Summary:

The student loan situation is critical, and the WSJ (subscription required) suggests that there are increasing worries that a large number of borrowers will default. The numbers are indeed concerning with 43% in default already, delinquent or in postponement as shown below. This has had strange implications. But while I think that the increase in student loan debt is part of the increasing inequality in the country, and one might add, the increasing costs of college education, that forces kids to borrow large amounts for a shot at a better life, it's unlikely that it would lead to a short run crisis, and a recession. In contrast to the sub-prime and mortgage based borrowing, student loans are about the possibility of future income, not short run consumption. So I would not expect a collapse of current consumption, if the default rate increases significantly. And I doubt that there is a large bank, like Lehman, that would go under if a large number of borrowers default (of course I might be wrong on that).At any rate, that does NOT mean that the problem is minor. Quite the opposite. By reducing the ability of people to spend earlier in life, and delaying other normal commitments like, for example buying a house, the increase in the student debt burden might be drag on long term growth prospects.

Topics:

Matias Vernengo considers the following as important: Student debt

This could be interesting, too:

The student loan situation is critical, and the WSJ (subscription required) suggests that there are increasing worries that a large number of borrowers will default. The numbers are indeed concerning with 43% in default already, delinquent or in postponement as shown below. This has had strange implications. But while I think that the increase in student loan debt is part of the increasing inequality in the country, and one might add, the increasing costs of college education, that forces kids to borrow large amounts for a shot at a better life, it's unlikely that it would lead to a short run crisis, and a recession. In contrast to the sub-prime and mortgage based borrowing, student loans are about the possibility of future income, not short run consumption. So I would not expect a collapse of current consumption, if the default rate increases significantly. And I doubt that there is a large bank, like Lehman, that would go under if a large number of borrowers default (of course I might be wrong on that).At any rate, that does NOT mean that the problem is minor. Quite the opposite. By reducing the ability of people to spend earlier in life, and delaying other normal commitments like, for example buying a house, the increase in the student debt burden might be drag on long term growth prospects.

Topics:

Matias Vernengo considers the following as important: Student debt

This could be interesting, too:

run75441 writes Another Student Loan Scam Involving Prestigious Universities this time

run75441 writes “Unshakeable Burden of Student Loans”

Nick Falvo writes The 2021 federal budget

run75441 writes Student Loan Debt Crisis Town Hall – November 20, 2020

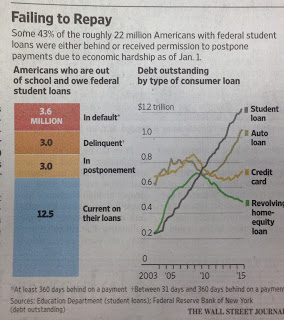

The student loan situation is critical, and the WSJ (subscription required) suggests that there are increasing worries that a large number of borrowers will default. The numbers are indeed concerning with 43% in default already, delinquent or in postponement as shown below.

This has had strange implications. But while I think that the increase in student loan debt is part of the increasing inequality in the country, and one might add, the increasing costs of college education, that forces kids to borrow large amounts for a shot at a better life, it's unlikely that it would lead to a short run crisis, and a recession. In contrast to the sub-prime and mortgage based borrowing, student loans are about the possibility of future income, not short run consumption. So I would not expect a collapse of current consumption, if the default rate increases significantly. And I doubt that there is a large bank, like Lehman, that would go under if a large number of borrowers default (of course I might be wrong on that).

This has had strange implications. But while I think that the increase in student loan debt is part of the increasing inequality in the country, and one might add, the increasing costs of college education, that forces kids to borrow large amounts for a shot at a better life, it's unlikely that it would lead to a short run crisis, and a recession. In contrast to the sub-prime and mortgage based borrowing, student loans are about the possibility of future income, not short run consumption. So I would not expect a collapse of current consumption, if the default rate increases significantly. And I doubt that there is a large bank, like Lehman, that would go under if a large number of borrowers default (of course I might be wrong on that).

At any rate, that does NOT mean that the problem is minor. Quite the opposite. By reducing the ability of people to spend earlier in life, and delaying other normal commitments like, for example buying a house, the increase in the student debt burden might be drag on long term growth prospects. That's why a bailout of students is necessary, and a permanent solution for the cost of college education is needed.