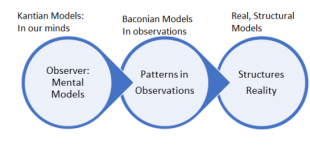

from Asad Zaman In the previous post (Three Types of Models 5), we discussed three types of models. The first type is based purely on patterns in observations, and does not attempt to go beyond what can be seen. This is an “observational” or Baconian model. The second type attempt to look through the surface and discover the hidden structures of reality which generate the observations we see. The best approach to this type of models has been developed by Roy Bhaskar, so we can call it a...

Read More »Still in the danger zone

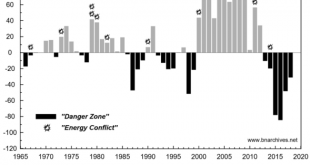

from Shimshon Bichler and Jonathan Nitzan In December 2017, we posted a RWERB entry, titled ‘Profit warning: there will be blood’. We warned that, although the Weapondollar-Petrodollar Coalition might no longer be in the Middle East driver’s seat, the oil and armament companies, the region’s oil-exporting autocracies and various non-state groups were all keen on seeing their oil incomes rise from record lows. And we observed that, in this context, ‘the prospects of a new energy conflict,...

Read More »Does it — really — take a model to beat a model?

from Lars Syll A critique yours truly sometimes encounters is that as long as I cannot come up with some own alternative model to the failing mainstream models, I shouldn’t expect people to pay attention. This is, however, to totally and utterly misunderstand the role of philosophy and methodology of economics! As John Locke wrote in An Essay Concerning Human Understanding: The Commonwealth of Learning is not at this time without Master-Builders, whose mighty Designs, in advancing the...

Read More »In half a century what have we done with that knowledge?

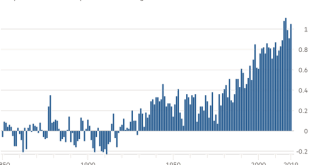

from Edward Fullbrook A version of this graph appeared in yesterday’s Guardian. I have a vivid memory from almost exactly half a century ago that relates to it. It was February 1970 and snowing. It was rural Wisconsin in the States and I was riding in a car with a woman who was the mother of six and a well-known peace activist but with no connection to science or environmentalism. We were coming from Frank Lloyd Wright’s estate Taliesin where I lived, and as we neared Madison and...

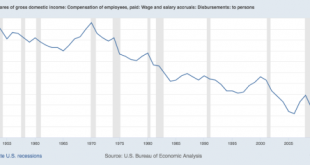

Read More »What inequality?!

from David Ruccio Economic inequality in the United States and around the world is now so obscene, and has convinced more and more people to do something about it, that the business press has initiated a campaign to deny its very existence. They and the folks they represent are losing the battle of public opinion. And they’ve decided to do something about it. First up was the Economist, the “newspaper” of record for liberal capitalism [ht: sk], claiming that new research undermines the...

Read More »Where’s the Barefoot Revolution in economics?

from Blair Fix Yesterday I was reminded of what got me interested in economics. I’ll preface this by saying that I make my living as a substitute teacher in Toronto. It’s not glamorous, but it pays the bills. It gives me time to do research from outside academia. When I’m in high school classrooms, I always browse the posters on the wall. It’s funny what you see. You find things (both good and bad) that you’d never see in institutions of ‘higher learning’. It’s a daily source of amusement...

Read More »Is economics — really — predictable?

from Lars Syll As Oskar Morgenstern noted already back in his 1928 classic Wirtschaftsprognose: Eine Untersuchung ihrer Voraussetzungen und Möglichkeiten, economic predictions and forecasts amount to little more than intelligent guessing. Making forecasts and predictions obviously isn’t a trivial or costless activity, so why then go on with it? The problems that economists encounter when trying to predict the future really underlines how important it is for social sciences to incorporate...

Read More »Petition and statement on violence at Jawaharlal Nehru University

To sign on to this letter, please click here. We are shocked and horrified to learn of the terrible attack on the Jawaharlal Nehru University on the evening on 5 January 202, by a group of armed goons who targeted a peaceful gathering of teachers and students. We note that this terrible event comes in the wake of a prolonged struggle by the students against a fee hike that would force nearly half of them to abandon their studies, and after an even longer series of protests by the faculty...

Read More »Three types of models – 5

from Asad Zaman It is important to understand that there are three type of models, corresponding the following diagram. The simplest type of model is a pattern in the data that we observe. A second type of model is a “mental model”. This is a structure we create in our own minds, in order to understand the patterns that we see in the observations. The third type of model is a structure of the hidden real world, which generates the patterns that we see. Some examples will be helpful in...

Read More »How to teach econometrics

from Lars Syll Professor Swann (2019) seems implicitly to be endorsing the traditional theorem/proof style for teaching econometrics but with a few more theorems to be memorized. This style of teaching prepares students to join the monks in Asymptopia, a small pristine mountain village, where the monks read the tomes, worship the god of Consistency, and pray all day for the coming of the Revelation, when the estimates with an infinite sample will be revealed. Dirty limited real data sets...

Read More » Real-World Economics Review

Real-World Economics Review