My friend Dr. Sabri Oncu has established an innovative seminar program at Kadir Has University in Turkey. Called the "Kadir Has Lectures on Global Political Economy", it has had lectures from a number of non-mainstream economists, including Ann Pettifor, Frances Coppola, Yanis Varoufakis, and Jan Kregel. Forthcoming lecturers include Louis Philippe Rochon and Matias Vernengo. You can find the series here: https://www.youtube.com/playlist?list=PLF796nZs0vOE-Rbrquqdfdrm0ck92lMjI...

Read More »Professor Steve Keen and Friends: Episode 05 Special Guest Carmen Medina

Professor Steve Keen is an internationally recognized Economist. Described by Vox Day and Daniel Sanderson as "the greatest living economist," this video series is designed to bring out Steve's natural humility. Joined by regular guests Daniel Sanderson and Tyrone Keynes (Ty), the series will oscillate between friendly banter and economic excellence. WARNING: if you are a close-minded neoclassical economist, climate denier, or generally an angry person, this show is NOT for you....

Read More »Professor Steve Keen and Friends: Episode 04

Professor Steve Keen is an internationally recognized Economist. Described by Vox Day and Daniel Sanderson as "the greatest living economist," this video series is designed to bring out Steve's natural humility. Joined by regular guests Daniel Sanderson and Tyrone Keynes (Ty), the series will oscillate between friendly banter and economic excellence. WARNING: if you are a close-minded neoclassical economist, climate denier, or generally an angry person, this show is NOT for you....

Read More »Professor Steve Keen and Friends: Episode 03 Steve’s PhD Thesis, MMT and More

Professor Steve Keen is an internationally recognized Economist. Described by Vox Day and Daniel Sanderson as "the greatest living economist", this video series is designed to bring out Steve's natural humility. Joined by regular guests Daniel Sanderson and Tyrone Keynes (Ty), the series will oscillate between friendly banter and economic excellence. WARNING: if you are a close-minded neoclassical economist, climate denier, or generally an angry person, this show is NOT for you....

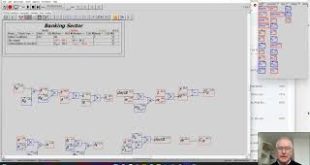

Read More »Friede Gard Prize Workshop 05 Combined Godley Flowchart

Previous models have been either Godley Table or flowchart models. The full power of Minsky comes from integrating the two, with the flowchart method covering physical production and the Godley Tables enabling these to be integrated with financial flows.

Read More »Professor Steve Keen and Friends

Professor Steve Keen is an internationally recognized Economist. Described by Vox Day and Daniel Sanderson as "the greatest living economist", this video series is designed to bring out Steve's natural humility. Joined by regular guests Daniel Sanderson and Tyrone Keynes (Ty), the series will oscillate between friendly banter and economic excellence. WARNING: if you are a close-minded neoclassical economist, climate denier, or generally an angry person, this show is NOT for you....

Read More »Friede Gard Prize Lecture 05 Energy In Production Functions

Both Neoclassical and Post Keynesian economic models have been "energy blind": postulating output from inputs of Technology, Labor and Capital, but ignoring energy (and matter, for that matter...). In this lecture I show how tautological and wrong the Cobb Douglas Production Function is, and that incorporating energy into it does enormous damage to the Neoclassical paradigm. On the other hand, the empirically-based Leontief Production Function only needs to acknowledge that what...

Read More »Friede Gard Prize Workshop 04 Goodwin To Minsky

In this very short video (for me! Under 15 minutes), I show how to add private debt to the Goodwin cyclical growth model that I built in the previous workshop. The result is a model of Minsky's Financial Instability Hypothesis.

Read More »Friede Gard Prize Lecture 06 Method And Revolutions

Economics remains pre-scientific because, while Planck said "science advances one funeral at a time", for economics, funerals alone aren't enough.

Read More »Friede Gard Lecture 04 The Fantasy Production Function

The "Cobb-Douglas Production Function" dominates Neoclassical macroeconomic models today. Decades ago, Anwar Shaikh showed that it's "excellent fit to national data" occurred because it is simply a transformation of wage and profit data under conditions of a slowly changing distribution of income, while Mankiw showed that to fit international data, the coefficient for capital had to be increased from 0.3 to at least 0.8. My insight that "labour without energy is a...

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch