from C. P. Chandrasekhar It’s a paradox that has periodically recurred in recent times. Financial indicators are hugely favourable from the point of view of those who benefit from them, even when the performance of the real economy is poor or dismal. In this Covid-afflicted year, that paradox has manifested itself with greater intensity. And with a difference. Even while the real economy remains in contractionary mode, not only have stock market returns exploded, but India’s stock of...

Read More »Econometrics and the challenge of regression specification

from Lars Syll Most work in econometrics and regression analysis is — still — made on the assumption that the researcher has a theoretical model that is ‘true.’ Based on this belief of having a correct specification for an econometric model or running a regression, one proceeds as if the only problem remaining to solve have to do with measurement and observation. When things sound too good to be true, they usually aren’t. And that goes for econometric wet dreams too. The snag is, of...

Read More »JANUARY 6, 2021

from Peter Radford The crisis lingers on. One would think, although we are now in an odd world, that abetting, instigating, and applauding an attack on Congress would result in more than a gentle rebuke. Apparently not. The wheels of American politics move extremely slowly and the perpetrator of the crime still is hunkered down in the White House bloviating, no doubt, about how he was robbed of his victory in November’s election. Perhaps there will be enough spine amongst those who...

Read More »Sliding doors: The day US democracy almost died

from Thomas Palley It is now four days since the January 6 mob attack on the US Congress which President Donald Trump incited. In a manner akin to a combat situation, the numbness induced by the overwhelming nature of the event is giving way to shock and anger. What is also becoming clear is just how close US democracy came to dying. Sliding Doors The film Sliding Doors begins with two different scenarios in which the course of the main protagonist’s life depends on whether or not she...

Read More »Overconfident economists

from Lars Syll Worst of all, when we feel pumped up with our progress, a tectonic shift can occur, like the Panic of 2008, making it seem as though our long journey has left us disappointingly close to the State of Complete Ignorance whence we began … It often takes years down the Path, but sooner or later, someone articulates the concerns that gnaw away in each of us and asks if the Assumptions are valid … It would be much healthier for all of us if we could accept our fate, recognize...

Read More »European (un)employment in times of Corona: hard won gains down the drains

. Eurostat has recently published new data on EU unemployment. It’s going down again. Which seems good. But there is more to this than meets the eye. To be counted as ‘unemployed’ one has to have no ‘gainful employment’ and to be actively seeking for a job. People who give up seeking are not counted as unemployed. Neither are people leaving the labor market. And people are giving up seeking as well as leaving the labor market… Eurostat has engineered a ‘dashboard’ which maps the...

Read More »Why partisanship will increase in the Post-Trump Era

from Mark Weisbrot There is a gigantic and increasingly unbridgeable divide on economic policy. Many are hoping that when Trump — one of the most divisive US presidents in the past century or more — leaves office, the historically elevated levels of partisanship in US politics will at least begin to subside. But the opposite is vastly more likely. There are short- and intermediate-run, as well as long-run, reasons for this result that have little to do with the Trump phenomenon. Most...

Read More »Why do we need pluralism in times of disruption? A practical guide

from Asad Zaman Today we are going through a period of disruption due to the COVID-19 pandemic that impacts us individually and collectively in an unprecedented manner. Because we see how interconnected we are, the sense of unity, solidarity in time of crisis is necessary. So why bother with pluralism in the first place? Introductory remarks about pluralism and the new normal We are currently in an unprecedented moment in human history. Although humanity went through several pandemics and...

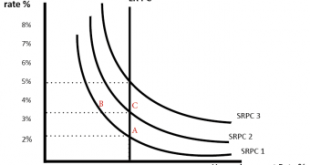

Read More »NAIRU — closer to religion than science

from Lars Syll Once we see how weak the foundations for the natural rate of unemployment are, other arguments for pursuing rates of unemployment economists once thought impossible become more clear. Wages can increase at the expense of corporate profits without causing inflation … The harder we push on improving output and employment, the more we learn how much we can achieve on those two fronts. That hopeful idea is the polar opposite of a natural, unalterable rate of unemployment. And...

Read More »Corporate power and the future of U.S. capitalism

from Shimshon Bichler and Jonathan Nitzan Corporate power in the United States has risen to unprecedented levels, but the rate at which this power has grown is decelerating. Both facts have important implications for the future of U.S. capitalism. According to the theory of capital as power (or CasP for short), the quest for capitalized power – and for more and more of it – is the key driving force of modern capitalism. Capitalists, CasP argues, particularly dominant ones, judge their...

Read More » Real-World Economics Review

Real-World Economics Review