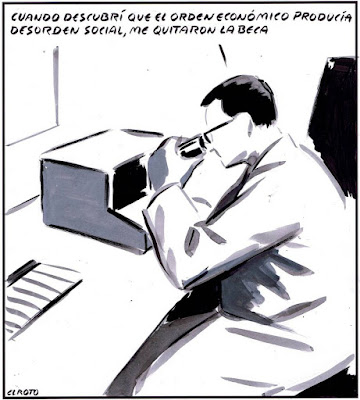

“When I discovered that the economic order produced social disorder, they took away my scholarship.”New working paper by Tom Palley. From the abstract:This paper introduces the notion of monetary disorder. The underlying theory rests on a twin circuits view of the macro economy. The idea of monetary disorder has relevance for understanding the experience and consequences of the recent decade-long period of monetized large budget deficits and ultra-easy monetary policy. Current policy rests on Keynesian logic whereby a large fall in aggregate demand warrants robust offsetting monetary and fiscal policy actions. That logic neglects potential monetary disorder being bred within the financial circuit in the form of inflated asset prices and leveraged balance sheets. That disorder is likely

Topics:

Matias Vernengo considers the following as important: Keynesian, Palley

This could be interesting, too:

Matias Vernengo writes Paul Davidson (1930-2024) and Post Keynesian Economics

Matias Vernengo writes Paul Davidson (1930-2024)

Matias Vernengo writes Keynes’ denial of conflict: a reply to Professor Heise’s critique

Matias Vernengo writes Dollar Hegemony and Argentina

New working paper by Tom Palley. From the abstract:

This paper introduces the notion of monetary disorder. The underlying theory rests on a twin circuits view of the macro economy. The idea of monetary disorder has relevance for understanding the experience and consequences of the recent decade-long period of monetized large budget deficits and ultra-easy monetary policy. Current policy rests on Keynesian logic whereby a large fall in aggregate demand warrants robust offsetting monetary and fiscal policy actions. That logic neglects potential monetary disorder being bred within the financial circuit in the form of inflated asset prices and leveraged balance sheets. That disorder is likely to develop long before inflation accelerates so that inflation targeting fails to protect against it. Political factors increase the policy danger as the benefits of disorder are front-loaded and the costs backloaded. The paper concludes with a policy discussion regarding how to prevent Keynesian goods market counter-cyclical stabilization policy from causing monetary disorder.

Download it here.