By Thomas Palley (guest blogger)Every week my e-mail box receives a steady stream of articles aimed at cultivating public animus to Russia. The articles are always wrapped in a narrative in which Russia is a threat to democracy in Ukraine, Eastern Europe, and elsewhere. The effect is to create public support for hardline action (economic and/or military) against Russia.The insidious underside of this campaign is it paves the way for a scenario in which Ukraine provokes Russia, thereby...

Read More »A Materialist-Institutionalist Model of Capitalist Social Reproduction

By David Fields (guest Blogger)One of the defining features of classical political economy, particularly Marx, is the schema of a class system based on those who control the means of production, capitalists, and those who do not, wage labor. Yet, the intricacies of capitalist reality are more complex. As such, is it possible to formulate a model that better captures integrated social processes? Below is my attempt to do just that. This model, in my view, allows for greater attention to be...

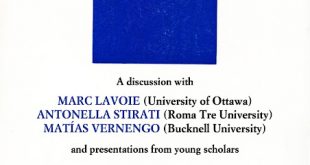

Read More »On Garegnani’s contributions to economics

[embedded content]My initial comments at the seminar on the legacy of Pierangelo Garegnani's contributions to economics organized by the Italian Post Keynesian Network. The full seminar here.

Read More »Part Two of the interview at Radio UNAL

More on the same issues, with a discussion of Piero Sraffa and the surplus approach (this week there will be an event on the legacy of Pierangelo Garegnani). In Spanish again.

Read More »On the Worldly Philosophy at Radio UNAL

Interview in Spanish to Radio UNAL with Óscar Morillo. We discuss the the origins of political economy and their importance and the continuous relevance for the understanding of modern capitalism. Link here.

Read More »Garegnani: Ten Years After

This event organized by the Italian Post Keynesian Network. I wrote about Garegnani's contributions when he passed away here in the blog. We will discuss some of the issues he raised, but also the new directions of Sraffian economics.

Read More »Review of Keynesian Economics issue on Financialization

Volume 9, Issue 4 of the Review of Keynesian Economics is now available. The issue is devoted to the twin topics of “financialization” and the “macroeconomics of international finance”. The first paper by Michael Hudson analyzes the impact on distributional outcomes of adding capital gains to and subtracting rent seeking activity from GDP. The second paper examines financialization’s rolling sector dynamics whereby it loads the economy with debt. The third paper by Esteban Pérez Caldentey...

Read More »Financialization revisited: the economics and political economy of the vampire squid economy

New paper by Thomas Palley. From the abstract:This paper explores the economics and political economy of financialization using Matt Taibbi’s vampire squid metaphor to characterize it. The paper makes five innovations. First, it focuses on the mechanics of the “vampire squid” process whereby financialization rotates through the economy loading sector balance sheets with debt. Second, it identifies the critical role of government budget deficits for the financialization process. Third, it...

Read More »The Biden administration should ignore the debt ceiling

The administration run excessive budget deficits, and accumulated too much debt in the face of successive economic crises. As a result, it was forced to compromise politically in order to avoid a catastrophic default, and the subsequent political crisis brought about chaos, and the collapse of the established institutions. Of course, this is not a cautionary tale about the United States. It is a description of the economic crisis that led to the French Revolution.But in spite of the...

Read More »On the irrelevance of inflation expectations: the return of the working class

There are many myths about the Phillips Curve and the so-called Monetarist Counter-Revolution of the 1960s and 1970s. Forder's book is a good read on some of these issues. Jeremy Rudd's recent paper is also a must read, and has now been accepted for publication in the Review of Keynesian Economics (ROKE).It debunks the myth about the importance of inflationary expectations for explaining the Great Inflation of the 1970s, and casts doubts about the Monetarist Counter Revolution, the Rational...

Read More » Naked Keynesianism

Naked Keynesianism