Naturally, politicians and pundits debate whether the amount is excessive. But implicit in their seemingly routine deficit debate is a remarkable shift: Inflation has replaced debt — the old stalking horse for defeating progressive legislation — as the primary concern with deficit spending.It's a subtle change, with profound consequences. And it augurs the rise of a revolutionary approach to political economy, Modern Monetary Theory (MMT), as the dominant paradigm in the politics of...

Read More »I was always a seller.

In my early trading days I was always a seller. That was a terrible strategy. Trade and invest using the concepts of MMT. Get a 30-day free trial to MMT Trader. https://www.pitbulleconomics.com/ Download my podcasts! New one every week. https://www.buzzsprout.com/1105286 Mike Norman Twitter https://twitter.com/mikenorman

Read More »The Driscoll Brothers Intimidate Everyone at the Pub | Only Fools and Horses

[embedded content]

Read More »Biden’s China Policy: A More Polite Trump — Paul Jay interviews Amb. Chas Freeman

Getting beyond the BS. Win-win grows the pie. Zero-sum threatens to destroy the pie.Amb. Chas Freeman presents a realist analysis of US foreign policy. The Analysis (March 12, 2021)Biden’s China Policy: A More Polite TrumpPaul Jay interviews Amb. Chas FreemanSee alsoTranscript below the video and podcast.CHINA RISINGInvited to Huawei’s “Protecting IP-Driving Innovation 2021 White Paper Forum”, here is my analysis and what you need to know for your (ICT – Information, Communication and...

Read More »Links — 20 March 2021

FAIR (US hypocritically outraged when the tables are turned)WSJ rage at ‘woke’ China foreshadows new redbaiting of social justice activistsAri PaulSputnik International (Russian state sponsored)US Pushes Sub-Hunting Plane Contract on Germany, Berlin Says it Can’t Afford $1.8 Bln Price TagIranian FM Zarif Blasts EU for Asking Tehran to ‘Act Responsibly’ While Ignoring 'Israel’s Nukes'Elon Musk Addresses China Ban Rumours, Says Tesla Would ‘Get Shut Down’ if It Spied AnywhereZero Hedge[NY]...

Read More »Austerity-Addicted Media Scaremonger Over Infrastructure ‘Spending Spree’ — Julie Holar

As soon as Democrats took over Washington with big plans for reviving the economy, corporate media started sounding the alarm about government spending (FAIR.org, 1/25/21). With the party’s infrastructure bill - which could come in around $2 trillion over four years - now pending, the media deficit hawks are on high alert, tossing around big, scary numbers to throw cold water on the bill.It’s hardly surprising to find deficit hawkery from the Washington Post editorial board (3/11/21), which...

Read More »Sentiment

Boomers bullish...AAII Sentiment Survey: Bullish sentiment is at an unusually high level for the second consecutive week.https://t.co/CPRW7Qb6JE pic.twitter.com/9JUhkCDr3R— AAII SentimentSurvey (@AAIISentiment) March 18, 2021

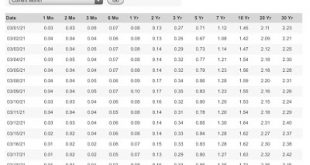

Read More »Zero US Rates

Effective zero reported here out to 90 days (some reports of actual negative rates, Treasury reporting system here probably cannot accept a negative input ?) and lower numbers starting to creep out to the right axis of time.... meanwhile Mike reporting everyone is short the 10-yr go figure.. US going Mike’s “full Japan!”? imo still not out of realm of possibility....

Read More »Fed pulls the rug on the banks. Now what?

No more SLR exemption as of March 31. Will bond yields soar and markets collapse? Trade and invest using the concepts of MMT. Get a 30-day free trial to MMT Trader. https://www.pitbulleconomics.com/ Download my podcasts! New one every week. https://www.buzzsprout.com/1105286 Mike Norman Twitter https://twitter.com/mikenorman

Read More »Links — 19 March 2021

The Automatic EarthPutin is 1000x BidenRaúl Ilargi MeijerRT (Russian state sponsored)After Biden’s ‘killer’ comments about Putin, time to make a break in Russia-US relations; further engagement is pointless for nowFyodor Lukyanov, editor-in-chief of Russia in Global Affairs, chairman of the Presidium of the Council on Foreign and Defense Policy, and research director of the Valdai International Discussion ClubSouthFrontNATO In Panic Mode After Losing Track Of Russian Submarine In Eastern...

Read More » Mike Norman Economics

Mike Norman Economics