I don't know if any of you saw this, but last weekend I was in Granite Falls, WA, doing a wilderness survival training course. It was the hardest thing I ever did. Tested me to the limit, even more than my rim-to-rim Grand Canyon day hike in 2021.Nonstop rain, cold. Slept outside under a tarp. Had really poor equipment. I had to learn to compartmentalize my thoughts into half hour intervals just to get through the night. No sleep, by the way. I simply couldn't.Frankly, I am still processing...

Read More »Why are people so triggered? What’s going on?

I did a video on attachments and how attachments are a source of our suffering. (Buddhist concept.) I related it to investing and trading. (i.e. we are "attached" to the outcomes.)People got pissed off. They unsubscribed or criticized me on talking about this.Is this normal? I've been trading for over 40 years. Been a member and floor trader on 4 exchanges. Managed money for a major hedge fund. Ran a proprietary trading desk for a major international bank.Economist by education. (Wharton,...

Read More »Dealing with doubt

You don't know what's going to happen, so what should you do? Trade and invest using the concepts of MMT. Get a 30-day free trial to MMT Trader. https://www.mmteconomics.com/ Mike Norman Twitter https://twitter.com/mikenorman Mike Norman Economics: https://mikenormaneconomics.blogspot.com/ Understanding the Daily Treasury Statement video course. https://www.pitbulleconomics.com/understanding-daily-treasury-statement-video-course/?s2-ssl=yes

Read More »Fiscal flows are accelerating!

If you don’t believe me about the importance of these flows, and how they dictate, economic activity and market trends, just watch this video.

Read More »China’s Position on the Political Settlement of the Ukraine Crisis — Chinese Foreign Ministry

Full text.Ministry of Foreign Affairs of the People's Republic of ChinaChina’s Position on the Political Settlement of the Ukraine Crisis2023-02-24 09:00

Read More »Attachment is the source of all suffering. (Market related.)

If you are attached to the monetarist view or any single variable form of analysis, you will subject yourself to suffering and losses.

Read More »Russian Oil Sanctions Have Redrawn Global Trade Maps — Irina Slav

Both India and China are importing Russian crude at a record pace.Energy Intelligence: at least 20 trading companies—but probably a lot more—are sending Russian oil around the world.According to Trafigura, the total number of tankers that have been “reserved” to carry Russian oil could be as high as 600, of which 400 crude tankers.Vitol, Trafigura, BP, Shell, Equinor—all of them upped and left whatever business they had in Russia, leaving an empty space. It did not take very long for this...

Read More »Wolf Knows Better. I know He Does — Peter Radford

Does Martin Wolf make a sophmore error in thinking that saving causes investment? It appears so.The Radford Free PressWolf Knows Better. I know He DoesPeter Radford

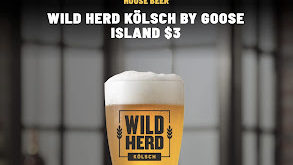

Read More »$3 beers

B-dubs advertising a $3 beer for happy hour 4-7.. I believe this may be a 22oz draft … maybe only a 16.. … whichever I haven’t seen this type of price in quite a while…

Read More »Farm Prices

Mom & Pop meat store over on the eastern shore:These prices aren’t too bad… $35 for 40lb leg segments… right now the closer you can get to the farm gate the better the prices…Middle men getting excess margin right now… won’t last…

Read More » Mike Norman Economics

Mike Norman Economics