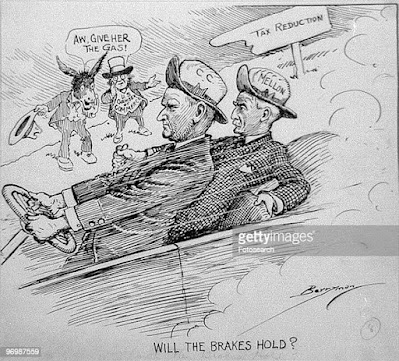

Calvin Coolidge and Andrew Mellon A new paper by Ahmad Borazan on the 1920-21 recession, often seen in libertarian and Austrian circles as an example of a laissez-faire recovery. From the abstract:The US recovery from the 1920–21 recession has been presented as a triumph of laissez-faire policies and a serious challenge to Keynesian economics. This study interrogates this claim by using previously unutilised data and examines the historical development of the early 1920s recession and recovery. The study refutes the laissez-faire view and shows that the recovery indeed fits Keynes’s perspective. The deflationary recession was largely engineered by the Federal Reserve a la 1980s Volker disinflation. The recovery closely followed the reversal of tight monetary policy and was propelled by

Topics:

Matias Vernengo considers the following as important: 1920-21 recession, Borazan, Great Depression

This could be interesting, too:

Matias Vernengo writes COVID-19 Crisis: More Like the 1920-1921 Recession

Lord Keynes writes Keynes’ Life: 1931

Lord Keynes writes Keynes’ Life: 1930

Lord Keynes writes Keynes’ Life: 1929

Calvin Coolidge and Andrew Mellon

A new paper by Ahmad Borazan on the 1920-21 recession, often seen in libertarian and Austrian circles as an example of a laissez-faire recovery. From the abstract:

The US recovery from the 1920–21 recession has been presented as a triumph of laissez-faire policies and a serious challenge to Keynesian economics. This study interrogates this claim by using previously unutilised data and examines the historical development of the early 1920s recession and recovery. The study refutes the laissez-faire view and shows that the recovery indeed fits Keynes’s perspective. The deflationary recession was largely engineered by the Federal Reserve a la 1980s Volker disinflation. The recovery closely followed the reversal of tight monetary policy and was propelled by exceptionally long pent-up private consumption and residential spending. The recovery initiated the Roaring Twenties boom of weakened organised labour, rising income inequality and mounting private debt. This private debt-led boom proved unsustainable and was fraught with risks that contributed to the severity of the Great Depression. Although the recovery was not driven by fiscal policy, it cannot be seen as driven by price flexibility either.

Full paper here.