This article first appeared in the Indian journal Economic and Political Weekly on 18 July 2022. A Murder in Konya Konya is a province in Turkey. On 6 July 2022, about an hour before I started writing this article, a murder news hit the Turkish pages of the internet: “In Konya City Hospital, a patient shot and killed a cardiologist and his secretary today.” Whether the assassin committed suicide or the private security killed him is unknown, although there are both rumours. City hospitals, the third largest public–private partnership (PPP) endeavour in Turkey, are the second leg of the Healthcare Reform Programme started by the governing Justice and Development Party (JDP) after it won the election in the late 2002. Also known as the Health Transformation Programme, the World Bank

Topics:

T. Sabri Öncü considers the following as important: Article, Economics & Ideology, investment, Long Read, public debt, sovereign debt

This could be interesting, too:

Jeremy Smith writes UK workers’ pay over 6 years – just about keeping up with inflation (but one sector does much better…)

T. Sabri Öncü writes Argentina’s Economic Shock Therapy: Assessing the Impact of Milei’s Austerity Policies and the Road Ahead

T. Sabri Öncü writes The Poverty of Neo-liberal Economics: Lessons from Türkiye’s ‘Unorthodox’ Central Banking Experiment

Ann Pettifor writes Global Economic Governance: What’s “Growth” Got to Do with It?

This article first appeared in the Indian journal Economic and Political Weekly on 18 July 2022.

A Murder in Konya

Konya is a province in Turkey. On 6 July 2022, about an hour before I started writing this article, a murder news hit the Turkish pages of the internet: “In Konya City Hospital, a patient shot and killed a cardiologist and his secretary today.” Whether the assassin committed suicide or the private security killed him is unknown, although there are both rumours.

City hospitals, the third largest public–private partnership (PPP) endeavour in Turkey, are the second leg of the Healthcare Reform Programme started by the governing Justice and Development Party (JDP) after it won the election in the late 2002. Also known as the Health Transformation Programme, the World Bank supported the programme from its initiation in 2003 with two adaptable programme loans. The World Bank also provided technical guidance and shared the experiences of other countries (World Bank 2018). The second leg is officially known as the Health PPP Programme (also supported and partially funded by the World Bank) and started in 2010 (IFC 2018).

Of course, such homicides and other forms of violence in the healthcare sector are neither only because of the ongoing Turkish City Hospitals experiment nor new nor unique to Turkey. But there is no doubt that their frequency and intensity have increased after the Deng-Volcker-Thatcher-Reagan Revolution of 1978-1980, starting in the mid-1980s (see, for example, Leather 2002).

Deng-Volcker-Thatcher-Reagan Revolution

David Harvey (2005) coined the Deng-Volcker-Thatcher-Reagan Revolution in his book titled A Brief History of Neoliberalism. Also called the neo-liberal revolution, the economic programme of this revolution consists of three pillars (Öncü 2018): (i) Fiscal reforms to “generate savings,” that is, “austerity,” by eliminating the concept of public goods and services; (ii) structural reforms to “enhance competitiveness and growth,” such as privatisation of public assets as well as the provision of public goods and services, and deregulation of the markets, including the labour market, that is, “labour market flexibility”; and (iii) financial reforms to “enhance financial stability,” such as central bank independence, prohibition of direct central bank lending to the government, bringing inflation under control, and opening the borders to capital flows (capital account liberalisation).

And in 1980, if not earlier, two sister international financial institutions (IFIs) created in 1944, the International Monetary Fund (IMF) and the World Bank, became the promoters of this economic programme at the country level through what is known as the structural adjustment programmes (SAPs).

The original task of the IMF was to help the countries tackle temporary balance-of-payment deficits by providing short-term loans. The original purpose of the World Bank was to provide financial assistance, that is, long-term loans for the reconstruction of the countries devastated by World War II and for others to “develop.” Although created as overseers of Keynesian principles of government intervention, these IFIs transformed themselves into adherents to free-market principles advocated by monetarists, led by the economist Milton Friedman of the University of Chicago, to oversee the country-level implementations of the economic programme (Pfeiffer and Chapman 2010).

The Revolution in Turkey

The Deng-Volcker-Thatcher-Reagan Revolution arrived in Turkey in two waves, the first of which hit in 1979 with a balance-of-payments crisis, forcing the Turkish government to approach the IMF for short-term loans. The IMF and World Bank imposed a SPA on Turkey.

