Still negative: Chicago Fed National Activity IndexHighlightsDecember was a weak month for the U.S. economy but a little less weak than November, based on the national activity index which improved to minus 0.22 from minus 0.36 (revised lower from minus 0.30). The improvement is centered in the production component as contraction in industrial production eased to minus 0.4 percent from November’s very deep minus 0.9 percent. Other components were steady with sales/orders/inventories and consumption & housing both slightly negative. The only component in positive ground is employment, unchanged in the month at a solid plus 0.12. Despite the improvement in December, the 3-month average fell to minus 0.24 from minus 0.19 in November. This report is a reminder that economic activity is subdued which is a major factor, aside from low oil and commodity prices, holding down inflation.

Topics:

WARREN MOSLER considers the following as important: FED, housing

This could be interesting, too:

Nick Falvo writes Subsidized housing for francophone seniors in minority situations

NewDealdemocrat writes Declining Housing Construction

Nick Falvo writes Homelessness among older persons

Bill Haskell writes Q3 Update: Housing Delinquencies, Foreclosures and REO

Still negative:

Chicago Fed National Activity Index

Highlights

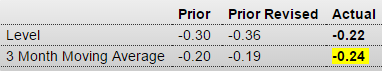

December was a weak month for the U.S. economy but a little less weak than November, based on the national activity index which improved to minus 0.22 from minus 0.36 (revised lower from minus 0.30). The improvement is centered in the production component as contraction in industrial production eased to minus 0.4 percent from November’s very deep minus 0.9 percent. Other components were steady with sales/orders/inventories and consumption & housing both slightly negative. The only component in positive ground is employment, unchanged in the month at a solid plus 0.12. Despite the improvement in December, the 3-month average fell to minus 0.24 from minus 0.19 in November. This report is a reminder that economic activity is subdued which is a major factor, aside from low oil and commodity prices, holding down inflation.

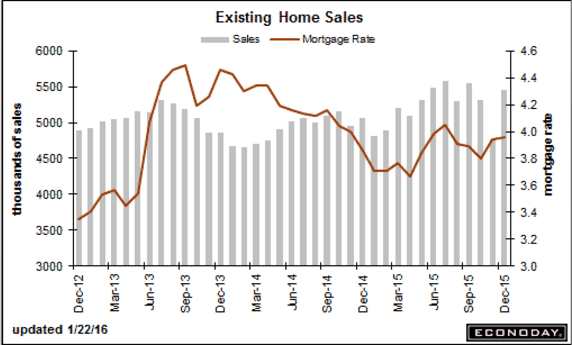

Up more than expected, but from the chart you can see the average of the last two volatile months is still down a bit vs prior months: