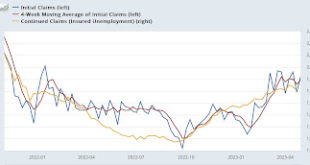

Jobless claims hoist yellow flag again; employment and unemployment likely to show further deceleration tomorrow – by New Deal democrat Initial jobless claims rose 13,000 to 242,000 last week, while the 4 week average rose 3,500 to 239,250. Continuing claims, with a one week lag, declined -38,000 to 1.805 million: This is right in the range of the past 2 months. YoY initial claims are up 11.0%, the 4 week average is up 10.8%, and...

Read More »How to end the debt ceiling stand-off democratically: set fiscal policy through elections, not hostage taking

The Biden administration and congressional Democrats have so far refused to negotiate with House Republicans over spending cuts to resolve the looming debt ceiling crisis. This tactic has successfully pressured Republicans into passing a bill with unpopular spending cuts that Democrats will quite rightly use to their advantage in the upcoming election. But now that the House Republicans have put a plan on the table it will be difficult for...

Read More »Running Late tonight and I am Tired.

New Deal democrat has a post up. I hope you read it as it is some of the best commentary on the internet abut Labor, Employment, Unemployment, plus the basis for each. I read him each day as I post his dialogue. It is excellent. So as you are waiting for me to post a couple of more commentaries, you should read his commentary. I should be back by noon at the latest. Good night and see you all tomorrow. Bill...

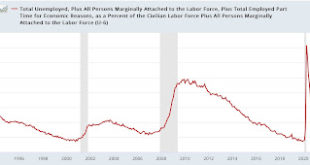

Read More »The un(der)employment rate leads wage growth: 2023 update

The un(der)employment rate leads wage growth: 2023 update – by New Deal democrat I had already planned on taking an updated look at wage growth today, but there was a little flutter on twitter about job openings and last week’s Q1 wage and benefits data, so that sealed the deal. To wit: as I used to write many times during the last expansion, wage growth is a long lagging indicator. It tends to increase only after unemployment (or even...

Read More »What is Section 4 of the 14th, “The validity of the public debt of the United States?”

14th Amendment to the U.S. Constitution: Civil Rights (1868) | National Archives, Section 4. “The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned. But neither the United States nor any State shall assume or pay any debt or obligation incurred in aid of insurrection or rebellion against...

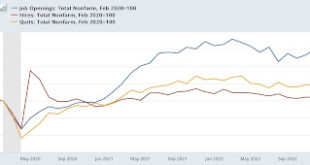

Read More »March JOLTS report shows labor market about halfway to pre-pandemic normalization

March JOLTS report shows labor market about halfway to pre-pandemic normalization – by New Deal democrat The title of this piece is an important to clue the relative nature of this morning’s Job Openings and Labor Turnover report for March. For the last several years, the jobs market has been a game of “reverse musical chairs,” where there are always more chairs than participants. Those employers whose chairs weren’t filled had to increase...

Read More »Selection of In-Box Articles I Found Interesting

Another collection of articles on various topics from my In-Box. Puling quite a bit from Healthcare. Some interesting articles in this batch. I hope you take a few moments and read some of them. Most are not terribly long winded. I wander in the comments section to see what is being said on various topics. I am not impressed with many of the responses. The ones on carrying bullet-spewing-weapons are just plain ignorant. Healthcare Doctor on...

Read More »Where Do Eight Billion People Live?

SWP Report 2023 | United Nations Population Fund, unfpa.org) In November 2022, the world population eclipsed 8 billion people. For many of us, it represents a milestone the human family should celebrate. A milestone of people living longer, healthier lives, and enjoying more rights and greater choices than ever before. If you have not noticed India eclipsed China in population. At the bottom of the chart, each area of Earth is color coded to...

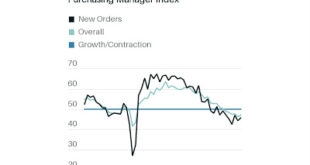

Read More »Manufacturing and construction start out the month’s data to the negative side

Manufacturing and construction start out the month’s data to the negative side – by New Deal democrat As usual, we start the month with reports on last month’s manufacturing, and construction from two months ago. The ISM manufacturing index has a 75 year record of being a very reliable leading indicator. According to the ISM, readings below 48 are consistent with an oncoming recession. And there, the news is not good. Not only has the index...

Read More »Facebook users can now claim Cambridge Analytica settlement

I never gave this a thought. Never thought I was being tracked and my personal data spread. I do get a lot of trash mail which I block or send to phishing or junk. Maybe some of you have issues with Facebook? Double checking the information for clarity and accuracy. ~~~~~~~~ Facebook users can apply for their portion of a $725 million lawsuit settlement, NPR, Eyana Archie Facebook’s parent company, Meta, is doling out the payments to...

Read More » The Angry Bear

The Angry Bear