This is a repost by Socialist Economist of an earlier article by Nick Johnson. If you didn't catch it here at MNE the first time, here it is again. If you did, well, it's more evidence of MMT getting media exposure.Socialist EconomistModern Monetary Theory and Inflation – Anwar Shaikh’s Critique Nick Johnson, The Political Economy of Development

Read More »Zap — Dr. Kelton tweet thread on issuing money

Stephanie Kelton tweet explaining the basis of MMT. Some keeper quotes.Political RealityDr. Kelton tweet thread on issuing money Zap

Read More »Dean Baker — Trump and China: Going with Patent Holders Against Workers

Dean Baker argues that what the president considers a winning deal with China is a good deal for US transnational corporations but a bad deal for American workers. Moreover, it only s good deal short term for corporations and likely a bad deal longer term. What Baker doesn't mention is that the hardline approach to China that the Trump administration is taking on all levels is looked upon in China as must more Western humiliation of the oldest continuous civilization on the planet. The...

Read More »Craig A. Van Matre — Moderen [sic] Monetary Theory is unsustainable hypocrisy

No, this is not the Onion.Can't even spell the name "Modern Monetary Theory" right. OK, finance and economics is hard, but spelling?Columbia Daily TribuneModeren [sic] Monetary Theory is unsustainable hypocrisy Craig A. Van Matre, retired attorney formerly with Van Matre, Harrison, Hollis and Taylor

Read More »William Black – Deutsche Bank Crime Weakens Global Financial System

Bill Black says Deutsche Bank is a criminal outfit; it's shareholders lose money while it's CEO's take in millions. The bank could trigger the next recession, says Bill Black. [embedded content] Professor of Economics and Law, William Black, who was a top regulator in the S&L crisis, says, “Deutsche Bank is one of the potential sources of the next recession, and you can see lots of people warning that there are signs that a serious recession is pretty likely relatively soon. . . . The...

Read More »Steve Keen Says U.S. Heading for 2020 Recession

[embedded content]

Read More »Russell A. Whitehouse — The Myth Of Capitalism – Book Review

A complement of Thomas Piketty's Capital in the 21st Century. The principal point is that competition is the driver of capitalism as companies strive in the marketplace to achieve efficiency and effectiveness in anticipating and meeting demand. When competition decreases, the engine fails to function as an evolutionary force. This is hardly a new idea. See "What Is Monopoly Capital?" by John Bellamy Foster and "Monopoly Capitalism" by Paul M. Sweezy. But the authors of The Myth of...

Read More »Links — 7 Dec 2018

Moon of AlabamaNeocons Sabotage Trump's Trade Talks - Huawei CFO Taken Hostage To Blackmail China Zero HedgeChina Prepares Retaliation To Huawei CFO Arrest Tyler Durden CounterpunchThe Universal Declaration of Human Rights at 70: Time to De-Colonize Human Rights! Ajamu Baraka CounterpunchThe Bomb that Did Not Detonate: Julian Assange, Manafort and The Guardian Binoy Kampmark, lecturer at RMIT University, Melbourne Dances with BearsTHE LIE THAT SHOT DOWN MALAYSIA AIRLINES FLIGHT...

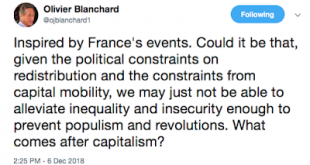

Read More »Olivier Blanchard tweet

https://twitter.com/ojblanchard1/status/1070776221741580288

Read More »Caitlin Johnstone — Nikki Haley To Be Replaced By Blonde Version Of Nikki Haley

Is this becoming an American tradition? Caitlin Johnstone — Rogue JournalistNikki Haley To Be Replaced By Blonde Version Of Nikki HaleyCaitlin Johnstone

Read More » Mike Norman Economics

Mike Norman Economics