There has been a lot of writing about Bidenomics (a name that might stick, like Reaganomics; nobody really thinks of Clintonomics as a thing) recently. It is fundamentally about the return of industrial policy, even if I personally think that this is less momentous than what people think. Don't get me wrong, both the rediscovery of fiscal policy after the 2007-9 recession (no fiscal packages after the 1990-91 or 2001 recessions, but packages after both 2007-9 and Pandemic in 2020), and the rediscovery of industrial policy, in part because of the rise of China, and in part because of the Pandemic/Chain supply shock, are important. And Bidenomics might stick because it announces a New Washington Consensus, that at least in theory abandons the neoliberal stances of the old one (see Jake

Topics:

Matias Vernengo considers the following as important: Bidenomics, Deindustrialization, industrial policy, Reaganomics, Summers

This could be interesting, too:

Matias Vernengo writes Serrano, Summa and Marins on Inflation, and Monetary Policy

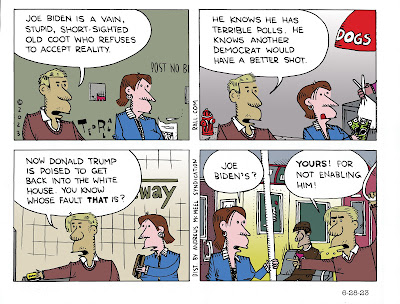

Matias Vernengo writes The second coming of Trumponomics

Matias Vernengo writes The Economist and the American Economy

Matias Vernengo writes More on the possibility and risks of a recession

There has been a lot of writing about Bidenomics (a name that might stick, like Reaganomics; nobody really thinks of Clintonomics as a thing) recently. It is fundamentally about the return of industrial policy, even if I personally think that this is less momentous than what people think. Don't get me wrong, both the rediscovery of fiscal policy after the 2007-9 recession (no fiscal packages after the 1990-91 or 2001 recessions, but packages after both 2007-9 and Pandemic in 2020), and the rediscovery of industrial policy, in part because of the rise of China, and in part because of the Pandemic/Chain supply shock, are important. And Bidenomics might stick because it announces a New Washington Consensus, that at least in theory abandons the neoliberal stances of the old one (see Jake Sullivan's speech).

My concern is that on both counts, the macroeconomic or fiscal front, and on the microeconomics, or industrial policy front, rhetoric is stronger than action. Or that it will be, at any rate. I'm not trying to blame Biden (or his team) for not breaking (or not enough) with conventional views. I mean I might have my views on how lefty or progressive (or even pro labor) Biden is (he did sign vote for every Free Trade Agreement possible, but he is allowed to change his mind). My concern is how much the common sense within the Democratic Party has changed. And while the the 2007-9 recession had moved many Dems and their advisors to rethinking about the macroeconomic consensus (not long ago Larry Summers was saying posties were right, and the economy had no tendency to full employment), the Pandemic inflation has done the opposite, as I noted here.

If the lesson was that Summers had been wrong (and Christina Romer right) on the size of the fiscal package needed for a fast recovery back then, now it seems that most economists (in the mainstream) agree with the notion that excess demand (particularly the last fiscal package early in 2021, and less the Pandemic ones, but that's another story) caused inflation, and the Fed fell behind and was correct in raising rates substantially. Note that the mechanism by which the Fed would reduce inflation is the conventional one, higher unemployment, less demand, lower prices (Summers, ironically, is one of the few actually that brings up the issue of bargaining power of workers with lower unemployment). And this diagnosis remains even though the level of unemployment didn't go down (after the recovery) at the same time that inflation came significantly down.

Of course, there's room still to discuss whether the Fed (together with the freezing of fiscal spending growth for next year by Congress) will end up throwing the economy into a recession or not. But either way, part of the legacy of the last crisis will be to reinforce the conventional new consensus model. Note, however, that the political risk is huge. Because Biden is forced to defend the notion that the economy (that recovered fast from the pandemic, no doubt) is doing great. And of course, the pre-Pandemic situation was far from ideal, and there's a reason why over the last decades a right-wing, blue collar movement has emerged. On that, trade policies were central, and the new industrial policy should play a role.

On the industrial policy front, it is worth remembering the existence of what Fred Block called the hidden developmental state, which suggests that the US always did industrial policy. But I doubt that the main effect of the New Washington Consensus will be to bring back many manufacturing jobs. Most of the ones that the establishment wants to move away from China (or at least part of the establishment, Adam Posen's views suggest that some are in doubt, about the movement away from the old one) will move to other Asian countries, like Vietnam and India.

At any rate, there are some reasons to be mildly skeptical about Bidenomics from a progressive perspective. Of course, I do think this is a huge improvement on Clintonomics, which was just Reaganomics, but more fiscally conservative.