This video is part of a blog post I'm writing to follow up on Nick Rowe's excellent work in putting my arguments about the role of the change in debt in effective demand into a form (a) that Neoclassical economists can understand and (b) that accounting zealots can accept does not violate any accounting identities. Here I build a model of Loanable Funds in Minsky, and then convert it into a model of Endogenous money. I'll later post another video that simulates both these models to contrast...

Read More »High-speed Design in Minsky

There's no such thing as a demo that works flawlessly when done live, and this is no exception: I made a few entry errors, and spotted a couple of new bugs in the process. But overall this still shows how easy it is to design a system dynamics model in Minsky.

Read More »Crash Course in Non-Equilibrium Economics Lecture 5B

The implications of endogenous money for macroeconomics, and plans for the development of Minsky over time

Read More »Crash Course in Non-Equilibrium Economics Lecture 5A

This final lecture covers the topic of money in economic instability--both the dispute over whether the Neoclassical Loanable Funds or the Post Keynesian Endogenous Money model is more realistic, the economics implications of the latter, and how the Open Source economic modeling program Minsky can be used to model either theory.

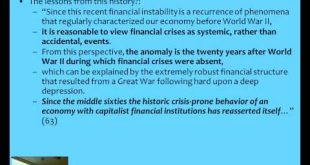

Read More »Crash Course in Non-Equilibrium Economics Lecture 4B

A debt crisis in a model of Minsky's Financial Instability Hypothesis has the unexpected feature of a preceding "Great Moderation".

Read More »Crash Course in Non-Equilibrium Economics Lecture 4A

Modeling Minsky's Financial Instability Hypothesis transforms Goodwin's model with fixed cycles into one that can display chaos. In the first half of this lecture I explain the importance of nonlinearity and the number of dimensions of a dynamic model.

Read More »Crash Course in Non-Equilibrium Economics Lecture 3B

Hyman Minsky's strength was to integrate the disequilibrium and monetary views of Marx, Schumpeter, Fisher, Keynes and Kalecki into a coherent and convincing model of a capitalist economy. This half of the lecture verbally outlines the Financial Instability Hypothesis.

Read More »Crash Course in Non-Equilibrium Economics Lecture 3A

Hyman Minsky's strength was to integrate the disequilibrium and monetary views of Marx, Schumpeter, Fisher, Keynes and Kalecki into a coherent and convincing model of a capitalist economy. This lecture explains Kalecki's contribution and then verbally outlines the Financial Instability Hypothesis.

Read More »Crash Course in Non-Equilibrium Economics Lecture 2A

I regard Marx, Schumpeter, Fisher, Keynes, Kalecki and Goodwin as the major foundations of a non-equilibrium approach to economics. This lecture provides an overview of the first 4--including a non-orthodox interpretation of Marx that is bound to annoy Marxists but emphasizes his coherent analysis of the cyclical nature of capitalism

Read More »Crash Course in Non-Equilibrium Economics Lecture 1A

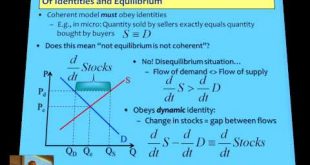

Lectures on non-equilibrium economics at FLACSO (Latin American Social Sciences Institute). This first lecture covers why economics must be a disequilibrium discipline, and why it has thus far failed to become one.

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch