Summary:

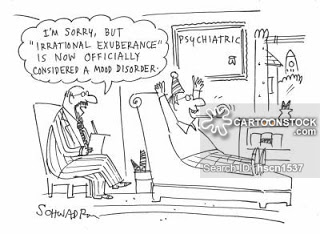

Yesterday I listened to this interview on the radio (Bloomberg's Surveillance) with Robert Shiller (you can jump to the last 9 minutes, that's when Shiller starts talking). He is for fiscal stimulus to get us out of the funk, but for higher rates to deal with outline asset prices. No discussion of using regulation to preclude speculation and bubbles in asset markets.PS: The piece cited at the beginning of the interview is this one.

Topics:

Matias Vernengo considers the following as important: Shiller

This could be interesting, too:

Yesterday I listened to this interview on the radio (Bloomberg's Surveillance) with Robert Shiller (you can jump to the last 9 minutes, that's when Shiller starts talking). He is for fiscal stimulus to get us out of the funk, but for higher rates to deal with outline asset prices. No discussion of using regulation to preclude speculation and bubbles in asset markets.PS: The piece cited at the beginning of the interview is this one.

Topics:

Matias Vernengo considers the following as important: Shiller

This could be interesting, too:

Matias Vernengo writes Robert Shiller’s Godley-Tobin Lecture

Matias Vernengo writes Phishing for phools

Yesterday I listened to this interview on the radio (Bloomberg's Surveillance) with Robert Shiller (you can jump to the last 9 minutes, that's when Shiller starts talking). He is for fiscal stimulus to get us out of the funk, but for higher rates to deal with outline asset prices. No discussion of using regulation to preclude speculation and bubbles in asset markets.

PS: The piece cited at the beginning of the interview is this one.