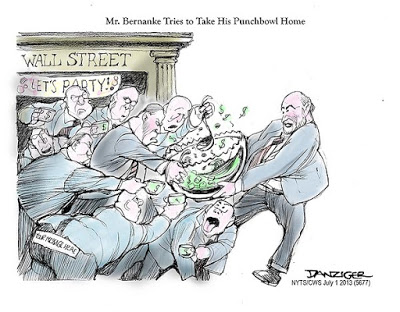

By Thomas PalleyFederal Reserve Chairman William McChesney Martin famously declared that the Federal Reserve “is in the position of the chaperone who has ordered the punch bowl removed just when the party was really warming up.” This paper uses the punch bowl metaphor to analyze how the Federal Reserve can improve monetary policy so as to deliver shared prosperity with greater financial stability. The problem is the party starts earlier on Wall Street than Main Street, so the Fed may remove the punchbowl before the party reaches Main Street. Ensuring Main Street attends the party requires a new recipe for the punch, new serving rules, and a new punch master. Additionally, there is a deeper problem that current neoliberal growth model has the economy addicted to monetary punch. Resolving that requires a cure that goes beyond the punch bowl. Read rest here.

Topics:

Matias Vernengo considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

Federal Reserve Chairman William McChesney Martin famously declared that the Federal Reserve “is in the position of the chaperone who has ordered the punch bowl removed just when the party was really warming up.” This paper uses the punch bowl metaphor to analyze how the Federal Reserve can improve monetary policy so as to deliver shared prosperity with greater financial stability. The problem is the party starts earlier on Wall Street than Main Street, so the Fed may remove the punchbowl before the party reaches Main Street. Ensuring Main Street attends the party requires a new recipe for the punch, new serving rules, and a new punch master. Additionally, there is a deeper problem that current neoliberal growth model has the economy addicted to monetary punch. Resolving that requires a cure that goes beyond the punch bowl.

There will be a lot of postmortems for the European Union (EU) after Brexit. Many will suggest that this was a victory against the neoliberal policies of the European Union. See, for example, the first three paragraphs of Paul Mason's column here. And it is true, large contingents of working class people, that have suffered with 'free-market' economics, voted for leaving the union. The union, rightly or wrongly, has been seen as undemocratic and responsible for the economics woes of Europe.

The problem is that while it is true that the EU leaders have been part of the problem and have pursued the neoliberal policies within the framework of the union, sometimes with treaties like the Fiscal Compact, it is far from clear that Brexit and the possible demise of the union, if the fever spreads to France, Germany and other countries with their populations demanding their own referenda, will lead to the abandonment of neoliberal policies. Aust…

The economy in Venezuela has collapsed (GDP has fallen by about 14% or so in the last two years), inflation has accelerated (to three digit levels; 450% or so according to the IMF), there are shortages of essential goods, recurrent energy blackouts, and all of these aggravated by persistent violence. Contrary to what the press suggests, these events are not new or specific to left of center governments. Similar events occurred in the late 1980s, in the infamous Caracazo, when the fall in oil prices caused an external crisis, inflation, and food shortages, which eventually, after the announcement of a neoliberal economic package that included the i…