In the university, we need to open up and reorganize our antiquated departmental structures to recognize what’s been happening outside traditional economics departments. Well before “neoliberalism’s” ascent in the 1970s, mid-century academic economics had largely purged their departmental curriculum of cross-disciplinary topics that it had inherited from 19th and early 20th century “political economy”: for example, the close study of legal systems, social relations and institutions,...

Read More »MMT and ‘monetary crankery’

from Lars Syll MMTists often like to position themselves as the only ones to properly understand the ‘operational realities’ of modern monetary systems. Ironically, many of the claims made by MMTists on this topic are misleading at best. One common rhetorical tactic that I’ve noticed they employ, which often catches their critics out, is to use the term ‘government’ in a way that’s different typically from how it is used in mainstream economics. When they say ‘government’, they tend to...

Read More »Ross Douthat and the Great Resignation

from Dean Baker The General Picture: Policy Was Structured to Redistribute Upward I don’t agree with much about Ross Douthat’s politics, but he often makes some interesting points. He did so in his latest column on the Canadian “truckers” protest against vaccine mandates. Douthat argues that support for the protest stems from resentment by people who do various types of manual labor against the professional class. His point is that the latter have largely been setting the rules in ways...

Read More »American market populism dominates

from Ken Zimmerman (originally a comment) Nixon initiated the regime of free-floating currencies that continues to this day by ending US commitment to the international gold standard. The immediate effect of Nixon’s unlinking the dollar was to cause the price of gold to skyrocket; it hit a peak of $600 an ounce in 1980. This of course had the effect of causing U.S. gold reserves to increase dramatically in value. The value of the dollar, as denominated in gold, plummeted. The result was a...

Read More »Paul Krugman and the power of folk economics

from Lars Syll And then there’s Paul Krugman who … has stumbled on folk economics. And I’ll give him credit, since the “folk” he refers to “needn’t be members of the working class. They can be, and often are, members of the elite: plutocrats, powerful politicians and influential pundits.” Absolutely! … But then he reverts to classic Krugman: mainstream economists get it mostly right, and all they really need is the “IS-LM model” to analyze economic crises (such as the 2007-08 crash) and...

Read More »Folk economics

from David Ruccio James Ensor, “The Intrigue” (1890)Mainstream economists have, it seems, discovered the existence of economic ideas outside the official discipline of economics. It took them long enough! But, unfortunately, they don’t treat the topic particularly seriously —certainly not in the way the scholars who pioneered the project of the New Economic Criticism, starting in the mid-1990s, set out to conduct their theoretical and empirical work. No, for mainstream economists it’s...

Read More »The Grossman-Stiglitz paradox

In general the price system does not reveal all the information about “the true value” of the risky asset … The only way informed traders can earn a return on their activity of information gathering, is if they can use their information to take positions in the market which are “better” than the positions of uninformed traders. “Efficient Markets” theorists have claimed that “at any time prices fully reflect all available information” … If this were so then informed traders could not earn...

Read More »MMT and the pandemic inflation

from Lars Syll So what is the MMT solution to dealing with inflation ex post—i.e. once the problem is here? There isn’t one. And I’d suggest running fast and far from anyone who offers you a quick and easy prescription for dealing with any and all inflation. Mainstream economists, of course, offer just such a solution. The Federal Reserve will fix it! After all, it’s already their job (dual mandate), and they can act quickly and “independently,” tightening policy without fear of any...

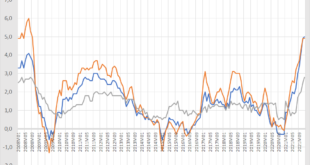

Read More »Do economists have the ‘periodic table’ of prices needed to pin down inflationary epochs?

Are we living in an epoch of high inflation? it’s a difficult question to answer as we’re lacking the tools to do this. Economics – heterodox and mainstream alike – is lacking a profound ‘periodic table’ of prices. This hampers them when they write and talk about inflation. There are a lot of pieces to this puzzle. The framework of the national accounts provides us with the distinction between expenditure prices (investments, government purchases, household...

Read More »Weekend read – Fisher’s flawed foundations of statistics

from Asad Zaman This lecture is about the personality of Sr Ronald Fisher and his foundational ideas about statistics. The idea that statistics is all about “data reduction” is due to lack of computational capabilities at the time of Fisher – it was not possible to analyze 1000’s of data points, without reducing them to manageable summaries. Even though computer capabilities now make this possible, intellectual inertia has kept the discipline of statistics bound to the now obsolete mold...

Read More » Real-World Economics Review

Real-World Economics Review