My speech to staff and students at the University of Zagreb on how Minsky developed the Financial Instability Hypothesis, and why I see this as a foundation for a new non-equilibrium, monetary, complex systems approach to economics. The bad news is that crises like 2008 become not unpredictable shocks as in Neoclassical theory, but regular events in a sophisticated monetary market economy. I'll post the presentation Powerpoint file and an audio recording of the discussion to my blog.

Read More »What Is Neoclassical Economics & an Alternative Monetary Macroeconomics

This is a talk I gave in Tel Aviv, Israel at the invitation of the Rethinking Economics Student Forum there, and at the Palestine Economic Policy Research Institute in Ramallah, Palestine. I cover the defining features of Neoclassical Economics, contrast these with Post Keynesian Economics, and simulate a debt deflation using the Open Source modelling program Minsky (sourceforge.net/p/minsky/).

Read More »Discussion on Monetary Complex Systems Macroeconomics at Spiru Haret University

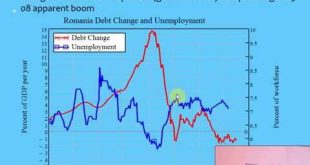

The discussion after my presentation on "Monetary Complex Systems Macroeconomics" at Spiru Haret University (in Bucharest Romania) on

Read More »Monetary Complex Systems Macroeconomics at Spiru Haret University

This presentation explains why macroeconomics should be a fundamentally monetary, non-equilibrium and complex systems field of enquiry. I gave it at Spiru Haret University in Bucharest, Romania. I visited Spiru Haret to assess its suitability as an exchange partner for Kingston University. It is a private and not-for-profit University, and I was very pleasantly surprised--to the point of being envious--by the quality of both its facilities and its staff.

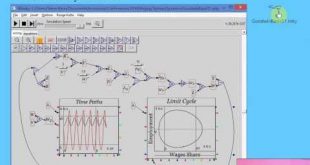

Read More »Minsky Demonstration at UK System Dynamics Conference

The UK Chapter of the International System Dynamics Society (http://systemdynamics.org.uk/) invited me to speak about my Minsky software (https://sourceforge.net/p/minsky/) at its annual conference on March 26. This is my talk, where I poked some fun at economists and their ignorance of system dynamics. The Powerpoint file and Minsky files used will be downloadable from my blog (http://www.debtdeflation.com/blogs/)

Read More »Should governments run surpluses?

My talk at the "'Economics With Justice" seminar series at the The School of Economic Science in Mandeville Place, London. I cover where the argument for austerity came from, a thought experiment about what will happen when a government runs a sustained surplus, and a model showing what happens when the government does run a surplus. There's a blip at the 37 minute point when I had a model problem in the live presentation; I insert a repaired simulation done after at my office.

Read More »3 Steve Keen Kingston Masters lectures on endogenous money (3)

Lectures from the Kingston Masters program module Economic Change and Ideas. These three hours of lectures cover the macroeconomics of endogenous money. They compare Endogenous Money to Loanable Funds using the Open Source system dynamics program Minsky, and explain how change in debt affects both aggregate expenditure and aggregate income

Read More »3 Steve Keen Kingston Masters lectures on endogenous money (2)

Lectures from the Kingston Masters program module Economic Change and Ideas. These three hours of lectures cover the macroeconomics of endogenous money. They compare Endogenous Money to Loanable Funds using the Open Source system dynamics program Minsky, and explain how change in debt affects both aggregate expenditure and aggregate income

Read More »3 Steve Keen Kingston Masters lectures on endogenous money (1)

Lectures from the Kingston Masters program module Economic Change and Ideas. These three hours of lectures cover the macroeconomics of endogenous money. They compare Endogenous Money to Loanable Funds using the Open Source system dynamics program Minsky, and explain how change in debt affects both aggregate expenditure and aggregate income

Read More »Rethinking Economics at the London School of Economics

I was invited by the Rethinking Economics student association at the London School of Economics to give a talk about Greece, Austerity, Post Keynesian Economics and anticipating the crisis. There was an excellent audience of around 150 for the talk, and a good discussion (which unfortunately was not recorded).

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch