This is just for ‘goods’ but seems to be counter to all other releases reporting weak exports, but it has been zig zagging it’s way lower and August was particularly weak. And note the weakness in car imports: International trade in goodsHighlightsSeptember reversed August’s outsized goods trade gap, coming in at .6 billion vs .2 billion. Exports jumped 3.1 percent following August’s 3.2 percent decline with wide gains in consumer goods, autos, industrial supplies and capital goods. Imports fell 2.5 percent following the prior month’s 2.2 percent gain. Decreases are wide including industrial supplies, capital goods, autos and consumer goods. The results do point to slowing demand but, because imports are counted as a subtraction in the national accounts, they should nevertheless give a boost to third-quarter GDP estimates. And this typical commentary from today on why the Fed isn’t hiking: The decision comes amid multiple data points that show a weakening in the economy, particularly in job gains and exports. Inflation measures the Fed follows also reflect little in the way of wage and price pressures, while economists are anticipating a muted holiday shopping season.

Topics:

WARREN MOSLER considers the following as important: FED, trade

This could be interesting, too:

Frances Coppola writes Trade lunacy is back

Angry Bear writes Policies Shifted Trade from China?

NewDealdemocrat writes Inflation is decelerating substantially towards the Fed target ADDENDUM: the huge impact of shelter

NewDealdemocrat writes Interest rates, the yield curve, and the Fed chasing a Phantom (lagging) Menace

This is just for ‘goods’ but seems to be counter to all other releases reporting weak exports, but it has been zig zagging it’s way lower and August was particularly weak. And note the weakness in car imports:

International trade in goods

Highlights

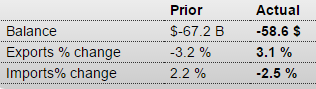

September reversed August’s outsized goods trade gap, coming in at $58.6 billion vs $67.2 billion. Exports jumped 3.1 percent following August’s 3.2 percent decline with wide gains in consumer goods, autos, industrial supplies and capital goods. Imports fell 2.5 percent following the prior month’s 2.2 percent gain. Decreases are wide including industrial supplies, capital goods, autos and consumer goods. The results do point to slowing demand but, because imports are counted as a subtraction in the national accounts, they should nevertheless give a boost to third-quarter GDP estimates.

And this typical commentary from today on why the Fed isn’t hiking:

The decision comes amid multiple data points that show a weakening in the economy, particularly in job gains and exports. Inflation measures the Fed follows also reflect little in the way of wage and price pressures, while economists are anticipating a muted holiday shopping season.