This is going nowhere: Consumer CreditHighlightsRevolving credit showed substantial life in November, up .7 billion and helping to boost total consumer credit by .0 billion. Nonrevolving credit, boosted by auto financing and student loans, has been the foundation of strength for this series during the whole recovery, but less so in November when it added only .3 billion for the smallest contribution since February 2012. But it’s the gain for revolving credit, growing at an annualized 7.4 percent in the month, and the implication for credit-card use that are important for what to expect in holiday spending. The results here are positive.Consumer credit in the United States increased by 13.95 USD billion in November of 2015, lower than a downwardly revised 15.61 USD billion in October and below market expectations of a 18.25 USD billion gain. Revolving credit rose by 5.65 USD billion, following an upwardly revised 0.65 USD billion in October while nonrevolving credit slowed to 8.29 USD billion from 15.55 USD billion. The jobs report looks suspect to me. For one thing, with GDP growth way down, and little if any top line corporate growth, why the hiring? That is, if the numbers are not revised, it means productivity is running negative- more jobs for the same output. The December jobs report is not necessarily indicative of a strong economy in the U.S.

Topics:

WARREN MOSLER considers the following as important: Employment

This could be interesting, too:

Ken Houghton writes Just Learn to Code

Merijn T. Knibbe writes Employment growth in Europe. Stark differences.

NewDealdemocrat writes In-depth look at the leading indicators from the employment report

NewDealdemocrat writes One more time: bifurcation in the jobs report, as Establishment Survey shows continued jobs growth, while Household Survey comes close to triggering the “Sahm Rule”

This is going nowhere:

Consumer Credit

Highlights

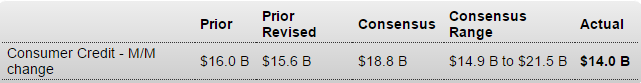

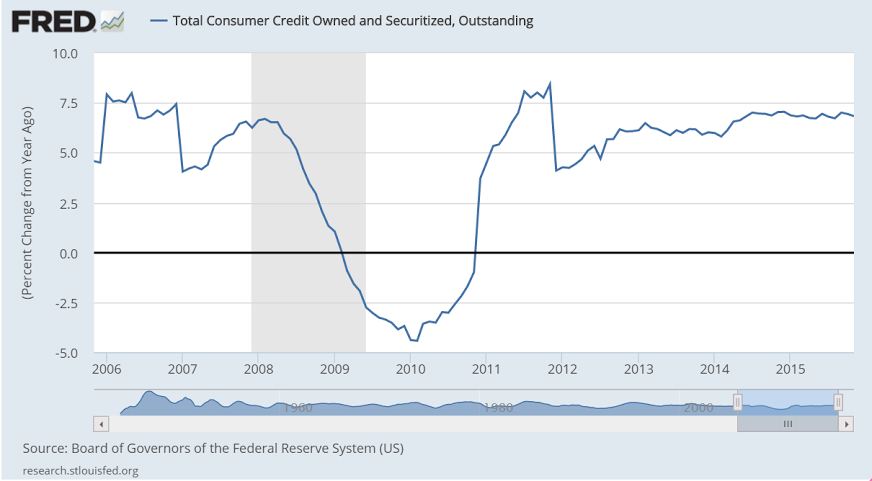

Revolving credit showed substantial life in November, up $5.7 billion and helping to boost total consumer credit by $14.0 billion. Nonrevolving credit, boosted by auto financing and student loans, has been the foundation of strength for this series during the whole recovery, but less so in November when it added only $8.3 billion for the smallest contribution since February 2012. But it’s the gain for revolving credit, growing at an annualized 7.4 percent in the month, and the implication for credit-card use that are important for what to expect in holiday spending. The results here are positive.Consumer credit in the United States increased by 13.95 USD billion in November of 2015, lower than a downwardly revised 15.61 USD billion in October and below market expectations of a 18.25 USD billion gain. Revolving credit rose by 5.65 USD billion, following an upwardly revised 0.65 USD billion in October while nonrevolving credit slowed to 8.29 USD billion from 15.55 USD billion.

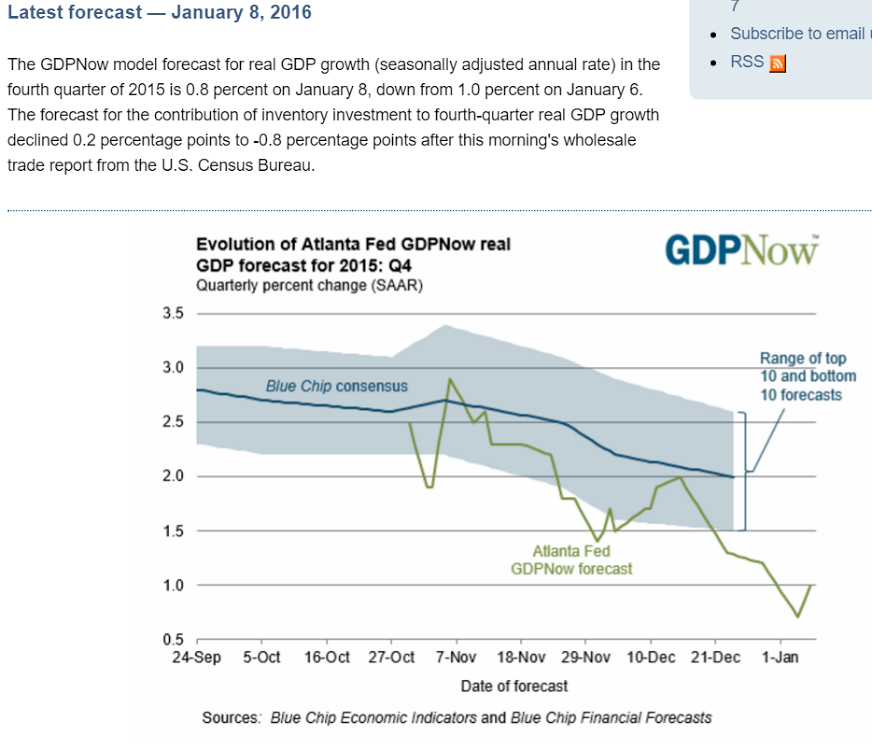

The jobs report looks suspect to me. For one thing, with GDP growth way down, and little if any top line corporate growth, why the hiring? That is, if the numbers are not revised, it means productivity is running negative- more jobs for the same output.

The December jobs report is not necessarily indicative of a strong economy in the U.S., Art Cashin of UBS said Friday.

“Not to be a wet blanket, but that jobs number is a little suspect. If you look at the household survey: 485,000 [and] 35 percent of those went to people under the age of 19. Another chunk went to people over 55; only 16,000 out of 485,000 jobs went to people between the ages of 24 and 55,” Cashin told CNBC’s “Squawk Alley.”

“That sounds like a lot of part-time hiring to me,” he said

Merrill: Warm Weather “added nearly 100,000 jobs in December”