By Eric Tymoigne I struggled a few years to get a Money and Banking (M&B) course together. It lacked coherency and students had difficulty linking the different parts of the class. A good part of the problem comes from the M&B textbooks that, besides having outdated presentations, are a disparate collection of chapters without a coherent core. So I gave up with textbooks and went my own way. The core of the financial system consists of financial documents and among them are balance sheets. Balance sheets provide the foundation upon which most of an M&B course can be taught: monetary creation by banks and the central bank, nature of money, financial crises, securitization, financial interdependencies, you name it, it has to do with a balance sheet. As Minsky used to note, if you cannot put your reasoning in terms of a balance sheet there is a problem in your logic. So chapter 1 in my “textbook” is about balance-sheet mechanics and that is where I will start the series of blogs on M&B. Yes accounting is tedious but one must get a good grasp of key accounting concepts to understand financial mechanics. The “money” chapter, usually first in M&B texts, only comes much later once balance-sheet mechanics and financial concepts such as present value have been well understood. I hope to make this a weekly endeavor, written between taking care of a baby and a 4-year old.

Topics:

Devin Smith considers the following as important: Eric Tymoigne, money and banking

This could be interesting, too:

Mike Norman writes Banks And Money (Sigh) — Brian Romanchuk

Mike Norman writes Lars P. Syll — The weird absence of money and finance in economic theory

Eric Tymoigne writes Can the US Treasury run out of money when the US government can’t?

Eric Tymoigne writes “What You Need To Know About The Trillion National Debt”: The Alternative SHORT Interview

By Eric Tymoigne

I struggled a few years to get a Money and Banking (M&B) course together. It lacked coherency and students had difficulty linking the different parts of the class. A good part of the problem comes from the M&B textbooks that, besides having outdated presentations, are a disparate collection of chapters without a coherent core. So I gave up with textbooks and went my own way.

The core of the financial system consists of financial documents and among them are balance sheets. Balance sheets provide the foundation upon which most of an M&B course can be taught: monetary creation by banks and the central bank, nature of money, financial crises, securitization, financial interdependencies, you name it, it has to do with a balance sheet. As Minsky used to note, if you cannot put your reasoning in terms of a balance sheet there is a problem in your logic.

So chapter 1 in my “textbook” is about balance-sheet mechanics and that is where I will start the series of blogs on M&B. Yes accounting is tedious but one must get a good grasp of key accounting concepts to understand financial mechanics. The “money” chapter, usually first in M&B texts, only comes much later once balance-sheet mechanics and financial concepts such as present value have been well understood. I hope to make this a weekly endeavor, written between taking care of a baby and a 4-year old. This won’t cover everything I do in M&B. I will focus on banks, central bank and money.

What is a balance sheet?

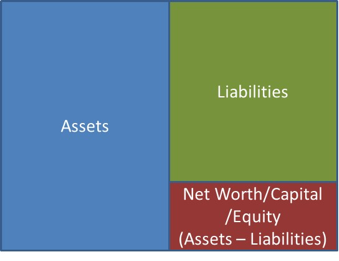

It is an accounting document that records what an economic unit owns (its “assets”) and owes (its “liabilities”). The difference between its assets and liabilities is called net worth, or equity, or capital.

Figure 0a. A balance sheet

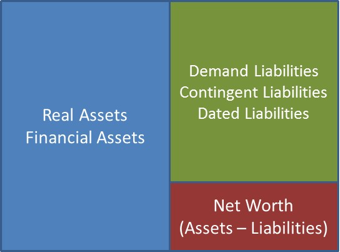

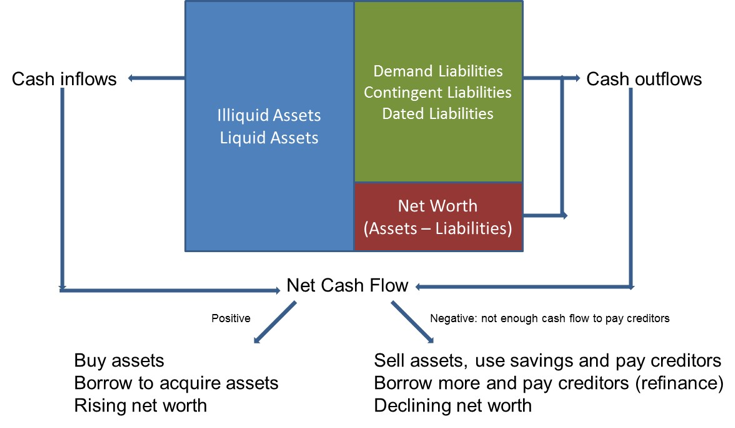

There are many different ways to classify assets and liabilities. For our purpose, a balance sheet can be detailed a bit more as follows:

Figure 0b. A simple balance sheet

Financial assets are claims on other economic units and real assets may be reduced to physical things (cars, buildings, machines, pens, desks, inventories, etc.). Demand liabilities are liabilities that are due at the request of the creditors (e.g., cash can be withdrawn from a bank account at will and at any time by the account holder), contingent liabilities are due when a specific event occurs (e.g., life insurance payments to a widow), dated liabilities are due at specific periods of time (e.g., mortgages interest and principal payment are due every month).

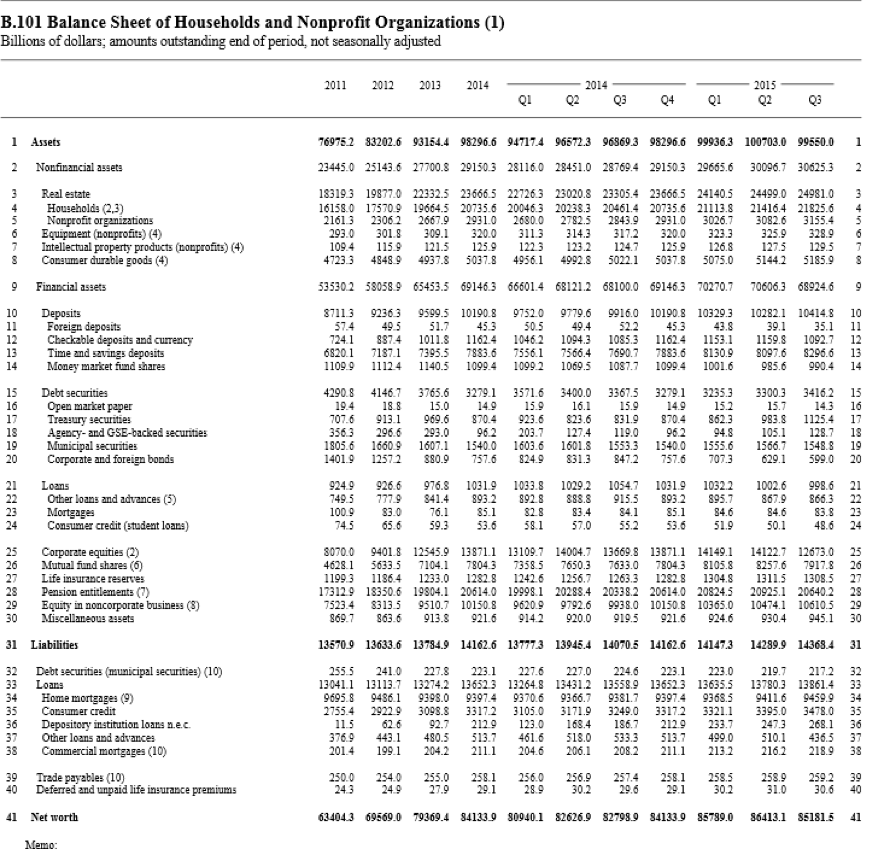

Balance sheets can be constructed for any economic unit. That unit can be a person, a firm, a sector of the economy, a country, anybody or anything with assets and liabilities. Below is the balance sheet of the households sector (and non-profit organizations) in the United States (from the Financial Accounts of the United States). In the third quarter of 2015, U.S. households owned $99.6 trillion worth of assets and owed $14.4 trillion worth of liabilities, making net worth equal to $85.2 trillion (99.6 – 14.4). Households held $30.6 trillion of real assets, $68.9 trillion of financial assets. Their two main liabilities were home mortgages ($9.5 trillion) and consumer credit, i.e. credit cards, auto loans, student loans, etc. ($3.5 trillion).

Balance sheet rules

A balance sheet follows double-entry accounting rules. As such A BALANCE SHEET MUST ALWAYS BALANCE, that is to say the following must always be true:

Assets = Liabilities + Net Worth

The practical, and central, implication is that a change in one item on the balance sheet must be offset by at least one change somewhere else so that a balance sheet stays balanced.

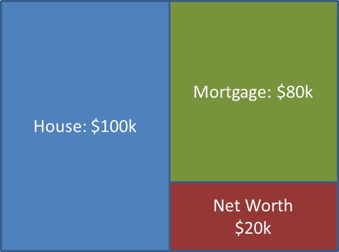

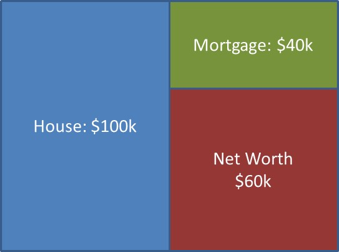

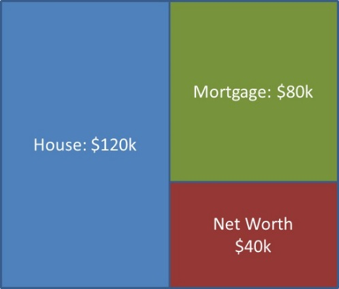

Let’s start with a very simple balance sheet. The only asset is a house worth $100k that was purchased by putting down 20k and asking for $80k from a bank:

Figure 1. A simple balance sheet

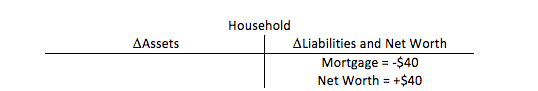

What is the impact of repaying $40k of principal (i.e. outstanding amount) on the mortgage?

Figure 2. Effect of Repayment of Mortgage Principal

The value of mortgage went down by 40k and the value of net worth went up by 40k so that the accounting equality is preserved.

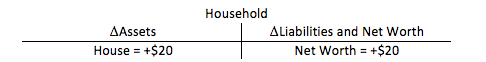

Going back to the first balance sheet, what is the impact of the value of the house going up by $20k?

Figure 3. Effect of higher house price

The asset value went up by $20k and the net worth went up by $20 and here again the accounting equality is preserved.

Sometimes, to get to the point more quickly and to highlight the changes, economists prefer to use so-called “T-accounts” (because the shape of the table looks like a T) that record only the changes in the balance sheet.

Figure 4. T-account that records the repayment of the mortgage principal

Figure 5. T-account that records the higher house value

The offsetting is shown more clearly. It comes from opposite changes in two items on the right side of the balance sheet (Fig. 4), and a change in asset and net worth by the same amount (Fig. 5). Of course these are not the only two ways the offsetting is done to preserve the accounting equality. We will encounter other cases as we move forward. The point is that one must change at least two things in a balance sheet to make sure that the equality A = L + NW is preserved. One must always ask: what is the offsetting entry change? This has practical implication when studying how banks and central bank operate.

What makes the balance sheet change?

One can classify factors that change a balance sheet in three categories:

- Cash inflows and outflows: net cash flow

- Incomes and expenses: net income

- Capital gains and capital losses: net change in the market value of assets and liabilities

These categories are recorded more carefully in other accounting documents than the balance sheet, but we will focus on their relationship with the balance sheet.

Net Cash Flow

Cash inflows and cash outflows lead to a change in the amount of funds held by an economic unit, i.e. a change in the amount of physical currency or funds in a bank account held on the asset side. Some assets lead to cash inflows while some liabilities and capital (dividend payments) lead to cash outflows.

Figure 6. Balance sheet and cash flow

If the cash inflows are greater than the cash outflows, monetary assets held by an economic unit go up. The economic unit can use them to buy assets or pledge them to leverage. If net cash flow is negative, then monetary-asset holdings fall and the economic unit may have to go further into debt to pay some of its expenses.

Current amount of funds = Previous amount of funds + Net cash flow

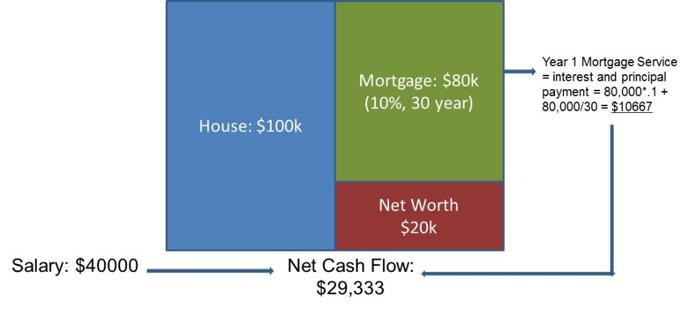

Going back to our very simple balance sheet, assume that a salary of $40k is earned and that part of the salary is used to service a 30-year fixed-rate 10 % mortgage. Assuming linear repayment of principal to simplify (actual mortgage servicing is calculated differently), the cash flow structure looks like this:

Figure 7. Balance sheet and cash flows, an example

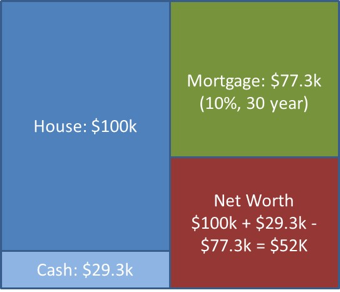

The balance sheet at the beginning of the following year is (assuming all cash flows involve actual cash transfer instead of electronic payments):

Figure 8. Balance sheet after the cash-flow impacts

Quite a few things have change in the balance sheet. There is a net inflow of cash of $29.3k, the principal (i.e. outstanding amount) of the mortgage fell by the amount of principal repaid, and net worth accounts for these two changes.

Net Income

Net income leads to a change in the net worth:

Current Net worth = Previous Net worth + Net income of the period

Net income (e.g., Earnings before Taxes is a proxy of net income) can be positive or negative so net worth may rise or fall. In the previous example (Fig. 7 and Fig. 8), net cash flow and net income are the same thing; however, not all incomes lead to a gain of funds as will be illustrated later when studying banks.

Capital Gains and Capital Losses

Finally, the value of assets and liabilities may change because of changes in their market value. If accounting is done on a “mark-to-market” basis, i.e. by valuating balance-sheet items based on their current market value, these changes will be accounted in the balance sheet and net worth will be affected accordingly:

Current Net Worth = Previous Net Worth + Net income of the period + Net capital gains of the period

The example of Figure 3 is a simple illustration of the impact of capital gains.

That is it for today! Following posts will apply all this to banks and central bank.