“On my wall, the colors on the maps are running” Two years ago in a post entitled “Those who cannot see must feel”, I wrote: That’s the translation of an old German saying that I used to hear from my grandmother when I misbehaved. It is pretty clear that, over the next four years, the American public is going to do a lot of feeling …. The results will range somewhere in between bad, disastrous, catastrophic, and cataclysmic, depending on how badly...

Read More »Weekly Indicators for November 19 -23 at Seeking Alpha

by New Deal democrat Weekly Indicators for November 19 -23 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. Conditions among the long leading indicators continue to slowly deteriorate. As usual, clicking over and reading not only is educational as to the current and future state of the economy, but helps reward me with a few $$$ for my efforts.

Read More »A belated Happy Thanksgiving and a note about the Index of Leading Indiators

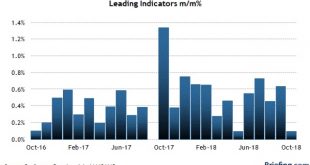

A belated Happy Thanksgiving and a note about the Index of Leading Indiators The past few days have been spent entertaining and gorging on turkey et al., so I haven’t been posting, but there wasn’t much in the way of economic data, so really nothing has been missed. I hope you, your family, and your loved ones had a happy Thanksgiving! One item that did get reported on Wednesday worth a quick mention was the Conference Board’s Index of Leading...

Read More »Squanto — A Sad Thanksgiving Tale

Squanto — A Sad Thanksgiving Tale I do not know how widely it is still taught or how, but when I was in elementary school in Ithaca, New York, I was taught about the “First Thanksgiving,” an event that happened in October, 1621 in Plymouth, Massachusetts, following a good harvest after the pilgrim colony, founded in 1620, had a hard year that saw half their population die (about 50 people, mostly of starvation). It was a joint feast of the pilgrims...

Read More »A Vicious Place

The world according to Trump — notice a trend here? Reporter: “Who should be held accountable?” [for Jamal Khashoggi’s murder] Trump: “Maybe the world should be held accountable because the world is a vicious place. The world is a very, very vicious place.” — November 22, 2018. “The world is a vicious and brutal place. We think we’re civilized. In truth, it’s a cruel world and people are ruthless. They act nice to your face, but underneath they’re out to...

Read More »Open thread Nov. 23, 2018

House Democrats are Backing off on Nancy Pelosi

Most recently, Rep. Brian Higgins (D-NY) gave his support for Pelosi for a major infrastructure bill early in the next Congress and a commitment to let Higgins lead the charge on a proposal to let Americans buy into Medicare at age 50. I am hoping they design the Medicare buy-in as it is not cheap in its present form and doses not include vision or dental. Rep. Marcia Fudge (D-OH) abandoned her quest to be the House Speaker. Instead, Fudge will head up...

Read More »NYT video series on Fake News. Worth the watch

I had heard about a video series on NPR’s Fresh Air regarding the origin and current issue with the concept of Fake News via Russia. You can listen and read the interview of the author, Adam Ellick here. There are 3 videos of 15 to 17 minutes each. The series is titled: Operation Infektion, Russian Disinformation: From Cold War to Kanye You can watch them here. It begins with the AID’s hoax that it was a biological weapon developed and released by...

Read More »October housing permits and starts flat vs. trend

October housing permits and starts flat vs. trend This morning’s report on housing permits and starts will do nothing to stop the now-received wisdom that higher interest rates, higher prices, (and the impact of the cap on the mortgage tax deduction) has caused this most important cyclical market to cool. On the other hand, they aren’t evidence of any intensifying downturn. While we wait for FRED, here’s the Census Bureau’s graphic representation of...

Read More »District Federal Court Rips Administration on Census

I have had enough court time to last a life time. While mine was not fun and it was a battle, this I find hilarious. It is a well placed shot across the bow of someone who believes they are impervious to society, the courts, and morality. The census case arrived in front of Manhattan District Federal Judge Furman requesting that he delay proceedings. Calling it the ‘latest and strangest effort’ in its crusade to delay proceedings in the case. He said what...

Read More » The Angry Bear

The Angry Bear