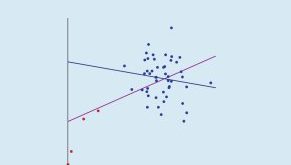

In order to make causal inferences from simple regression, it is now conventional to assume something like the setting in equation (1) … The equation makes very strong invariance assumptions, which cannot be tested from data on X and Y. (1) Y = a + bx + δ What happens without invariance? The answer will be obvious. If intervention changes the intercept a, the slope b, or the mean of the error distribution, the impact of the intervention becomes difficult to determine. If the variance of...

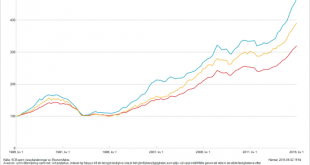

Read More »Ingen bobubbla?

Och i senaste numret av Ekonomisk Debatt skriver professor emeritus Harry Flam att vi inte har en bostadsbubbla i Sverige och att “bostadsrättspriserna bestäms av fundamentala faktorer och inte av överdrivna förväntningar om framtida kapitalvinster.” Hmm … Men vänta nu lite … Den minnesgode kanske erinrar sig att denne Flam är samma person som i boken Tillämpad makroekonomi (SNS, 2011) har ett kapitel som diskuterade huruvida Sverige skulle förlora eller vinna på att gå med i EMU....

Read More »Brad DeLong is right. Public debt ratios are too low!

Brad DeLong is right. Public debt ratios are too low! One of the most effective ways of clearing up this most serious of all semantic confusions is to point out that private debt differs from national debt in being external. It is owed by one person to others. That is what makes it burdensome. Because it is interpersonal the proper analogy is not to national debt but to international debt…. But this does not hold for national debt which is owed by the nation to citizens of the same nation....

Read More »Bayesian overload

Although Bayesians think otherwise, to me there’s nothing magical about Bayes’ theorem. The important thing in science is for you to have strong evidence. If your evidence is strong, then applying Bayesian probability calculus is rather unproblematic. Otherwise — garbage in, garbage out. Applying Bayesian probability calculus to subjective beliefs founded on weak evidence is not a recipe for scientific akribi and progress. Neoclassical economics nowadays usually assumes that agents that...

Read More »How to cure the recession …

How to cure the recession … [embedded content] (h/t Gabriel)

Read More »Econometric confusions

In a recent issue of Real World Economics Review there was a rather interesting, if somewhat dense, article by Judea Pearl and Bryant Chen entitled Regression and Causation: A Critical Examination of Six Econometrics Textbooks … The paper appears to turn on a single dichotomy. The authors point out that there is a substantial difference between what they refer to as the “conditional-based expectation” and “interventionist-based expectation”. The first is given the notation: E[Y|X] While...

Read More »Moments like this you never forget!

Moments like this you never forget! Last year Mark Blyth gave the U. S. Senate Budget Committee a well-earned lecture on public debt. Unforgettable and absolutely fabulous!

Read More »Wren-Lewis/Mirowski/Syll on neoliberalism

Oxford professor Simon Wren-Lewis had a post up some time ago commenting on traction gaining ‘attacks on mainstream economics’: One frequent accusation … often repeated by heterodox economists, is that mainstream economics and neoliberal ideas are inextricably linked. Of course economics is used to support neoliberalism. Yet I find mainstream economics full of ideas and analysis that permits a wide ranging and deep critique of these same positions. The idea that the two live and die...

Read More »The tiny little problem with Chicago economics

The tiny little problem with Chicago economics Every dollar of increased government spending must correspond to one less dollar of private spending. Jobs created by stimulus spending are offset by jobs lost from the decline in private spending. We can build roads instead of factories, but fiscal stimulus can’t help us to build more of both. This form of “crowding out” is just accounting, and doesn’t rest on any perceptions or behavioral assumptions. John Cochrane And the tiny little...

Read More »Send in the clowns

Send in the clowns No, I wasn’t thinking of U. S. republican presidential candidates … [embedded content]

Read More » Lars P. Syll

Lars P. Syll