The dangers of neglecting methodology Alex Rosenberg — chair of the philosophy department at Duke University, renowned economic methodologist and author of Economics — Mathematical Politics or Science of Diminshing Returns? — had an interesting article up on What’s Wrong with Paul Krugman’s Philosophy of Economics some time ago. Writes Rosenberg: Krugman writes: ‘So how do you do useful economics? In general, what we really do is combine...

Read More »MindYourDecisions (personal)

Bedridden with a severe cold, it’s easy to get restless. Solving fun math problems is my way of enduring … [embedded content] [embedded content] Advertisements

Read More »Shostakovich

[embedded content] Advertisements

Read More »The Ricardian Vice (II)

The Ricardian Vice (II) The completeness of the Ricardian victory is something of a curiosity and a mystery. It must have been due to a complex of suitabilities in the doctrine to the environment into which it was projected. That it reached conclusions quite different from what the ordinary uninstructed person would expect, added, I suppose, to its intellectual prestige. That its teaching, translated into practice, was austere and often unpalatable, lent it...

Read More »The Ricardian Vice (I)

The Ricardian Vice (I) Ricardo’s … interest was in the clear-cut result of direct, practical significance. In order to get this he cut that general system to pieces, bundled up as large parts of it as possible, and put them in cold storage — so that as many things as possible should be frozen and ‘given.’ He then piled one simplifying assumption upon another until, having really settled everything by theses assumptions, he was left with only a few...

Read More »Gimme Some Lovin’ (personal)

Gimme Some Lovin’ (personal) [embedded content] Steve Winwood’s voice still, after fifty years, gives me goose pimples. Absolutely fabulous. Advertisements

Read More »The benefits of free trade — a fallacy based on a fantasy

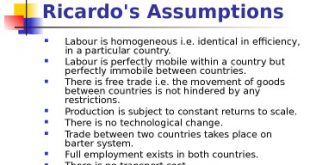

The benefits of free trade — a fallacy based on a fantasy Plenty of people will try to convince you that globalization and free trade could benefit everyone, if only the gains were more fairly shared … This belief is shared by almost all politicians … and it’s an article of faith for the economics profession. You are right to reject it … It’s a fallacy based on a fantasy, and it has been ever since David Ricardo dreamed up the idea of “Comparative Advantage...

Read More »Ricardian trade theory — how is this still a thing?

Ricardian trade theory — how is this still a thing? On Saturday, April 19th 1817, David Ricardo published The Principles of Political Economy and Taxation, where he laid out the idea of comparative advantage, which since has become the foundation of neoclassical, ‘mainstream’ international trade theory … This week we saw lots of praise of Ricardo, by the likes of The Economist, CNN, Forbes and Vox. Mainstream economists today tend to see the rejection of...

Read More »What is Post-Keynesian economics?

What is Post-Keynesian economics? [embedded content] Advertisements

Read More »Keynes on ‘money neutrality’ and the ‘classical dichotomy’

Paul Krugman has repeatedly over the years argued that we should continue to use neoclassical hobby horses like IS-LM and AS-AD models. Here’s one example: So why do AS-AD? … We do want, somewhere along the way, to get across the notion of the self-correcting economy, the notion that in the long run, we may all be dead, but that we also have a tendency to return to full employment via price flexibility. Or to put it differently, you do want somehow to make clear the notion...

Read More » Lars P. Syll

Lars P. Syll