I began another post critical of Joe Stiglitz’s analysis with the caveat that I like Joe. I’ll add to that that I respect his intellect too, both because he’s very bright—you don’t win a Nobel Prize (even in Economics!) without being very bright—and because compared to some other winners, he is very capable of thinking beyond the limitations of the mainstream. But there are some mainstream concepts that are so deeply embedded in even highly intelligent, flexible thinkers like Joe, that they...

Read More »Our Dysfunctional Monetary System

The great tragedy of the global economic malaise is that it is caused by a shortage of something that is essentially costless to produce: money. Click here to read the rest of this post.

Read More »The Mainstream Obsession with Microfoundations and why it is an intellectual dead-end

Mainstream economists insist that macroeconomic models have to be derived from microeconomic foundations. However the microeconomics from which they try to derive macroeconomics is unsound. Firms do not face rising marginal cost, but constant or falling costs; and "well behaved" demand curves for the market cannot be derived from individual demand curves. Furthermore, the important phenomena in economics, like the important phenomena in many sciences, emerge from the interactions between...

Read More »Intellectual foundations of endogenous money

The argument that banks originate loans and thereby create money and additional demand was once a commonplace position. But in the 1950s, American Neoclassicals in particular began to push the view that banks are effectively just intermediaries between savers and investors; the view that banks were uniquely important in capitalism became a fringe view. I cover this history and the revival of the endogenous money approach by Basil Moore, Augusto Graziani and others

Read More »For Kingston “Becoming An Economist” students

I’m posting videos of lectures given by my Kingston colleagues to the introductory “Becoming an Economist” course, since the StudySpace software Kingston uses doesn’t support MP4 files. The first is Devrim Yilmaz’s lecture last week on “Data Collection and Presentation”. http://www.debtdeflation.com/blogs/wp-content/uploads/2016/01/Devrim.mp4

Read More »Dialectics as a foundation for a dynamic nonequilibrium monetary economics

This is a long prelude to explaining the development of Minsky's Financial Instability Hypothesis, and an exposition of the foundations of my approach to economics as well--which starts from Marx's dialectical philosophy. An essential aspect of my approach is that I reject the "Labor Theory of Value" on the basis of Marx's own philosophy. Since this is such a non-standard approach to Marx, a lengthy digression covering the development of Marx's approach to economics is required.

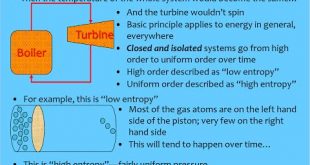

Read More »Value theory, thermodynamics and dialectics

Only one school of economic thought came close to getting the relationship between energy and economics right: the Physiocrats. I give a basic outline of thermodynamics, then explain why any theory of production which doesn't acknowledge the fundamental role of energy in creating economic value is wrong--including the "Marxian" labor theory of value. I then introduce Marx's dialectical philosophy, which I cover in more detail in the next lecture

Read More »My Kingston Inaugural Lecture with slides and data

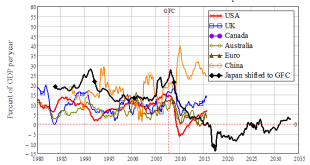

I’ve been Head of School at Kingston University London for over 18 months now, but these things do take time: last Wednesday I gave my inaugural Professorial lecture to an audience of about 200 people. My screen-recording video of the talk is below. Click here to download the Powerpoint slides; Minsky crisis model; Minsky Loanable Funds model; Minsky Endogenous Money model; Private Debt levels (6 countries); Private Credit growth (6 countries); USA Private Debt change & Unemployment;...

Read More »Inaugural Lecture at Kingston University

Nobel Laureate Edward Prescott claimed in 1999 that capitalism is inherently stable, and "absent some change in technology or the rules of the economic game, the economy converges to a constant growth path with the standard of living doubling every 40 years". 30 years earlier, the maverick economist Hyman Minsky made the opposing claim that "capitalism is inherently flawed, being prone to booms, crises and depressions" and that this instability "is due to characteristics the financial system...

Read More »Note To Joe Stiglitz: Banks Originate, Not Intermediate, And That’s Why Aggregate Demand Is Stuffed

I like Joe Stiglitz, both professionally and personally. His Globalization and its Discontents was virtually the only work by a Nobel Laureate economist that I cited favourably in my Debunking Economics, because he had the courage to challenge the professional orthodoxy on the “Washington Consensus”. Far more than most in the economics mainstream—like Ken Rogoff for example—Joe is capable of thinking outside its box. But Joe’s latest public contribution—“The Great Malaise Continues” on...

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch