A conference by the World Economics Association (WAE) and IDEAs, 20th April to 20th May, 2022. Rationale This World Economics Association (WEA) – International Development Economic Associates (IDEAs) Conference, led by the Professors Alicia Puyana and Maria Alejandra Madi, calls for a pluralist reflection about current knowledge in...

Read More »The big lie of the elites

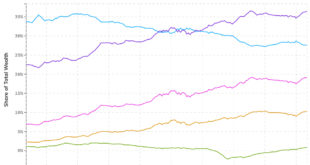

from Dean Baker We all know about the Trumpers’ big lie: somehow millions of votes were stolen from their hero, but the liberals were so smart in their steal that Trump’s team can’t produce any evidence. That one rightly draws contempt from anyone not in the cult, but what about the big lie that the vast majority of intellectuals seem to accept? Regular readers know what I am talking about. The big lie is that the massive rise in inequality over the last four decades was somehow the...

Read More »How to lie with inequality statistics

from David Ruccio In the world according to Paul Krugman, “most Americans” have gotten considerably richer over the past two years (even if “the gains have been especially big at the top”), “lower-income Americans [have] seen relatively large income gains,” and “the simple story that the pandemic has been great for the wealthy and bad for the working class doesn’t hold up.” Really? To support his argument, Krugman trots out a series of charts from Realtime Inequality, which is in fact an...

Read More »An MMT perspective on the public debt problem

from Lars Syll One of the most effective ways of clearing up this most serious of all semantic confusions is to point out that private debt differs from national debt in being external. It is owed by one person to others. That is what makes it burdensome. Because it is interpersonal the proper analogy is not to national debt but to international debt…. But this does not hold for national debt which is owed by the nation to citizens of the same nation. There is no external creditor. We owe...

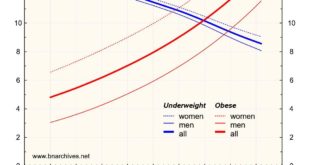

Read More »Obesity

from Shimshon Bichler & Jonathan Nitzan Here is a silent killer. While the proportion of the world’s population subject to hunger keeps falling, that of the overfed, mostly with junk, is climbing. In 2005, the two trends crossed: for the first time in the history of humanity, the number of obese people surpassed that of the underweight, and the process continues unabated. The latest data, for 2016, show that almost 14% of the world’s population is now obese — nearly three times more...

Read More »Social sciences and the colonised mind

from Prabhat Patnaik A crucial component of the imperialist system is the colonisation of third world minds that helps to sustain it. This colonisation is pervasive, but here we shall discuss only academic colonisation and that too relating to the social sciences. Social sciences are of critical importance because the problems of the third world are above all social problems, and since the colonisation of third world minds has the effect of inculcating in them the belief that imperialism...

Read More »More thoughts on the Great Inflation Debate

from Dean Baker With inflation remaining stubbornly high for longer than I, and many others, expected, I want to take another stab at the argument of the inflation hawks. As a jumping off point, I will use the argument put forward by Larry Summers and Jason Furman, probably the two most prominent and coherent economists arguing that we have underestimated the risks of persistently high inflation.[1] There are three main components to the Summers-Furman (SF) argument. (Their arguments are...

Read More »Weekend read – The crypto frontier of financialisation

from Maria Alejandra Madi and WEA Pedagogy Blog Hayek proposed the abolition of the government’s monopoly on the issuance of fiat money in his book “Denationalisation of Money: The Argument Refined” (1976). In reality, his support for a complete privatization of the money supply stemmed from his dissatisfaction with the management of central banks, which, in his opinion, had been heavily influenced by political considerations. As a result, the ultimate goal of Hayek’s denationalisation of...

Read More »Does drinking cause you to become a man?

from Lars Syll Breaking news! Using advanced multiple nonlinear regression models similar to those in recent news stories on alcohol and dairy and more than 3.6M observations from 1997 through 2012, I have found that drinking more causes people to turn into men! Across people drinking 0-7 drinks per day, each drink per day causes the drinker’s probability of being a man to increase by 10.02 percentage points (z=302.2, p<0.0001). Need I say, profound implications for public health...

Read More »The most truthful answer to the Queen’s question

from Nat Dyer Famously, Queen Elizabeth II asked professors at the London School of Economics (LSE) in 2008 why they did not notice the crisis coming. The moment has become a founding story of ‘new economics’. In the aftermath, the net was cast wide to catch those who did anticipate parts of the crisis. Many names have been put forward including Dean Baker, Steve Keen, Nouriel Roubini, Ann Pettifor, Raghuram Rajan, and Hyman Minsky. But, a name that’s missing from virtually every list was...

Read More » Real-World Economics Review

Real-World Economics Review