Janet Yellen “Not Tall Enough” So said Donald Trump on several occasions in connection with possibly appointing her as Fed Chair, according to an article in today’s Washington Post by Philip Rucker, John Dawsey, and Damian Paletta. This article, along with several others, mostly covered the 20 minute interview these three had with Trump in the Oval Office. Most of the news was wxs expected: on MbS still “maybe he did and maybe he didn’t” on his role in...

Read More »Trump More Seriously Kowtows To MBS

Trump More Seriously Kowtows To MBS We have already seen the spectacle of Trump simply dismissing the reported CIA conclusion that Saudi Crown Prince Mohammed bin Salman (MbS) ordered the gruesome murder and dismemberment of journalist Jamal Khashoggi (“Maybe he did, maybe he didn’t”) He has put forward silly excuses for this: low oil prices! (nonexistent) hundreds of billions of dollars of arms deals! Key to the anti-Iranian coalition! Oh, and also...

Read More »Aetna and CVS Merge

Nearly one year after agreeing to merge in a bid to reinvent healthcare for Americans, CVS Health and Aetna sealed the deal on Wednesday, bringing together one of the nation’s largest pharmacy chains and one of the largest health insurers. CVS Health President and CEO Larry Merlo: “Today marks the start of a new day in health care and a transformative moment for our company and our industry. By delivering the combined capabilities of our two leading...

Read More »CSX Slowly being Dissembled by Mantle Ridge Hedge Fund

CSX connects most major U.S. cities east of the Mississippi River. Since 2017, the railroad has laid off 6,000 employees, cut back on capital spending, and slashed the number of trains it runs and discontinued hundreds of the routes it serves. Together CSX and Union Pacific serve major U.S. cities west of the Mississippi River and together they discontinued service on 197 out of 301 cross-country routes that the two rail giants partnered on in September...

Read More »When White America Becomes a Minority

“Announcement of a Looming White Minority Makes Demographers Nervous.” NYT’s article makes this announcement of White America becoming a minority in the 2040’s like it is new news. It is not. Back in 2006, I exchanged emails with Joel Garreau about the same topic in his article 300 Million and Counting. Joel concentrated on the arrival of immigrants to the country being good news as it keeps our labor force younger than other countries such as Germany,...

Read More »Passed on the Romaine Salad This Year

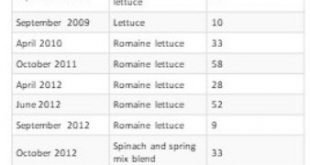

My wife was in charge of making the salad for Thanksgiving. For her easily done as she makes her own Italian dressing. I bought enough Romaine Hearts to feed 20 people. On Wednesday, we pitched them all as CDC said not to eat any Romaine as it was contaminated with E. Coli. We moved on to Spinach and Arugula. It is not the first-time leafy vegetables have been removed from the grocery shelf and the dinner table. Indeed, if you glance at the attached...

Read More »U.S. Interest Rates and Global Banking in Emerging Market Economies

by Joseph Joyce U.S. Interest Rates and Global Banking in Emerging Market Economies The spillover effects of changes in U.S. interest rates are widely recognized (see here and here). An increase in rates, for example, raises the cost of dollar-denominated financing outside the U.S., which has grown in recent years, while an appreciation of the dollar makes such debt even more expensive to service and refinance. The emerging markets are among the nations...

Read More »Open thread Nov. 27, 2018

Climate Change Report

; Via Bill McBride at Calculated Risk: Climate Change Report This is a critical threat and should be a nonpartisan issue. Here is the Fourth National Climate Assessment. An excerpt on the economic impact: In the absence of significant global mitigation action and regional adaptation efforts, rising temperatures, sea level rise, and changes in extreme events are expected to increasingly disrupt and damage critical infrastructure and property, labor...

Read More »Healthcare and….

Via Naked Capitalism and Lambert Strether: And now abideth faith, hope, charity, these three; but the greatest of these is charity. –Corinthians 13:13 I posted this letter in Links, but I found I could expand on it. Spectrum Health Care’s letter to Hedda Martin speaks for itself, and for what our health care system has become under neoliberalism: View image on Twitter Dan Radzikowski@DanRadzikowski (The provenance: I started with AOC, who...

Read More » The Angry Bear

The Angry Bear