By T. Sabri Öncü & Ahmet Öncü In Memory of David Graeber (1961–2020) This article first appeared in the Indian journal, Economic and Political Weekly, on 21 November, 2020 under the title “A Consortium Proposal to the SDR Basket Countries” On 30 March 2020, the United Nations Conference on Trade and Development (UNCTAD) called for a .5 trillion COVID-19 crisis package for developing countries.[1] The UNCTAD proposals were: (i) trillion to be made available through the expanded use of the International Monetary Fund (IMF) issued Special Drawing Rights (SDRs); (ii) trillion for debt cancellation; (iii) 0 billion to fund a Marshall Plan for health recovery to be dispersed as grants. Shortly after the UNCTAD call, many others jumped on to the bandwagon, and on 12 April 2020, even

Topics:

T. Sabri Öncü considers the following as important: International & World, Long Read, sovereign debt

This could be interesting, too:

T. Sabri Öncü writes Argentina’s Economic Shock Therapy: Assessing the Impact of Milei’s Austerity Policies and the Road Ahead

T. Sabri Öncü writes The Poverty of Neo-liberal Economics: Lessons from Türkiye’s ‘Unorthodox’ Central Banking Experiment

Ann Pettifor writes Global Economic Governance: What’s “Growth” Got to Do with It?

T. Sabri Öncü writes From Chile in 1973 to Argentina and Türkiye in 2023: Economic Genocide Continues

By T. Sabri Öncü & Ahmet Öncü

In Memory of David Graeber (1961–2020)

This article first appeared in the Indian journal, Economic and Political Weekly, on 21 November, 2020 under the title “A Consortium Proposal to the SDR Basket Countries”

On 30 March 2020, the United Nations Conference on Trade and Development (UNCTAD) called for a $2.5 trillion COVID-19 crisis package for developing countries.[1] The UNCTAD proposals were: (i) $1 trillion to be made available through the expanded use of the International Monetary Fund (IMF) issued Special Drawing Rights (SDRs); (ii) $1 trillion for debt cancellation; (iii) $500 billion to fund a Marshall Plan for health recovery to be dispersed as grants.

Shortly after the UNCTAD call, many others jumped on to the bandwagon, and on 12 April 2020, even the Financial Times editorial board joined the choir.[2] Despite that only 42% would go to emerging and developing countries, the Financial Times argued for an allocation of one trillion Special Drawing Rights (SDRs) (about $1.37 trillion at the time) to address the ongoing COVID-19 crisis and its economic outcomes as a matter of moral duty.

But, on 16 April 2020, the United States (US) Treasury Secretary Steven Mnuchin opposed the allocation of SDRs: [3]

We recognise that a number of IMF members support a general Special Drawing Right (SDR) allocation to the membership. In our view, an SDR allocation is not an effective tool to respond to urgent needs. Almost 70% of an allocation would be provided to G20 countries, most of which do not need, and would not use additional SDRs to respond to the crisis. By contrast, all low-income countries, including those facing urgent balance of payments needs, would receive just three percent of any allocation. A better, more targeted approach would be for members to enhance IMF support to low-income countries by providing grants to the Catastrophe Containment and Relief Trust (CCRT) and through new grants and loans to the Poverty Reduction Growth Trust (PRGT). Advanced economies could also explore using their existing SDRs to bolster PRGT resources or otherwise support low-income countries. The Administration is currently exploring a US contribution to the PRGT and CCRT.

The SDRs

Under the Bretton Woods monetary system that lasted between 1944 and 1971, the US would fix the price of gold at $35 per ounce, and the rest of the countries would peg their currencies to the dollar, albeit in some adjustable window. And the IMF was created to assist the other countries to peg their currencies to that of the US by providing short-term loans during temporary balance of payment deficits.

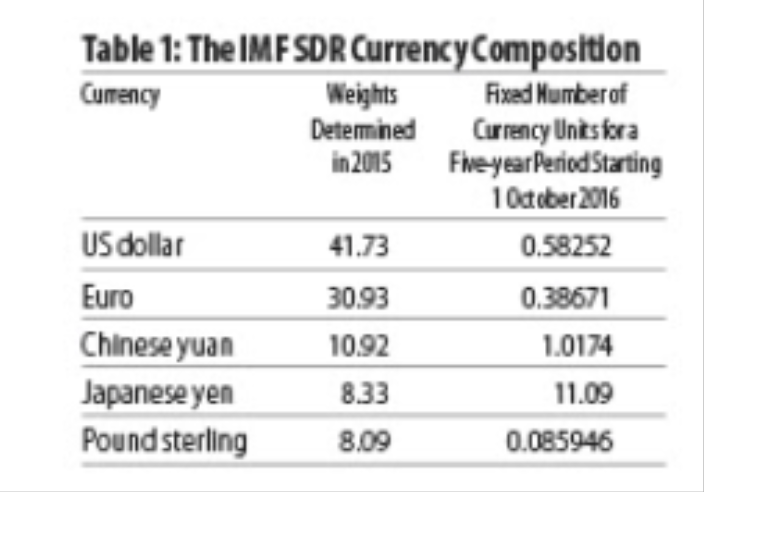

Pressures on the US dollar–gold fix that started in 1960 and peaked in 1968 led to the creation of the SDRs as a supplemental official reserve currency in 1969. Initially fixed at 1 SDR to 1 US dollar and kept there until the collapse of the Bretton Woods system in 1971, the price of the SDR currently fluctuates daily and, since 1 October 2016, is equal to the dollar price of the basket of currencies as given in Table 1:

SDRs can only be used to make payments to other member country central banks, the IMF itself, and the so-called “prescribed holders.” There currently are 16 “prescribed holders,” including the World Bank and major regional development banks. The IMF creates the SDRs at the stroke of a pen and allocates them to each member country in proportion to their membership quota, reflecting the relative position of the individual member country in the world economy.

Extant Debt Relief Efforts

There are five major institutions taking part in two important debt relief efforts for developing countries. The first three, the IMF, the World Bank, and the Group of 20 (G20) countries, are well known. The other two are the Paris Club and the International Institute of Finance (IIF).

The Paris Club currently is an informal group of 22 creditor countries. It was established in 1956 when Argentina voiced the need to meet its sovereign creditors to prevent a default. Also attended by some observers and occasional ad hoc partners, a general secretariat organises its monthly sessions. Senior officials from the French Treasury run the chair and the general secretariat. After its legally non-binding recommendations for debt restructuring the involved parties sign, the debtor country and each of the creditor countries sign binding bilateral agreements, implementing the recommendations.

Some 38 banks from the developed countries created the IIF in 1983 in response to the then so-called Less Developed Countries Debt Crisis that started with the Mexican default of 1982, which was triggered by the so-called Volcker Shock and the Second Oil Shock of 1979. Headquartered in Washington, DC, the IIF currently has 483 members comprising commercial and investment banks, asset managers, insurance companies, sovereign wealth funds, hedge funds, central banks, multilateral agencies, and development banks from all continents. As the most influential global association of financial institutions, the essential purpose of the IIF is to advocate regulatory, financial, and economic policies that are in the broad interest of its members. However, although the IIF can share views from the international financial community, it has no power over even its members.

One of the important debt relief efforts available for developing countries is that of the CCRT for low income and vulnerable countries which the IMF recommended on 15 April 2020, initially for 25 and now for an additional four for a total of 29 countries [Catastrophe Containment and Relief Trust]. The IMF created the CCRT on 4 February 2015 in response to the 2014 Ebola outbreak and assisted Guinea, Liberia, and Sierra Leone in February–March 2015 for about $100 million owed to itself. The purpose of the debt relief under the CCRT is to free up resources to meet the exceptional balance of payments needs created by the disaster rather than having to assign those resources to debt service. The countries the IMF deems eligible for the CCRT must make an application to receive assistance.

The CCRT essentially is a debt forgiveness facility cancelling the interest and principal due on debt owed to the IMF by the countries for an initial period of six months that may extend up to a total of two years. The IMF calls this two-year period the catastrophe containment window. Under certain conditions, the IMF extends the above debt forgiveness for an additional two-year period. More importantly, under extreme conditions in this second period, the IMF may cancel the entire debt. The IMF calls this period the post-catastrophe relief window.

The IMF financed the CCRT by the then already existing funds in the 2015 round. It has been trying to raise funds for a commitment of about SDR 1 billion in this round that started in April 2020 to provide relief on debt service for a total of two years while leaving the CCRT funded for future needs adequately. As of 4 October 2020, donors have provided grant contributions totalling about SDR 360 million, including from the United Kingdom (UK), Japan, Germany, the Netherlands, Switzerland, Norway, China, Mexico, Sweden, Bulgaria, Luxembourg, and Malta.

The other important debt relief efforts for developing countries is the Debt Service Suspension Initiative (DSSI). At the invitation of the IMF and World Bank on 25 March 2020, the G20 created the DSSI on 15 April 2020. And the Paris Club endorsed it on the same day. After calls by the IMF, World Bank, and the Paris Club for private creditor participation, the IIF joined the debate on 4 May 2020. Despite the ongoing discussions between the IIF and the IMF, World Bank, the Paris Club, and G20, there still is no clarity on private creditor participation. Neither is there any clarity on multilateral creditor participation nor the participation of non-Paris Club bilateral official creditors such as China and Russia.

Based on the criteria set in the G20 April Communiqué that have remained intact, there are currently 73 debtor countries eligible for the DSSI, and only 43 have signed up so far. Therefore, the DSSI essentially has been between these 43 debtor countries and their Paris Club bilateral official creditors.

Unlike the CCRT debt relief, the DSSI offers no debt forgiveness. When created, the G20 determined the suspension period to be from 1 May 2020 to the end of 2020. The then debt suspension would be net present value (NPV) preserving, and the repayment period would be three years with a one-year grace period (four years total). In their 14 October 2020 meeting, the G20 extended the suspension period merely by a six-month period to 30 June 2020, but removed the NPV-neutrality requirement, and changed the repayment period to five years with a one-year grace period (six years total). Finally, in their 13 November 2020 special meeting, although there was no change to the DSSI, recognising that debt treatments beyond the DSSI may be required on a case-by-case basis, they endorsed the Paris Club-initiated Common Framework for Debt Treatments beyond the DSSI.

How debt treatments beyond the DSSI will progress remains to be seen.

Four Debt Relief Proposals

Although there have been many valuable proposals since the onset of the COVID-19 crisis, we focus on four. They are the proposals of the UNCTAD we already summarised, Ortiz and Jolly (2020), Herman (2020a, b), and Stiglitz and Rashid (2020a, b), relevant parts of which we summarise below.

Ortiz and Jolly: Although they make eight respectable proposals that are beyond just debt relief, we are interested in their eighth proposal, which is about the provision of liquidity to developing countries. Their eighth proposal is “issuing Special Drawing Rights at the international financial institutions” or “issuing fiat money to developing countries via a multilateral consortium under the United Nations” to provide liquidity to prevent a global depression. Their eighth proposal intersects with the first proposal of the UNCTAD and offers a second alternative whose technical details are missing. In the next section, we will propose a way of issuing fiat money to developing countries via a multilateral consortium.

Herman: Like almost everybody else, Herman also calls for a new SDR allocation. But he does not stop there. Focusing on the CCRT of the IMF,

(i) he proposes to expand the CCRT to fund comparable relief for middle-income countries hit by the pandemic, such as Ecuador and Pakistan, or hurt by other disasters, natural or otherwise;

(ii) invites the so-called “advanced” member countries of the IMF which collectively held about SDR 126 billion at the end of 2019 to use their SDRs that sit idle on their books to make their donations to the ongoing IMF fundraising campaign for the pending enlargement of the CCRT SDR 1 billion to provide two years of relief instead of one year, as currently;

(iii) invites World Bank and “prescribed holder” regional development banks to create their CCRT-like facilities to ease the debt servicing of countries in need during difficult circumstances.

A celebrated aspect of his proposal is that it is not a debt suspension but a debt reduction proposal. Indeed, since in the above-described “post-catastrophe window,” the CCRT may cancel the entire debt stock if the situation of the debtor warrants it, this amounts to the CCRT cancelling the debt stock in full from day one. Furthermore, since the IMF, World Bank, and “prescribed holder” development banks are the main multilateral creditors, his proposal provides a solution to the yet unsolved problem of bringing the multilateral creditors into the ongoing debt relief efforts.

Stiglitz and Rashid: Their reason for making this proposal in July was that against the backdrop of tightened international capital, a sudden stop in new lending or rolling over of existing debt, and mounting fiscal challenges, governments of the low and middle income countries needed to service $130 billion in interest and principal repayment in 2020, and about half of this had to be paid to private bondholders. Indeed, although it is not official at the time of writing, Zambia technically defaulted on 13 November 2020, and the default winds are blowing towards Kenya and Ethiopia.

Their proposal was a multilateral sovereign debt buyback facility to be managed by the IMF. Developing countries seeking to restructure their debt would participate voluntarily and identify the sovereign bonds they would like the facility to buy back on their behalf. To fund the facility, the IMF would use (i) the already available resources; (ii) its New Arrangements to Borrow function; and (iii) supplemental funds from a global consortium of countries and multilateral institutions.

Like Herman (2020a), they invite those IMF member countries that do not need their full SDR allocation to donate or lend them to the new facility, and advocate a new SDR allocation that could provide additional resources. To ensure the maximum debt reduction for a given expenditure, the IMF could conduct an auction, announcing that it will buy back only a limited amount of bonds.

Whether such bond buyback programmes help or hurt the distressed debtors has always been debated, and Herman (2020a) and Chowdhury and Sundaram (2020) offer legitimate criticisms of this proposal. Perhaps a blend of the Secondary Market Corporate Credit Facility that the Federal Reserve Board created early in the ongoing crisis and the CCRT of the IMF, and funded by donations might help with the looming low- and middle-income country debt crisis better than such a buyback facility. Perhaps called the Secondary Market Developing Country Credit Facility, such a facility may purchase the bonds in the secondary market and offer the debt distressed country the CCRT-like debt relief.

Our Consortium Proposal

Given what we have documented, unless the world takes extraordinary measures, it is undeniable that a developing country’s debt crisis will develop if it has not started already. Ecuador, Lebanon, Belize, Suriname, and Argentina have already defaulted early in 2020, and Zambia joined the caravan on 13 November 2020. Anyone who needs more hard evidence can look at the Bank of Canada–Bank of England Sovereign Default Database.[4]

It is with these in mind that we make our consortium proposal to the SDR basket countries and invite the US, Germany, China, Japan, and the UK to form a consortium under the United Nations to create funds in their fiat currencies.

Although there are currently 19 countries in the eurozone, we suggest Germany, the largest eurozone economy, to represent the eurozone, since what we propose costs nothing to any country. It is up to the eurozone countries to decide how exactly to join the consortium, assuming they agree with what we propose.

For purposes of demonstration, we take the $2.5 trillion UNCTAD proposal. Given that $1 has been around 0.73 SDR on average since 1 October 2016, we fix this exchange rate for simplicity. With this exchange rate, the COVID-19 aid package the UNCTAD proposed would be SDR 1.825 trillion. It follows from Table 1 that SDR 1.825 trillion is the sum of amounts in the component currencies shown in Table 2:

What we propose is that the treasuries of the consortium countries, that is, the US, Germany, China, Japan and the UK issue zero-coupon perpetual bonds in their currencies in the amounts shown in Table 2, and sell them to their central banks (in the case of Germany, to the European Central Bank) for increased balances in their central bank accounts.

Hence, the consortium members created SDR 1.825 trillion synthetically.

Since the IMF can maintain deposit accounts with these central banks, the consortium members can donate these balances to the IMF and the rest follows. These funds can then be distributed through the IMF to the CCRT-like facilities that the World Bank and “prescribed holder” development banks Herman (2020a) suggested, and the like.

We should also mention that, similar to the Secondary Market Developing Country Credit Facility we proposed, a “Bad Bank” (see, for example, Öncü 2017) can be established under the auspices of the IMF to handle bank loans which the Secondary Market Developing Country Credit Facility leaves out.

To rephrase John Lennon, all we need are funds.

About the authors: T. Sabri Öncü ([email protected]) is an independent economist, İstanbul. Ahmet Öncü ([email protected]) teaches at Sabancı University, School of Business, İstanbul.

Notes

1 https://unctad.org/news/un-calls-25-trillion-coronavirus-crisis-package-developing-countries

2 https://www.ft.com/content/2691bfa2-799e-11ea-af44-daa3def9ae03

3 home.treasury.gov/news/press-releases/sm982

4 https://www.bankofcanada.ca/2020/06/staff-analytical-note-2020-13/

References

Chowdhury, A and J K Sundaram (2020): “Finance Covid-19 Relief and Recovery, Not Debt Buybacks,” Inter Press Service, https://www.ipsnews.net/2020/10/finance-covid-19-relief-recovery-not-debt-buybacks/

Herman, B (2020a): “Financing the Pandemic Response in Developing Countries: Voluntary Debt Relief Is No Answer; SDR Allocation Is,” ResearchGate, DOI: 10.13140/RG.2.2.17803.31526.

— (2020b): “What You Really Need to Know about the SDR and How to Make It Work for Multilateral Financing of Developing Countries,” Challenge, DOI: 10.1080/05775132.2020.1802178.

Ortiz, I and R Jolly (2020): “Is the IMF Encouraging World Financial Leaders to Walk Blindly towards More Austerity?” Inter Press Service, http://www.ipsnews.net/2020/10/imf-encouraging-world-financial-leaders-walk-blindly-towards-austerity/

Öncü, T Sabri (2017): “Bad Bank Proposal for India: A Partial Jubilee Financed by Zero Coupon Perpetual Bonds,” Economic & Political Weekly, Vol 52, No 10, pp 12–15.

Stiglitz, J and H Rashid (2020a): “Averting Catastrophic Debt Crises in Developing Countries: Extraordinary Challenges Call for Extraordinary Measures,” CEPR, https://cepr.org/sites/default/files/policy_insights/PolicyInsight104.pdf

— (2020b): “How to Prevent the Looming Sovereign Debt Crisis,” https://voxeu.org/article/how-prevent-looming-sovereign-debt-crisis