Read More »

Keen2012BehaviouralFinance02B

Keen2012BehaviouralFinance01B

Keen2012BehaviouralFinance01A

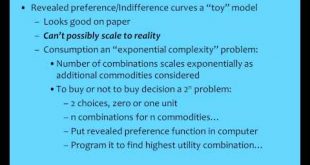

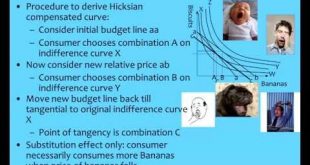

The Neoclassical theory of the behavior of a single individual is computationally impossible. Unfortunately I neglected to save sound on this movie, so I will also upload the unedited lecture on this topic from my subscription site.

Read More »Keen2012BehaviouralFinance08C

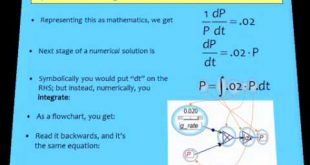

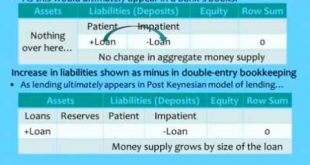

Modelling endogenous money, critiquing loanable funds, and introducing "Minsky", the software package--lots of bugs but usable now and available from http://www.debtdeflation.com/blogs/minsky/

Read More »Keen2012BehaviouralFinance08B

Modelling endogenous money, critiquing loanable funds, and introducing "Minsky", the software package--lots of bugs but usable now and available from http://www.debtdeflation.com/blogs/minsky/

Read More »Keen2012BehaviouralFinance08A

Modelling endogenous money, critiquing loanable funds, and introducing "Minsky", the software package--lots of bugs but usable now and available from http://www.debtdeflation.com/blogs/minsky/

Read More »Keen2012BehaviouralFinance07C

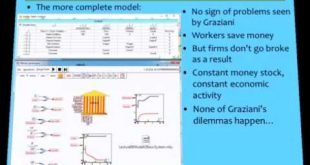

Circuit Theory, Graziani's brilliant insights but false steps when attempting to produce a model

Read More »Keen2012BehaviouralFinance07B

Circuit Theory, Graziani's brilliant insights but false steps when attempting to produce a model

Read More »Keen2012BehaviouralFinance07A

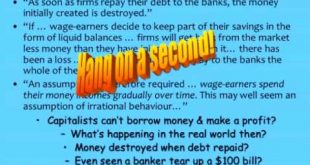

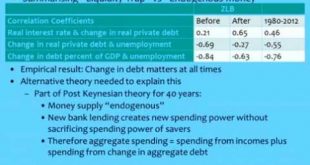

Introduction to endogenous money and finance: Schumpeter, Minsky and Graziani; why effective demand is income plus the change in debt, but sectoral balance still applies; the essentials of the monetary circuit

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch