Natalie Nougayrède is a very hawkish journalist who works for the Guardian, and all she ever writes about is how bad Putin is.I put out a post here last week where a journalist uncovered documents which showed that the Guardian editors regularly met with MI6 to discuss how best to report the news.From the Guardian Forget Putin’s ‘liberalism’ jibe. This man runs a war machine For too long, the west has turned a blind eye to Russian atrocities in a string of wars Nougayrède's article is...

Read More »Opportunity cost, MMT and public spending — John Quiggin

John Quiggin looks at at student debt cancellation in terms of opportunity cost and MMT.Crooked TimberOpportunity cost, MMT and public spendingJohn Quiggin | Professor and an Australian Research Council Laureate Fellow at the University of Queensland, and a member of the Board of the Climate Change Authority of the Australian Government

Read More »Banks reward shareholders with billions in buybacks, dividend hikes after Fed approval

Post annual CCAR banks win approval for 10s of $Bs of capital redistribution; some pretty big amounts here: JPMorgan JPM, +2.72% , the nation’s largest bank by assets, said it plans to buy back $29.4 billion in shares this cycle. It would also increase its dividend 12.5% to 90 cents a share. In total, JPMorgan would return roughly $40 billion to shareholders through dividends and stock repurchases over the next year. Wells Fargo WFC, +2.23% announced plans to buy back $23.1 billion in...

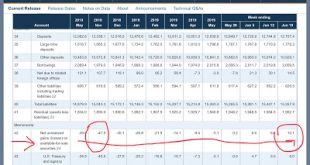

Read More »Effect of Policy Rate on Bank System Capital

Cut below from today's nsa H.8 report showing 'Unrealized Gain (Loss) on Available for Sale Securities': You can see how Fed interest rate increases in 2018 caused a discount in the $trillions of CCAR required out-sized Tier1 quality Bank Assets to a near $50B LOSS by the time of the last December rate increase in late Q4 of 2018; and the corresponding reduction in equity share index prices where we saw those indexes off about 20% by Christmas Eve from the previous Q3 highs as this severe...

Read More »Mental game coaching

Everyone needs a coach.

Read More »Will Modern Monetary Theory Go Mainstream? — Eric Winograd

Progress. The author admits that MMT makes sense economically and financially. However, Eric Winograd hopes it won't go mainstream based on expanding the size and role of government. So now it is ideology rather than theory or empirics.equities.comWill Modern Monetary Theory Go Mainstream? Eric Winograd

Read More »Tucker Carlson – John Bolton Is A Bureaucratic Tapeworm!” Tucker & Glenn Greenwald

Could this be the beginning of the end of the Neocon war machine? Another awesome video from Tucker Carlson, where he even interviews Glenn Greenwald.Tucker Carlson says the Neocons are all over Washington.Well, I bet the Neocons are planning to get Tucker Carlson removed right now.Wouldn't it be great to see the whole Neocon and the military industrial complex game exposed, and Tony Blair and G. W Bush put on trail? [embedded content]

Read More »Tucker Carlson – Tulsi Gabbard sounds off on ‘clear bias’ during her debate

This is inspirational, just look at the comments underneath where there are loads of conservatives saying they would vote for her. They're fed up with the Neocon's wars! [embedded content]

Read More »Racism is a framework, not a theory — Andrew Gelman

I am posting this for its relevance to philosophy of logic and philosophy of science rather than specifics. It draws a useful distinction between frameworks that generate theories and which are themselves not testable (hence falsifiable) and the theories a framework is used to generate.This is obviously relevant to philosophy of science, but why philosophy of logic? In his later work, Ludwig Wittgenstein sought to show that the overarching frameworks of a culture as a way of life are deeply...

Read More »Bank “Stress Tests!”

Fed's 2019 Comprehensive Capital Analysis and Review (CCAR), which the Liberal Art dialectic trained morons who cannot understand the regulatory accounting abstractions typically term the figurative "Stress Tests!", results out yesterday.CCAR is currently functioning as the control variable of effect out of the 4 separate regulatory functions that constitute US bank regulatory policy. The Board considers both quantitative and qualitative factors when evaluating a bank's capital plan....

Read More » Mike Norman Economics

Mike Norman Economics