Seems it’s always a central bank story. Goes up when they buy, down when they sell. Furthermore gold buying is supported by how it’s accounted for. That is, it doesn’t count as deficit spending or part of the pubic debt, even though the ‘taxpayer’ has to pay interest on the funds spent, just like any other deficit spending. Gold purchases are accounted for not as an ‘expense’ as ‘normal’ govt spending, but as purchases of an asset that remains on the balance sheet at ‘cost’. And yes, the funds spent provide the economy with ‘that which is needed to pay taxes’ just like any other govt spending, and thereby ‘use up’ aggregate demand (‘fiscal space’) created by taxation and residual savings desires just like any other govt spending. So it’s a political choice promoted by institutional structure that allows central bankers to buy all the gold they want without the political restrictions of other spending. China, Russia lead central banks gold buying spree By Cecilia JamasmieJan 13 — China and Russia added more gold to its reserves in November, leading the latest global central banks buying spree that saw them adding 55 tonnes of the yellow metal to their coffers, up almost 90% from the prior month.

Topics:

WARREN MOSLER considers the following as important: China, Russia

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Robert Skidelsky writes House of Lords Speech – Ukraine: “A wake up call” (International Relations and Defence Committee Report)

Robert Skidelsky writes The American Conservative – Why Is the UK So Invested in the Russia–Ukraine War?

Robert Skidelsky writes The American Conservative: Skidelsky on Russia, Ukraine and the Future of European Security

Seems it’s always a central bank story.

Goes up when they buy, down when they sell.

Furthermore gold buying is supported by how it’s accounted for. That is, it doesn’t count as deficit spending or part of the pubic debt, even though the ‘taxpayer’ has to pay interest on the funds spent, just like any other deficit spending. Gold purchases are accounted for not as an ‘expense’ as ‘normal’ govt spending, but as purchases of an asset that remains on the balance sheet at ‘cost’. And yes, the funds spent provide the economy with ‘that which is needed to pay taxes’ just like any other govt spending, and thereby ‘use up’ aggregate demand (‘fiscal space’) created by taxation and residual savings desires just like any other govt spending.

So it’s a political choice promoted by institutional structure that allows central bankers to buy all the gold they want without the political restrictions of other spending.

China, Russia lead central banks gold buying spree

By Cecilia Jamasmie

Jan 13 — China and Russia added more gold to its reserves in November, leading the latest global central banks buying spree that saw them adding 55 tonnes of the yellow metal to their coffers, up almost 90% from the prior month.

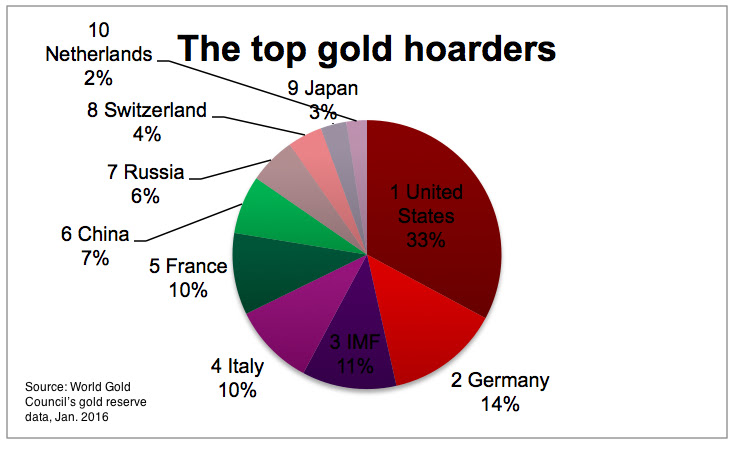

According to the latest World Gold Council’s gold reserve data, released Wednesday, China and Russia were once again the biggest buyers, with 21 tonnes and 22 tonnes added to their respective reserves.

The People’s Bank of China (PBoC) released data last week that showed 19 tonnes were added in December as well. But based on official figures, released last June for the first time since April 2009 and updated monthly ever since, the amount of gold held by the PBOC still only accounts for around 1.7% of its total reserves.

The increased purchases by the world’s sixth largest official sector gold holder could lend support to international prices of the precious metal, say analysts.

China, Russia lead central banks gold buying spree

Despite a jump in prices at the start of the year, gold is still trading close to historic lows. February gold was last up $3.00 at $1,088.50 an ounce, well down from last week’s two-month high of $1,113.10 an ounce, basis February Comex futures.