from David Ruccio Right now, the United States is mired in an economic depression, the Pandemic Depression, not dissimilar to what happened in the 1930s and again after the crash of 2007-08. Real (inflation-adjusted) gross domestic product contracted by an annual rate of 31.7 percent in the second quarter of 2020 (according to the Bureau of Economic Analysis) and at least 27 million American workers are currently unemployed (counting workers continuing to receive some kind of unemployment...

Read More »Dow Kicks Out ExxonMobil. So Is The Environment All Fixed Now?

Follow on Twitch: https://www.twitch.tv/actdottv Julianna welcomes back recurring guest Dean Baker, macroeconomist and co-founder of the Center for Economic and Policy Research, to discuss how starting this week, the oil giant ExxonMobil will no longer have a home on the Dow Jones Industrial Average. And it’s about time. Not only are Big Oil companies like Exxon destroying the planet, but they’re no longer sound investments. Dean Baker co-founded The Center for Economic and...

Read More »Dow Kicks Out ExxonMobil. So Is The Environment All Fixed Now?

Follow on Twitch: https://www.twitch.tv/actdottv Julianna welcomes back recurring guest Dean Baker, macroeconomist and co-founder of the Center for Economic and Policy Research, to discuss how starting this week, the oil giant ExxonMobil will no longer have a home on the Dow Jones Industrial Average. And it’s about time. Not only are Big Oil companies like Exxon destroying the planet, but they’re no longer sound investments. Dean Baker co-founded The Center for Economic and Policy Research...

Read More »Rethinking public debt

from Lars Syll Public debt is normally — as emphasized again and again by MMT economists — nothing to fear, especially if it is financed within the country itself (but even foreign loans can be beneficent for the economy if invested in the right way). Some members of society hold bonds and earn interest on them, while others pay taxes that ultimately pay the interest on the debt. The debt is not a net burden for society as a whole since the debt ‘cancels’ itself out between the two...

Read More »Pandemic Depression

from David Ruccio The number of initial unemployment claims for unemployment compensation in the United States once again surpassed one million—for the 21st time in the past 22 weeks—signaling a continuation of the Pandemic Depression. This morning, the U.S. Department of Labor (pdf) reported that, during the week ending last Saturday, another 1 million American workers filed initial claims for unemployment compensation. While initial unemployment claims remain well below the recent peak...

Read More »Uncertainty, learning, and rational expectations

from Lars Syll The rational expectations hypothesis presupposes — basically for reasons of consistency — that agents have complete knowledge of all of the relevant probability distribution functions. And when trying to incorporate learning in these models — trying to take the heat of some off the criticism launched against it up to date — it is always a very restricted kind of learning that is considered. A learning where truly unanticipated, surprising, new things never take place, but...

Read More »RCUW-TV EP 9: Dean Baker, Lake Havasu City Properties

In today's episode, Debi Pennington interviews Dean Baker with Lake Havasu City Properties.

Read More »RCUW-TV EP 9: Dean Baker, Lake Havasu City Properties

In today's episode, Debi Pennington interviews Dean Baker with Lake Havasu City Properties.

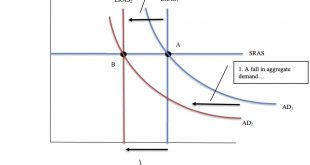

Read More »Supply and demand deconstructed

from Blair Fix Prices are caused by supply and demand, right? So say neoclassical economists. If you’ve bought their fairy tale, I recommend you watch this video. In it, Jonathan Nitzan demolishes the neoclassical theory of prices. It’s a master lesson in how to deconstruct a theory. Here’s the 100-word summary. Nitzan shows that the neoclassical theory of prices fails in six ways: Neoclassical theory hinges on utility that cannot be measured It relies on demand and supply curves...

Read More »MMT’s inflationary bias

from Lars Syll A view yours truly often encounters when debating MMT is that there is an inflationary bias in MMT and that its framework ignores expectations. Hmm … It is extremely difficult to recognize that description. Given its roots in the writings of Keynes, Lerner, and Minsky, it is, to say the least, rather amazing to attribute those views to MMT. Let me just quote one source to show how ill-founded the critique is on this issue: MMT recommends a different approach to the federal...

Read More » Real-World Economics Review

Real-World Economics Review