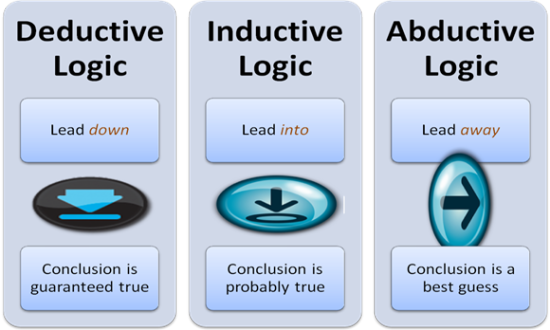

Deduction — induction — abduction In science – and economics – one could argue that there basically are three kinds of argumentation patterns/schemes/methods/strategies available: Deduction Premise 1: All Chicago economists believe in REH Premise 2: Robert Lucas is a Chicago economist —————————————————————– Conclusion: Robert Lucas believes in REH Here we have an example of a logically valid deductive inference. In a hypothetico-deductive reasoning — hypothetico-deductive confirmation in this case — we would use the conclusion to test the law-like hypothesis in premise 1 (according to the hypothetico-deductive model, a hypothesis is confirmed by evidence if the evidence is deducible from the hypothesis). If Robert Lucas does not believe in REH we have gained some warranted reason for non-acceptance of the hypothesis (an obvious shortcoming here being that further information beyond that given in the explicit premises might have given another conclusion). In a deductive-nomological explanation we would try to explain why Robert Lucas believes in REH with the help of the two premises (in this case actually giving an explanation with very little explanatory value).

Topics:

Lars Pålsson Syll considers the following as important: Theory of Science & Methodology

This could be interesting, too:

Lars Pålsson Syll writes Kausalitet — en crash course

Lars Pålsson Syll writes Randomization and causal claims

Lars Pålsson Syll writes Race and sex as causes

Lars Pålsson Syll writes Randomization — a philosophical device gone astray

Deduction — induction — abduction

In science – and economics – one could argue that there basically are three kinds of argumentation patterns/schemes/methods/strategies available:

Deduction

Premise 1: All Chicago economists believe in REH

Premise 2: Robert Lucas is a Chicago economist

—————————————————————–

Conclusion: Robert Lucas believes in REH

Here we have an example of a logically valid deductive inference.

In a hypothetico-deductive reasoning — hypothetico-deductive confirmation in this case — we would use the conclusion to test the law-like hypothesis in premise 1 (according to the hypothetico-deductive model, a hypothesis is confirmed by evidence if the evidence is deducible from the hypothesis). If Robert Lucas does not believe in REH we have gained some warranted reason for non-acceptance of the hypothesis (an obvious shortcoming here being that further information beyond that given in the explicit premises might have given another conclusion).

In a deductive-nomological explanation we would try to explain why Robert Lucas believes in REH with the help of the two premises (in this case actually giving an explanation with very little explanatory value).

Deductive logic of confirmation and explanation may work well — given that they are used in deterministic closed models! Applying it to real world systems, however, immediately proves it to be excessively narrow and hopelessly irrelevant. Both the confirmatory and explanatory ilk of hypothetico-deductive reasoning fails since there is no way you can relevantly analyze confirmation or explanation as a purely logical relation between hypothesis & evidence or between law-like rules and explananda.

The truth-preserving nature of deduction makes it different from all other kinds of reasoning. But it is also its limitation, since truth in the deductive context does not refer to a real world ontology (only relating propositions as true or false within a formal-logic system) and as an argument scheme is totally non-ampliative — the output of the analysis is nothing else than the input. Just to give an economics example, consider the following rather typical, but also uninformative and tautological, deductive inference:

Premise 1: The firm seeks to maximize its profits

Premise 2: The firm maximizes its profits when MC = MI

——————————————————

Conclusion: The firm will operate its business at the equilibrium MC = MI

Learning new things about reality demands something else than a reasoning where the knowledge is already embedded in the premises. These other kinds of reasoning may give good — but not conclusive — reasons. That is the price we have to pay if we want to have something substantial and interesting to say about the real world. As Stephen Toulmin has it:

In the case of substantial arguments there is no question of data and backing taken together entailing the conclusion, or failing to entail it: just because the steps involved are substantial ones, it is no use either looking for entailments or being disappointed if we do not find them. Their absence does not spring from a lamentable weakness in the arguments, but from the nature of the problems with which they are designed to deal. When we have to set about assessing the real merits of any substantial argument, analytical criteria such as entailment are, accordingly, simply irrelevant … ‘Strictly speaking’ means, to them, analytically speaking; although in the case of substantial arguments to appeal to analytic criteria is not so much strict as beside the point … There is no justification for applying analytic criteria in all fields of argument indiscriminately, and doing so consistently will lead one (as Hume found) into a state of philosophical delirium.

Induction

Premise 1: This is a randomly selected large set of economists from Chicago

Premise 2: These randomly selected economists all believe in REH

——————————————————————

Conclusion: All Chicago economists believes in REH

In this inductive inference we have an example of a logically non-valid inference that we would have to supply with strong empirical evidence to really warrant. And that is no simple matter at all:

In my judgment, the practical usefulness of those modes of inference, here termed Universal and Statistical Induction, on the validity of which the boasted knowledge of modern science depends, can only exist—and I do not now pause to inquire again whether such an argument must be circular—if the universe of phenomena does in fact present those peculiar characteristics of atomism and limited variety which appear more and more clearly as the ultimate result to which material science is tending …

The physicists of the nineteenth century have reduced matter to the collisions and arrangements of particles, between which the ultimate qualitative differences are very few …

The validity of some current modes of inference may depend on the assumption that it is to material of this kind that we are applying them … Professors of probability have been often and justly derided for arguing as if nature were an urn containing black and white balls in fixed proportions. Quetelet once declared in so many words—“l’urne que nous interrogeons, c’est la nature.” But again in the history of science the methods of astrology may prove useful to the astronomer; and it may turn out to be true—reversing Quetelet’s expression—that “La nature que nous interrogeons, c’est une urne”.

Justified inductions presupposes a resemblance of sort between what we have experienced and know, and what we have not yet experienced and do not yet know. Just to exemplify this problem of induction let me take two examples.

Let’s start with this one. Assume you’re a Bayesian turkey and hold a nonzero probability belief in the hypothesis H that “people are nice vegetarians that do not eat turkeys and that every day I see the sun rise confirms my belief.” For every day you survive, you update your belief according to Bayes’ Rule

P(H|e) = [P(e|H)P(H)]/P(e),

where evidence e stands for “not being eaten” and P(e|H) = 1. Given that there do exist other hypotheses than H, P(e) is less than 1 and a fortiori P(H|e) is greater than P(H). Every day you survive increases your probability belief that you will not be eaten. This is totally rational according to the Bayesian definition of rationality. Unfortunately — as Bertrand Russell famously noticed — for every day that goes by, the traditional Christmas dinner also gets closer and closer …

Or take the case of macroeconomic forecasting, which perhaps better than anything else illustrates the problem of induction. As a rule macroeconomic forecasts tend to be little better than intelligent guesswork. Or in other words — macroeconomic mathematical-statistical forecasting models, and the inductive logic upon which they ultimately build, are as a rule far from successful. The empirical and theoretical evidence is clear. Predictions and forecasts are inherently difficult to make in a socio-economic domain where genuine uncertainty and unknown unknowns often rule the roost. The real processes that underly the time series that economists use to make their predictions and forecasts do not confirm with the inductive assumptions made in the applied statistical and econometric models. The forecasting models fail to a large extent because the kind of uncertainty that faces humans and societies actually makes the models strictly seen inapplicable. The future is inherently unknowable — and using statistics and econometrics does not in the least overcome this ontological fact. The economic future is not something that we normally can predict in advance. Better then to accept that as a rule “we simply do not know.”

Induction is sometimes a good guide for evaluating hypotheses. But for the creative generation of plausible and relevant hypotheses it is conspicuously silent. For that we need another — non-algorithmic and ampliative — kind of reasoning.

Abduction

Premise 1: All Chicago economists believe in REH

Premise 2: These economists believe in REH

—————————————————————–

Conclusion: These economists are from Chicago

In this case, again, we have an example of a logically non-valid inference (the fallacy of affirming the consequent), but an inference that may nonetheless be a strongly warranted and truth-producing — in contradistinction to truth-preserving deductions — reasoning.

Here we infer something based on what would be the best explanation given the law-like rule (premise 1) and an observation (premise 2). The truth of the conclusion (explanation) is nothing that is logically given, but something we have to justify, argue for, and test in different ways to possibly establish with any certainty or degree. And as always when we deal with explanations, what is considered best is relative to what we know of the world. In the real world all evidence has an irreducible holistic aspect. We never conclude that evidence follows from hypothesis simpliciter, but always given some more or less explicitly stated contextual background assumptions. All non-deductive inferences and explanations are a fortiori context-dependent.

If extending the abductive scheme to incorporate the demand that the explanation has to be the best among a set of competing/rival/contrasting potential and satisfactory explanations, we have what is nowadays usually referred to as inference to the best explanation (IBE).

Having the best explanation means that you, given the context-dependent background assumptions, have a satisfactory explanation that can explain the fact better than any other competing explanation — and so it is reasonable to consider/believe the hypothesis to be true.

This, of course, does not in any way mean that we can not be wrong. Of course we can. As scientists we sometimes — much like Sherlock Holmes and other detectives that use abductive reasoning — experience disillusion. We thought that we had reached a strong abductive conclusion by ruling out the alternatives in the set of contrasting explanations. But — what we thought was true turned out to be false. But that does not necessarily mean that we had no good reasons for believing what we believed. If we cannot live with that contingency and uncertainty, well, then we’re in the wrong business. If it is deductive certainty you are after, get in to math or logic, not science.

Inference to the best explanation is an ampliative method of reasoning that makes it possible for us come up with theories and hypotheses that — in contradistinction to the entailments that deduction provide us with — transcend the epistemological content of the evidence that brought about them. As scientists we do not only want to be able to deal with observables. The content-enhancing aspect of inference to the best explanation gives us the possibility of acquiring new and warranted knowledge and understanding of things beyond empirical sense data — such as structures, relations, capacities, powers, etc.

Explanations are per se not deductive proofs. And deductive proofs often do not explain at all, since validly deducing X from Y does not per se explain why X is a fact, because it does not say anything at all about how being Y is connected to being X. Explanations do not necessarily have to entail the things they explain. The evidential force of inference to the best explanation is consistent with having less than certain belief.

Explanation is prior to inference. Inferring means that you come to believe something and have (evidential) reasons for believing so. As economists we entertain different hypotheses on inflation, unemployment, growth, wealth inequality, and so on. From the available evidence and our context-dependent background knowledge we evaluate how well the different hypotheses would explain these evidence and which of them qualifies for being the best accepted hypothesis. We base our inferences on explanatory considerations.

If only mainstream economists also understood these basics …

But they don’t!

Why?

Because in mainstream economics it’s not inference to the best explanation that rules the methodological-inferential roost, but deductive reasoning based on logical inference from a set of axioms. Although — under specific and restrictive assumptions — deductive methods may be usable tools, insisting that economic theories and models ultimately have to be built on a deductive-axiomatic foundation to count as being economic theories and models, will only make economics irrelevant for solving real world economic problems. Modern deductive-axiomatic mainstream economics is sure very rigorous — but if it’s rigorously wrong, who cares?

Instead of making formal logical argumentation based on deductive-axiomatic models the message, I think we are better served by economists who more than anything else try to contribute to solving real problems — and in that endeavour inference to the best explanation is much more relevant than formal logic.

Science is made possible by the fact that there are structures that are durable and are independent of our knowledge or beliefs about them. There exists a reality beyond our theories and concepts of it. It is this independent reality that our theories in some way deal with. Contrary to positivism, I would argue that the main task of science is not to detect event-regularities between observed facts. Rather, that task must be conceived as identifying the underlying structure and forces that produce the observed events.

Instead of building models based on logic-axiomatic, topic-neutral, context-insensitive and non-ampliative deductive reasoning — as in mainstream economic theory — it would be more fruitful and relevant to apply inference to the best explanation, given that what we are looking for is to be able to explain what’s going on in the world we live in.

When applying deductivist thinking to economics, mainstream economists usually set up “as if” models based on a set of tight axiomatic assumptions from which consistent and precise inferences are made. The beauty of this procedure is of course that if the axiomatic premises are true, the conclusions necessarily follow. The snag is that if the models are to be relevant, we also have to argue that their precision and rigour still holds when they are applied to real-world situations. They (almost) never do. When addressing real economies, the idealizations necessary for the deductivist machinery to work simply don’t hold.

The one-eyed focus on validity and consistency make mainstream economics irrelevant, since its insistence on deductive-axiomatic foundations doesn’t earnestly consider the fact that its formal logical reasoning, inferences and arguments show an amazingly weak relationship to their everyday real world equivalents. Although the formal logic focus may deepen our insights into the notion of validity, the rigour and precision has a devastatingly important trade-off: the higher the level of rigour and precision, the smaller is the range of real world applications. As scientists we can not only be concerned with the consistency of our universe of discourse. We also have to investigate how consistent our models and theories are with the universe in which we happen to live.

The more mainstream economists insist on formal logic validity, the less they have to say about the real world. And real progress in economics, as in all sciences, presupposes real world involvement, not only self-referential deductive reasoning within formal-analytical mathematical models.