The government prepared a “stabilisation” programme approved by the IMF on 24 January 1980, and the Turkish military -supported by the United States (US) Administration and domestic capitalists- attempted to guarantee the programme’s implementation with the coup d’état of 12 September 1980.

However, such attempts have never been highly successful, and Turkey had to wait for about 20 years for the second wave to arrive to make further progress. An exemplary success before the second wave was the capital account liberalisation of 1989. No other country that participated in the revolution managed to open the doors of its borders to capital flows as widely as Turkey did.

The second wave stroke Turkey in 2001. At that time, Turkey had been running a disinflation programme based on a crawling peg of the Turkish lira to the US dollar, approved and monitored by the IMF since 1999. Experience indicates that all such pegs break one day, and this one was no different. The peg broke in February 2001, and in March 2001, a capital exodus through the wide-open Turkish borders ensued. The lira lost about 50% against the dollar, and, on top of this currency crisis, a banking crisis followed. And then, the coalition government of the time went to the IMF and WB for the umpteenth time.

But, even after this umpteenth “stabilisation” programme, the coalition government collapsed. An early election in November 2002 during this economic turbulence started the now almost 20-year reign of the JDP in Turkey, and the ongoing looting began.

The Theory of Looting

Akerlof won the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel in 2001, whereas Paul M Romer won the same prize in 2018. Way before these prizes, in 1993, they penned an article, “Looting: The Economic Underworld of Bankruptcy for Profit,” in which they defined looting as going broke for profit (bankruptcy for profit) at the expense of society instead of going for broke (gambling on success). They showed that bankruptcy for profit “will occur if poor accounting, lax regulation, or low penalties for abuse give owners an incentive to pay themselves more than their firms are worth and then default on their debt obligations” and is most common “when a government guarantees a firm’s debt obligations” (Akerlof and Romer 1993). I mention that the government may guarantee the income of the firm also, as is the case with most PPP projects in Turkey.

They wrote:

If so, the normal economics of maximizing economic value is replaced by the topsy-turvy economics of maximizing current extractable value, which tends to drive the firm’s economic net worth deeply negative. Once owners have decided that they can extract more from a firm by maximizing their present take, any action that allows them to extract more currently will be attractive-even if it causes a large reduction in the true economic net worth of the firm.

(Akerlof and Romer 1993)

The Turkish PPP experiment of the last 20 years showcases the Akerlof and Romer theory of looting. Without the debt and income guarantees provided by the Turkish government, many of the Turkish PPPs cannot survive bankruptcy. Indeed, many have sought debt restructuring in recent years (Özgür 2018). This experiment also provides many examples for the claim of two IMF researchers, Jin and Rial (2016):

Large fiscal costs and fiscal risk have arisen from PPPs in both developing and advanced countries. Both traditional procurement and PPPs share common project risks, such as construction and demand risks. However, the above government bias and possible manipulation of PPPs add an important layer to the common project risks. An inadequate budgetary and/or statistical treatment may allow governments to ignore the impact of PPPs on public debt and deficit. In practice, governments often end up bearing more fiscal costs and risks than expected in the medium and longer term.

PPPs in the JDP Era

After the November 2002 election victory, the JDP took ownership of the 2001 “stabilisation” programme approved by the IMF and followed it through until it expired in February 2005. It then signed another three-year standby agreement for a $10 billion loan in May 2005 to continue the programme. Since May 2005, Turkey has not signed any agreement with the IMF, and the JDP paid the last instalment of the IMF loans in 2013, paying a total of $23.5 billion over a decade (Öncü 2018). However, the JDP’s firm ties with the WB, which guides, supports and monitors the ongoing structural reforms component of the 2001 “stabilisation” programme, remain.

Under the guidance of the World Bank, the JDP has performed the most aggressive privatisation programme of all governments since 1980. It has sold thermal power plants, hydroelectric power plants, ports, land, the public economic enterprises except the remaining 20, and other public assets for the measly total of $62.3 billion from 2003 to 2021 (T24 2021).

The performance of the JDP in the area of PPP projects has been even more exemplary. In 2018, Sedef Yavuz Noyan, head of the PPP department, Presidency of the Republic of Turkey, Presidency of Strategy and Budget, reported that after Brazil, India, and China, Turkey ranked fourth among 139 developing countries based on the PPP investments between 1990 and 2018 and had the largest market share in Europe in 2018 (Noyan 2019). In addition, five Turkish corporations with close ties to the government were placed among the top 10 PPP project sponsors worldwide by investments in 2018, and have remained there since then, indicating that the Turkish PPP market is heavily concentrated.1

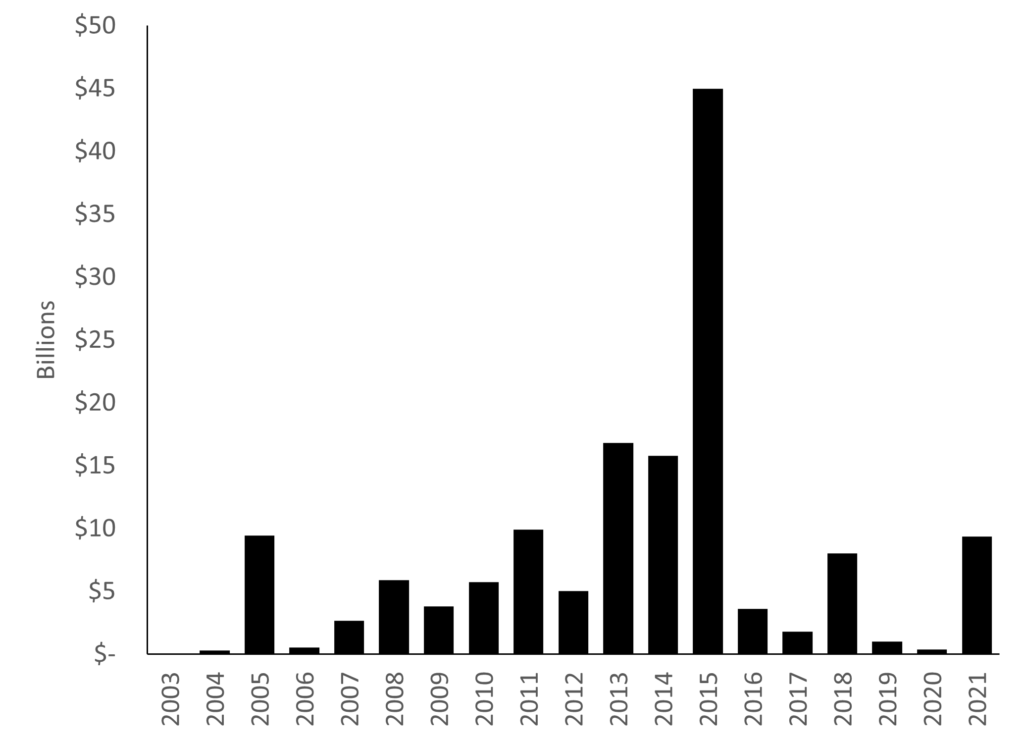

Based on data from the World Bank’s Private Participation in Infrastructure Database, Figure 1 depicts the evolution of PPP infrastructure investments (excluding health PPPs) in the JDP era. The total value of PPP infrastructure investments between 2003 and 2021 is $145.4 billion for 185 projects, whereas this value is about $170 billion for 257 projects between 1986 and 2021 (Presidency of the Republic of Türkiye 2022).

Figure 1: Public-Private Partnership Infrastructure Investments in Turkey (2003-2021)

The first problem is that the debts of these highly leveraged investments are almost invariably in hard currencies such as the US dollar and euro when the incomes they generate are always in domestic currency—an apparent currency mismatch. The second problem is that traditional procurement is less costly than PPP unless the state de-risks the investments through debt and income guarantees (Flor 2018). And because of these reasons, the state-provided debt and income guarantees are also in hard currencies. Unfortunately, no known income-guaranteed PPP in Turkey has earned more than what is guaranteed. In other words, the projected incomes were unrealistic and some of the projects were unnecessary, as evidenced by Zafer Airport, Kütahya. While the government guaranteed 3,29,433 passengers, only 3,847 passengers used it in the first quarter of 2022 (T24 2022).

The Ongoing Currency Crisis

I discussed the currency crisis that started in 2018 in detail in Öncü (2018), and the COVID-19 and Ukrainian crises exacerbated the fall of the Turkish lira since then. As of writing this article, $1 is 17.26 Turkish liras, whereas it was 3.78 Turkish liras on 1 January 2018, amounting to a roughly 80% drop in the lira over the period. Since Turkish production is dependent on imported intermediate and capital goods and energy and food consumption on imported agricultural products, inflation is rampant (about 80% officially).

Furthermore, the current account and budget deficit have been on the rise as well as external borrowing costs for the government and Turkish corporations. In May 2022, the finance account was also in the negative territory given the ongoing capital exodus, forcing Turkey to finance its current account deficit through central bank reserves and errors and omissions. The ratio of short-term external payments (current account deficit and short-term external debt) to liquid external assets is around 80%, creating fears for a balance-of-payments crisis. Although a full-blown debt crisis has not occurred, a Bloomberg analysis placed the Turkish sovereign debt as the 20th most distressed (Maki 2022).

And one cannot overlook the contribution of hard currency PPP debt to the foreign currency debt of the Turkish non-financial private sector debt and the influence of the hard currency PPP income guarantees on the growing budget deficit, worsening the ongoing economic turbulence in Turkey.

T. Sabri Öncü ([email protected]) is an economist based in İstanbul, Turkey.

Note

1 Also referred to as the gang of five by some, these corporations are Limak, Cengiz, Kolin, Kalyon, and MNG.

References

Akerlof, George A and Paul M Romer (1993): “Looting: The Economic Underworld of Bankruptcy for Profit,” Brookings Papers on Economic Activity, https://www.brookings.edu/wp-content/uploads/1993/06/1993b_bpea_akerlof_….

Flor, Lincoln (2018): “Using Guarantees to Drive Efficiency Gains in Road PPPs by Reducing Costs,” World Bank Blogs, 26 June, https://blogs.worldbank.org/ppps/using-guarantees-drive-efficiency-gains….

IFC (2018): “Transforming Turkey’s Health-Care System,” July, International Finance Corporation, https://www.ifc.org/wps/wcm/connect/news_ext_content/ifc_external_corpor….

Jin, Hui and Isabel Rial (2016): “Regulating Local Government Financing Vehicles and Public-Private Partnerships in China,” IMF Working Paper, 16/187.

Leather, Phil (2002): “Workplace Violence: Scope, Definition and Global Context,” Workplace Violence in the Health Sector—State of the Art, Cary Cooper and Naomi G Swanson (eds), Geneva: ILO/ICN/WHO/PSI, pp 24–34.

Maki, Sydney (2022): “Historic Cascade of Defaults Is Coming for Emerging Markets,” Bloomberg, 8 July, https://www.bloomberg.com/news/articles/2022-07-07/why-developing-countr….

Noyan, Sedef Yavuz (2019): “Turkey: PPPs Program, Collaboration with the Private Sector, Impact on Service Delivery and Its Governance Structures,” Presentation, Breakout Session D—Public-Private Interface and Economic Governance, Europe and Central Asia Regional Governance Conference, 11–12 June, https://thedocs.worldbank.org/en/doc/453101561126954441-0080022019/origi….

Öncü, Sabri (2018): “A Private Debt Story: Republic of Turkey Hires McKinsey & Company,” Economic & Political Weekly, Vol 53, No 41.

Özgür, Bahadır (2018): “Bu Faturayı Onlar ödemez!” Gazete Duvar,” https://www.gazeteduvar.com.tr/yazarlar/2018/06/04/bu-faturayi-onlar-odemez.

Presidency of the Republic of Türkiye (2022): “Investing in infrastructure & Public Private Partnership (PPP) Projects in Türki̇ye?” Republic of Türkiye Investment Office—Invest in Türkiye, June, https://www.invest.gov.tr/en/library/publications/lists/investpublicatio….

Pfeiffer, James and Rachel Chapman (2010): “Anthropological Perspectives on Structural Adjustment and Public Health,” Annual Review of Anthropology, Vol 39, pp 149–65.

T24 (2021): “AKP iktidarında 62 milyar dolarlık özelle-tirme yapıldı, 300 milyon metrekare Hazine arazisi ihaleyle satıldı,” https://t24.com.tr/haber/akp-iktidarinda-62-milyar-dolarlik-ozellestirme….

— (2022): “Zafer Havalimanı 2022’nin ilk 3 ayında da zarar şampiyonu oldu,” https://t24.com.tr/haber/zafer-havalimani-2022-nin-ilk-3-ayinda-da-zarar….

World Bank (2018): “Turkish Health Transformation Program and Beyond,” 2 April, https://www.worldbank.org/en/results/2018/04/02/turkish-health-transformation-program-and-beyond.