2023, but we still see inflated margins. This suggests something other than supply chains was the cause or at least that the effect is enduring beyond the period of actual shortages.

The third point is that inflation was worldwide. I have not looked at profit margins in other countries (perhaps someone else has these data), but we generally think that Europe has been somewhat more aggressive in enforcing anti-trust rules than the U.S. If profit shares have increased everywhere by similar amounts, that would argue against the idea that the issue was excessive monopolization in the U.S.

In any case, the data are clear, corporations are taking a larger share of the pie now than before the pandemic. Go nail the bastards, President Biden!