Aggregate production functions — neoclassical fairytales When one works – as one must at an aggregate level – with quantities measured in value terms, the appearance of a well-behaved aggregate production function tells one nothing at all about whether there really is one. Such an appearance stems from the accounting identity that relates the value of outputs to the value of inputs – nothing more. All these facts should be well known. They are not, or, if they are, their implications are...

Read More »On minimum wage and value-free economics

On minimum wage and value-free economics I’ve subsequently stayed away from the minimum wage literature for a number of reasons. First, it cost me a lot of friends. People that I had known for many years, for instance, some of the ones I met at my first job at the University of Chicago, became very angry or disappointed. They thought that in publishing our work we were being traitors to the cause of economics as a whole. David Card Back in 1992, New Jersey raised the minimum wage by 18...

Read More »In the long run — economics as ideology

In the long run — economics as ideology Although I never believed it when I was young and held scholars in great respect, it does seem to be the case that ideology plays a large role in economics. How else to explain Chicago’s acceptance of not only general equilibrium but a particularly simplified version of it as ‘true’ or as a good enough approximation to the truth? Or how to explain the belief that the only correct models are linear and that the von Neuman prices are those to which...

Read More »Macroeconomic models — beautiful but irrelevant

Macroeconomic models — beautiful but irrelevant Roman Frydman is Professor of Economics at New York University and a long time critic of the rational expectations hypothesis. In his seminal 1982 American Economic Review article Towards an Understanding of Market Processes: Individual Expectations, Learning, and Convergence to Rational Expectations Equilibrium — an absolute must-read for anyone with a serious interest in understanding what are the issues in the present discussion on rational...

Read More »‘Some are like water, some are like the heat’

‘Some are like water, some are like the heat’ [embedded content]

Read More »Nothing compares

[embedded content] A video masterpiece.

Read More »When science becomes dogmatism

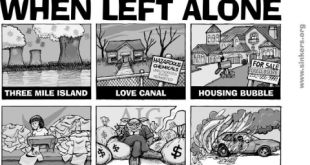

When science becomes dogmatism Abstraction is the most valuable ladder of any science. In the social sciences, as Marx forcefully argued, it is all the more indispensable since there ‘the force of abstraction’ must compensate for the impossibility of using microscopes or chemical reactions. However, the task of science is not to climb up the easiest ladder and remain there forever distilling and redistilling the same pure stuff. Standard economics, by opposing any suggestions that the...

Read More »‘New Keynesianism’ — an uncomfortable trade-off

‘New Keynesianism’ — an uncomfortable trade-off The crucial point however is: market conditions, which are presupposed in the model of intertemporal choice, are not given in reality. Distributing consumption optimally over time depends on the possibility of individuals to lend money on their permanent income, if temporary periods of low market income are to be bridged. Because this perfect financial market does not exist, consumption behaviour necessarily depends strongly on current...

Read More »Modern economics — an abstract monstrosity

Modern economics — an abstract monstrosity The paradox of modern economics is that while the computers are churning out more and more figures, giving more and more spurious precision to economic pronouncements, the assumptions behind this fiesta of quantification are looking less and less safe. Economic model making was never easier to undertake and never more disconnected from reality. Somewhere along the way economics took a wrong turn. What has occurred, and what has been vastly...

Read More »Yours truly on economics rules and deductivism

Yours truly on economics rules and deductivism Yours truly has two (!) articles in the latest issue (74) of Real-World Economics Review. One is a review of Dani Rodrik’s Economics Rules (Oxford University Press 2015) — When the model becomes the message — a critique of Rodrik — on which I run a series of blogposts here in December last year. Rodrik’s book is one of those rare examples where a mainstream economist — instead of just looking the other way — takes his time to ponder on the...

Read More » Lars P. Syll

Lars P. Syll