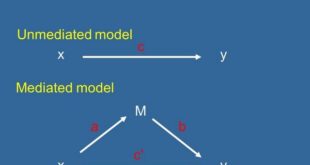

Analytical strategies in mediation analysis Case 3: Does cognitive skill (M) mediate the relation between college attendance (Z) and earnings (Y)? Case 3 involves one causal variable — college attendance — and two outcomes — one proximal (cognitive skill) and the other distal (earnings). College attendance is causal because a person may or may not go to college. Cognitive skill is not causal because one cannot be assigned or choose to have high skill; it is...

Read More »Economics journals — publishing lazy non-scientific work

Economics journals — publishing lazy non-scientific work In a new paper, Andrew Chang, an economist at the Federal Reserve and Phillip Li, an economist with the Office of the Comptroller of the Currency, describe their attempt to replicate 67 papers from 13 well-regarded economics journals … Their results? Just under half, 29 out of the remaining 59, of the papers could be qualitatively replicated (that is to say, their general findings held up, even if the...

Read More »Sail away

.[embedded content]

Read More »On the limited applicability of statistical physics to economics

On the limited applicability of statistical physics to economics Statistical mechanics reasoning may be applicable in the economic and social sciences, but only if adequate consideration is paid to the specific contexts and conditions of its application. This requires attention to “non-mechanical” processes of interaction, inflected by power, culture, institutions etc., and therefore of specific histories which gives rise to these factors … Outside of very...

Read More »Financial regulations

A couple of years ago, former chairman of the Fed, Alan Greenspan, wrote in an article in the Financial Times, re the increased demands for stronger regulation of banks and finance: Since the devastating Japanese earthquake and, earlier, the global financial tsunami, governments have been pressed to guarantee their populations against virtually all the risks exposed by those extremely low probability events. But should they? Guarantees require the building up of a buffer of...

Read More »Telegram — the global bullshit multiplicator

Telegram — the global bullshit multiplicator .[embedded content]

Read More »Joshua Angrist ‘Nobel Prize’ Lecture 2021

Joshua Angrist ‘Nobel Prize’ Lecture 2021 .[embedded content]

Read More »Exchangeability/Unconfoundedness/Ignorability

.[embedded content]

Read More »Language — an amazing thing

Language — an amazing thing .[embedded content]

Read More »Interpretation of regression results

Interpretation of regression results When econometric and statistical textbooks present simple (and multiple) regression analysis for cross-sectional data, they often do it with regressions like “regress test score (y) on study hours (x)” and get the result y = constant + slope coefficient*x + error term. When speaking of increases or decreases in x in these interpretations, we have to remember that it is a question of cross-sectional data and ‘increases’...

Read More » Lars P. Syll

Lars P. Syll