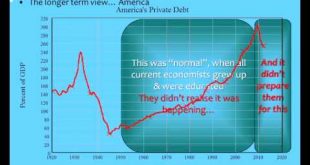

The empirical data on economics and finance contradicts standard Neoclassical macroeconomics. The need for a monetary economics.

Read More »Keen2012BehaviouralFinance06A

The sorry state of Macroeconomics. DSGE and why it is nonsense--as is IS-LM which it replaced.

Read More »Keen2012BehaviouralFinance05B

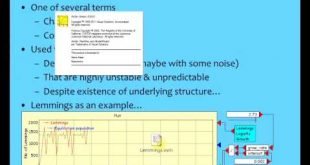

The Fractal and Inefficient Markets Hypotheses. Unfortunately I accidentally did not record the sound! When I do a comparable lecture for my subscription site, I will place that here.

Read More »Keen2012BehaviouralFinance05A

The Fractal and Inefficient Markets Hypotheses. Unfortunately I accidentally did not record the sound! When I do a comparable lecture for my subscription site, I will place that here.

Read More »Keen2012BehaviouralFinance04B

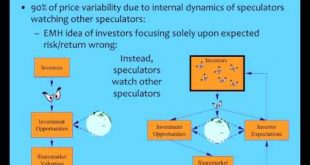

The actual behavior of stock markets

Read More »Keen Slides MCT-MMT Joint Seminar

My slides at the MCT-MMT joint seminar at the Fields Institute Toronto on July 2nd this year. My slides are unreadable in the video recording.

Read More »Keen on Schumpeter, Minsky & Aggregate Demand 2012 New Zealand Part 1

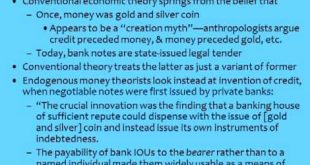

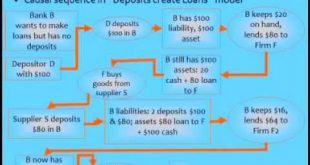

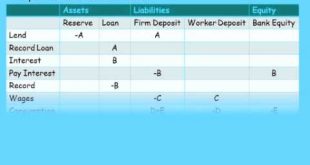

My talk in New Zealand, in which I explain the foundations of my monetary macroeconomics in Schumpeter's vision of disequilibrium, discontinuous growth, and Minsky's vision of the monetary system as a source of endogenous instability. This is a very detailed exposition of my views, more so than in any previous video. 2nd half follows

Read More »Keen on Schumpeter, Minsky & Aggregate Demand 2012 New Zealand Part 2

2nd half of my talk in New Zealand, in which I explain the foundations of my monetary macroeconomics in Schumpeter's vision of disequilibrium, discontinuous growth, and Minsky's vision of the monetary system as a source of endogenous instability. This is a very detailed exposition of my views, more so than in any previous video.

Read More »Keen2012StudyEconomicsAtUWS

I gave the talk below yesterday at UWS's Open Day, as an intoduction to economics for prospective university students. Preparing it made me reflect on the great good fortune I had to be appointed to UWS. This might evoke a "Huh?" response from the usual suspects on such issues--why be pleased about being appointed to a second-rate University (and in an out-of-the-way place like Sydney to boot)? It's because the Economics & Finance program at UWS has been almost unique amongst economics...

Read More »Matheus Grasselli – Extensions of the Keen-Minsky Model for Financial Fragility

Dr. Matheus Grasselli from the Fields Institute in Toronto Canada presents an in depth talk on the mathematical foundations of the Keen-Minsky Model.

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch