My talk at Cambridge, recording the audience and the discussion after the talk as well as the talk itself. The presentation takes about an hour; the discussion begins at the 59 minute and 25 second mark.Fast forward to there if you've already seen the slideshow. And a plea to my YouTube followers: if you want to help my campaign to reform economics, then support the Kickstarter campaign to produce the graphic novel/cartoon book Crash Boom Pop!:...

Read More »Economics as an anti-mathematical discipline (1)

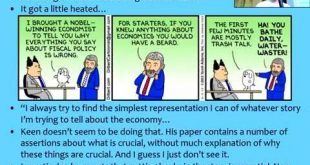

My talk to the Critical Realism seminar at Cambridge University last week. In contrast to my host Tony Lawson's perspective on the inappropriateness of mathematical modeling for economics, I argue that economics is in fact anti-mathematical as it currently exists, since any truly mathematical discipline would have been completely transformed by the many mathematical results that have contradicted the foundation beliefs of Neoclassical economics. Sound problems which trashed several recent...

Read More »What Is this Discipline called Economics

Economics as an anti-mathematical discipline. A talk at Sussex University. Support the comic Debunking Economics Kickstarter and Startjoin campaigns: https://www.startjoin.com/crashboompop and http://www.debtdeflation.com/blogs/2014/10/31/crash-boom-pop-on-boom-bust/

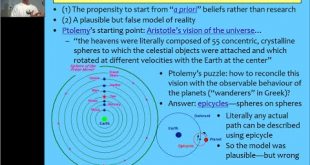

Read More »The overdue Copernican revolution in economics

I gave this talk to the first conference of the International Student Initiative for Pluralism in Economics (www.isipe.net) held in Tuebingen Germany on September 19-21 2014. I cover Minsky, money, complexity, and the economic crisis. I spoke too fast and covered topics at too high a level for many of the undergraduate students who are part of the rebellion against the dominance of economics tuition and research by Neoclassical economics, so I hope putting it up on YouTube gives students a...

Read More »Modern Monetary Theory and the Law

Sheffield University hosted a seminar on the implications of Modern Monetary Theory for the law. This is my contribution.

Read More »Don’t worry, be happy. The Bush Kings busking in Sydney

Just caught these three guys singing beautiful harmonies on George St Sydney. Thought to myself they would do this song well and the next thing I knew they were singing it! enjoy.

Read More »Economic theory: making Europe’s crisis worse

The mainstream ignorance about money and how it is created has led to the EU policy emphasis on running permanent government surpluses. This mistaken view of government being "like a business" that needs to ensure receipts exceed expenditure is the main reason that Southern Europe is in a Depression now. I compare the crisis in Greece to the USA and show that the cause was the same--a private debt bubble--in contrast to the usual narrative that irresponsible government spending in Greece...

Read More »The Dodgy Dynamics of Economics

Both Neoclassical (DSGE) and Post Keynesian (SFCA) models claim to be dynamic. But both violate core concepts in modern dynamics. Both also are at odds with their underling paradigms. Post Keynesian modelers can remedy both ills. Neoclassicals can't embrace modern dynamics without abandoning their core beliefs.

Read More »Dynamics of Endogenous money: just add banking realism to Loanable Funds

Take Krugman's Loanable Funds model of banking, add the realism that banks make loans to non-banks, and hey presto you get the real world of Endogenous Money, where change in debt (as well as change in velocity) affects aggregate demand. Illustrated with a simulation using Minsky software (download from https://sourceforge.net/p/minsky/).

Read More »Loanable Funds To Endogenous Money Live

This video builds a Loanable Funds model of lending, and then converts it to Endogenous Money by simply attributing the ownership of loans to the banking sector rather than to a non-bank agent. It illustrates the importance of including banks, debt and money in macroeconomic models--and emphasizes that models which don't have all 3 facets of lending are not models of the economy in which we live.

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch