Almost everything that’s wrong with conventional views on fiscal policy is on display in this column (well written and clear) by one of the key journalists from Folha de São Paulo, Vinicius Torres Freire. He suggests that the current fiscal adjustment is not credible. For him, this is a confidence crisis, caused by Lula’s insistence on attacking the central bank policy and his lukewarm support for the adjustment. Why the adjustment is necessary, he never asks. It’s evident, for any educated or serious person, one must conclude. Debt is too high, spending cannot go on forever. These are truisms, and if repeated long enough they do seem right.The problem of course is that the Brazilian fiscal problems (note that it is unclear why deficits that are not particularly large, by historical or

Topics:

Matias Vernengo considers the following as important: Brazil, fiscal conservatism, Lula

This could be interesting, too:

Matias Vernengo writes The behavior of the nominal exchange rate between the Brazilian Real and the dollar in 2024

Matias Vernengo writes Serrano, Summa and Marins on Inflation, and Monetary Policy

Matias Vernengo writes Very brief note on the Brazilian real and the fiscal package

Matias Vernengo writes 30 years of the Real Plan: Unoriginal Lessons from Latin American Stabilizations

Almost everything that’s wrong with conventional views on fiscal policy is on display in this column (well written and clear) by one of the key journalists from Folha de São Paulo, Vinicius Torres Freire. He suggests that the current fiscal adjustment is not credible. For him, this is a confidence crisis, caused by Lula’s insistence on attacking the central bank policy and his lukewarm support for the adjustment. Why the adjustment is necessary, he never asks. It’s evident, for any educated or serious person, one must conclude. Debt is too high, spending cannot go on forever. These are truisms, and if repeated long enough they do seem right.

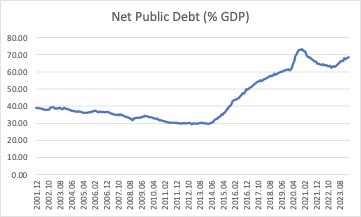

The problem of course is that the Brazilian fiscal problems (note that it is unclear why deficits that are not particularly large, by historical or comparative standards, and debt that grew as a proportion of GDP, but is in domestic currency and can be rolled over without any trouble routinely, are a problem) started when the economy stopped growing in 2015. And that’s when PT tried to promote an adjustment to appease the radical right. It was only then that public debt started growing as a share of GDP (see graph). We know how well that strategy worked out for Dilma.

In my Catalyst piece of a from last summer, I suggested that the problem Lula would face would be within his own coalition. The fiscal conservatives inside his coalition, and, in particular, those on the left and within PT, which include his own Finance Minister, Fernando Haddad. He truly and earnestly believes, as much as Torres Freire, that the path to growth is through fiscal consolidation, lower deficits and debt, obtained in his view mostly by increasing revenue (his critics and the 'markets', read the traders on Faria Lima, would prefer cuts on social spending), and obtaining investment grade, which would lead to an investment boom.

Note that many political scientists, for example Marcos Nobre here, suggest that somehow the problem is that Lula needs to negotiate with the so-called Centrão, the clientelist groups in congress, that control the voting and have a grip on governability. In that view, he is between the rock of lack of governability, and the hard place macroeconomic instability. In other words, he either continues with the clientelist policies that allowed all governments to deal with congress, but pays the price of not being able to deliver the fiscal results necessary, in this view, for price stability and growth (fiscal restraint also allows for lower interest rates, which would be instrumental for growth). He would also spend on unnecessary things rather than the crucial things that are needed for growth, including in the green transition. The notion is that whatever he does the likelihood is that the extreme right (the right without fear) might return (even without Bolsonaro).

Of course, that's a false dilemma. Brazil has no fiscal problem. The best way to consolidate, reducing debt, if that is deemed essential, would be promoting growth, and investing (public investment), including on a green transition, and that would allow the ratio of debt to GDP to fall, even if debt per se went up. The main problem for Lula is that many in his own party, and his key ministers are promoting an adjustment that might force him to miss the mandatory minimum expenditures on education and health, that would preclude providing the increases in wages of public sector workers, and the minimum wage, that would help promote a recovery. So Lula's fiscal problems are not what you might think. Brazil has no fiscal problems, which are normally political problems, and has not have any serious external issues either, a recurrent theme gong back for more than two decades and discussed here, more recently (and here and here, the last one with links to 7 additional posts, to give a few examples over the years). The problem is fiscal conservatism.