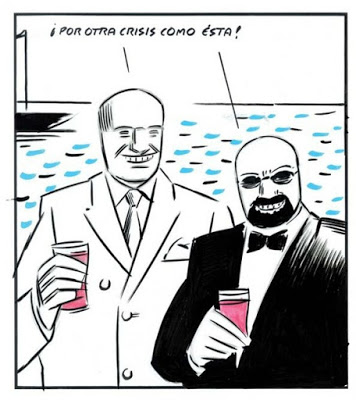

Here is to another crisis like this one! Paper co-authored with Esteban Pérez that was a Levy Institute working paper is published. From the abstract: The Spanish crisis is generally portrayed as resulting from excessive spending by households associated to a housing bubble and/or an excessive welfare spending beyond the economic possibilities of the country. We put forward a different hypothesis. We argue that the Spanish crisis resulted, in the main, from a widening deficit position in the non-financial corporate sector and a declining trend in profitability under a regime of financial liberalization and loose and unregulated lending practices. Full paper available here.

Topics:

Matias Vernengo considers the following as important: Esteban Pérez, euro, Levy Institute, Spain

This could be interesting, too:

Merijn T. Knibbe writes ´Extra Unordinarily Persistent Large Otput Gaps´ (EU-PLOGs)

Matias Vernengo writes Sharing Central Banks’ costs and profits of monetary policy in the euro area

Matias Vernengo writes Esteban Pérez Caldentey on the Ideas of Raúl Prebisch

Matias Vernengo writes Dollar Hegemony and Argentina

Paper co-authored with Esteban Pérez that was a Levy Institute working paper is published. From the abstract:

The Spanish crisis is generally portrayed as resulting from excessive spending

by households associated to a housing bubble and/or an excessive welfare spending beyond

the economic possibilities of the country. We put forward a different hypothesis. We argue

that the Spanish crisis resulted, in the main, from a widening deficit position in the non-

financial corporate sector and a declining trend in profitability under a regime of financial

liberalization and loose and unregulated lending practices.

Full paper available here.