No man is an island! Given how sweeping the changes wrought by SMD (Sonnenschein-Mantel-Debreu) theory seem to be, it is understandable that some very broad statements about the character of general equilibrium theory were made. Fifteen years after General Competitive Analysis, Arrow (1986) stated that the hypothesis of rationality had few implications at the aggregate level. Kirman (1989) held that general equilibrium theory could not generate falsifiable...

Read More »Sacrificing content for the sake of mathematical tractability

Sacrificing content for the sake of mathematical tractability A commodity is a primitive concept (Debreu 1991), and the model comprises a finite set of classes of commodities. The number of distinguishable commodities (Debreu 1959) or commodity labels (Koopmans and Bausch 1959) is a natural number. The Arrow—Debreu model continues by defining these commodities as goods that are physically determined … But after asserting that commodities are physically...

Read More »General equilibrium — the art of denying the obvious

General equilibrium — the art of denying the obvious General equilibrium is fundamental to economics on a more normative level as well. A story about Adam Smith, the invisible hand, and the merits of markets pervades introductory textbooks, classroom teaching, and contemporary political discourse. The intellectual foundation of this story rests on general equilibrium, not on the latest mathematical excursions. If the foundation of everyone’s favourite...

Read More »General equilibrium theory — still dead after all these years

General equilibrium theory — still dead after all these years Raphaële Chappe has written a very interesting article about the value of general equilibrium theory, concluding in the following words: For a student of real world markets, general equilibrium theory appears strangely distant. It is not surprising that a highly abstract framework consisting of hyper-rational agents might be ill equipped to provide a sufficiently credible account of markets in...

Read More »Krugman’s models — squeezing out central ideas from Keynes

Krugman’s models — squeezing out central ideas from Keynes The gist is that despite Krugman’s claims to the contrary, the analysis is not really Keynesian, at least in comparison to The General Theory, or GT. It does hark back to the world of the turn of the 20th century Swedish economist Knut Wicksell and contemporaries and followers such as Irving Fisher, James Tobin, and Robert Mundell … Krugman argues that the central bank should somehow intervene to...

Read More »Stiglitz on Brexit

[embedded content]

Read More »Economics at the edge

Economics at the edge The Fourth Nordic Post-Keynesian Conference will take place in Aalborg, Denmark, April 20-21 2017. More on the conference available here.

Read More »But once, we were here

But once, we were here [embedded content]

Read More »Krugman’s gadget interpretation of economics

Krugman’s gadget interpretation of economics Paul Krugman has often been criticized by people like yours truly for getting things pretty wrong on the economics of John Maynard Keynes. When Krugman has responded to the critique, by himself rather gratuitously portrayed as about “What Keynes Really Meant,” the overall conclusion is — “Krugman Doesn’t Care.” Responding to a post up here on Krugman not being a real Keynesian, Krugman writes: Surely we don’t...

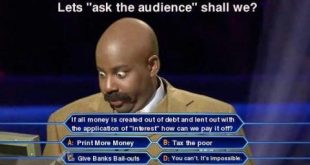

Read More »The reality of how money is created

The reality of how money is created Everything we know is not just wrong – it’s backwards. When banks make loans, they create money. This is because money is really just an IOU. The role of the central bank is to preside over a legal order that effectively grants banks the exclusive right to create IOUs of a certain kind, ones that the government will recognise as legal tender by its willingness to accept them in payment of taxes. There’s really no limit...

Read More » Lars P. Syll

Lars P. Syll