Looks like they are again making hawkish noises, taking the lead of the Fed: ECB wary of further action despite uncertain future By: Balazs Koranyi and John O’DonnellJan 14 (Reuters)* Many governors sceptical of need for further action in near term* Governors urge countries to act instead with reform* Oil price and inflation expectations:Many European Central Bank policy makers are sceptical about the need for further policy action in the near term, conversations with five of them indicate, even as inflation expectations sink and some investors bank on more easing.Next week’s rate meeting is expected to be relatively uneventful with the big test coming when the ECB releases its initial 2018 growth and inflation forecasts on March 10. But apparently recent market action has got the Fed thinking twice about it’s hiking intentions: China may slow Fed’s interest rate rises: Fed officials Jan 13 (Reuters) — The rout in China’s stock market, weak oil prices and other factors are “furthering the concern that global growth has slowed significantly,” Boston Fed President Eric Rosengren said. Rosengren also said a second hike will face a strict test as the Fed looks for tangible evidence that U.S. growth will be “at or above potential” and inflation is moving back up toward the Fed’s 2 percent target.

Topics:

WARREN MOSLER considers the following as important: ECB, FED

This could be interesting, too:

Merijn T. Knibbe writes Monetary developments in the Euro Area, september 2024. Quiet.

Sergio Cesaratto writes Di nuovo su TARGET2

NewDealdemocrat writes Inflation is decelerating substantially towards the Fed target ADDENDUM: the huge impact of shelter

NewDealdemocrat writes Interest rates, the yield curve, and the Fed chasing a Phantom (lagging) Menace

Looks like they are again making hawkish noises, taking the lead of the Fed:

ECB wary of further action despite uncertain future

By: Balazs Koranyi and John O’Donnell

Jan 14 (Reuters)

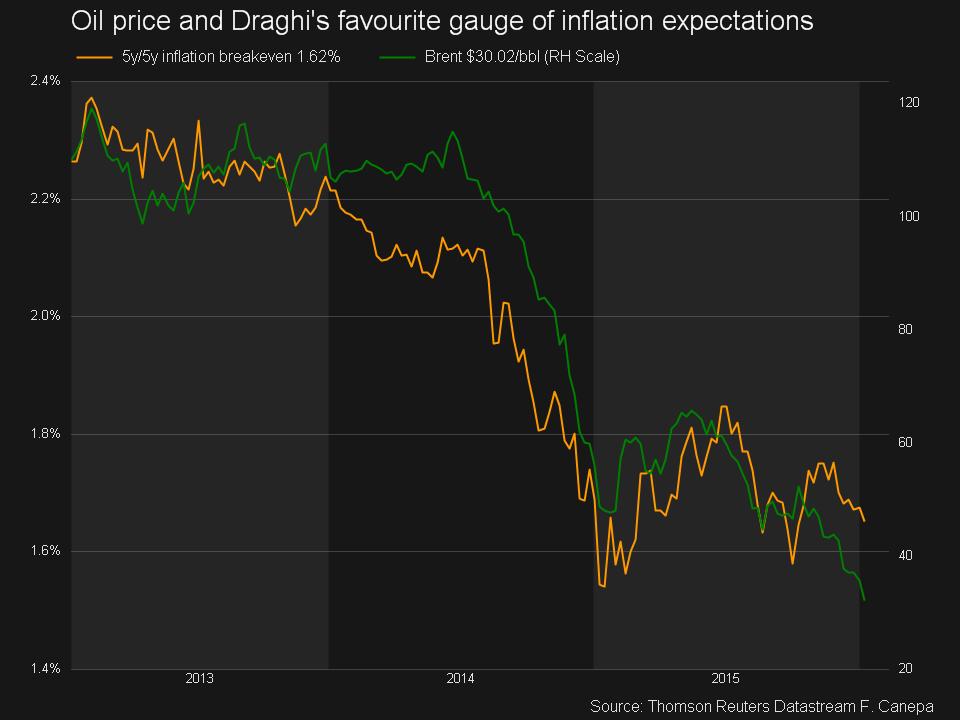

* Many governors sceptical of need for further action in near term

* Governors urge countries to act instead with reform

* Oil price and inflation expectations:

Many European Central Bank policy makers are sceptical about the need for further policy action in the near term, conversations with five of them indicate, even as inflation expectations sink and some investors bank on more easing.Next week’s rate meeting is expected to be relatively uneventful with the big test coming when the ECB releases its initial 2018 growth and inflation forecasts on March 10.

But apparently recent market action has got the Fed thinking twice about it’s hiking intentions:

China may slow Fed’s interest rate rises: Fed officials

Jan 13 (Reuters) — The rout in China’s stock market, weak oil prices and other factors are “furthering the concern that global growth has slowed significantly,” Boston Fed President Eric Rosengren said. Rosengren also said a second hike will face a strict test as the Fed looks for tangible evidence that U.S. growth will be “at or above potential” and inflation is moving back up toward the Fed’s 2 percent target. “It’s something that’s got to make you nervous,” Chicago Fed chief Charles Evans said of the drag slower growth in China could have on economies like the United States that don’t do much direct trade. Evans also said he was nervous about inflation expectations not being as firmly anchored as a year ago, and added it could be midyear before the Fed has a good picture of the inflation outlook.

Confirming the rail traffic indicators:

CSX fourth quarter profit falls on lower freight volumes

Jan 13 (Bloomberg) — CSX said freight volumes fell 6 percent in the fourth quarter, with a huge 32 percent decline in the amount of coal hauled. Fourth-quarter net income was $466 million or 48 cents per share, down 5 percent from $491 million or 49 cents per share a year earlier. Revenue in the quarter was $2.78 billion, down nearly 13 percent from $3.19 billion a year earlier. “We have not seen these kind of pressures in so many different markets because you have multiple aspects working against you: Low gas prices, low commodity prices, strength of the dollar,” CEO Michael Ward said on the call. Except auto, housing, “you are seeing pressure on most of the markets.”