This article originally appeared in the Indian journal Economic and Political Weekly on 13 March 2021. What the battle of GameStop has brought into light is that democracy in financial markets is just a myth: whoever controls the valves, controls the flow. The market-making and brokerage markets in the United States are heavily oligopolistic markets in which market-makers and brokers extract huge rents from the retail traders. Although the retail traders involved in the battle appear unaware of what they did, they brought these markets to a near collapse, which the oligopolists managed to stop. Theirs is neither a revolution nor Occupy Wall Street, but a novel form of collective action expected to continue. To summarise the GameStop debacle, on which there are already at least five

Topics:

Ahmet Öncü & T.Sabri Öncü considers the following as important: Article, Finance & Regulation, Long Read

This could be interesting, too:

Jeremy Smith writes UK workers’ pay over 6 years – just about keeping up with inflation (but one sector does much better…)

T. Sabri Öncü writes Argentina’s Economic Shock Therapy: Assessing the Impact of Milei’s Austerity Policies and the Road Ahead

T. Sabri Öncü writes The Poverty of Neo-liberal Economics: Lessons from Türkiye’s ‘Unorthodox’ Central Banking Experiment

Ann Pettifor writes Global Economic Governance: What’s “Growth” Got to Do with It?

This article originally appeared in the Indian journal Economic and Political Weekly on 13 March 2021.

What the battle of GameStop has brought into light is that democracy in financial markets is just a myth: whoever controls the valves, controls the flow. The market-making and brokerage markets in the United States are heavily oligopolistic markets in which market-makers and brokers extract huge rents from the retail traders. Although the retail traders involved in the battle appear unaware of what they did, they brought these markets to a near collapse, which the oligopolists managed to stop. Theirs is neither a revolution nor Occupy Wall Street, but a novel form of collective action expected to continue.

To summarise the GameStop debacle, on which there are already at least five movies and two television shows in the works as of writing,1 let us first explain what short selling is.

Short Selling

Short selling refers to the selling of financial assets that the investor does not own. First, the investor borrows the assets (such as some shares) from an owner (such as a broker-dealer) and then, sells them with the promise that they will purchase the assets back and return them to their rightful owner. The bet is that the asset price will go down so that the investor would profit from this trade, unless they are doing this for risk management purposes.

As in any borrowing, interest is paid on the total market price of the assets borrowed. Further, the debt of the investor is secured by depositing a percentage, usually determined by some regulator (although broker-dealers can increase it), of the borrowed amount in an account with the lender as collateral. This account is the so-called margin account on which interest is collected. Both these interest payments are calculated overnight, and the net interest paid or received is the difference between the former and the latter.

After all the assets are sold, as the asset market price goes down, the investor’s margin account goes up by the amount of the gain. Similarly, as the asset market price goes up, the margin account goes down by the amount of the loss. The amount deposited in the margin account when it is opened is the so-called initial margin. There also is the so-called maintenance margin, also usually determined by some regulator (although broker-dealers can increase it), below which the margin account cannot fall. If that happens, the investor would get a margin call to top their margin account back to the initial margin.

Lastly, there is the so-called rehypothecation. Hypothecation is a situation in which a borrower pledges an asset as collateral to secure a loan with the agreement that if the borrower fails to pay the loan, the lender owns the asset. Rehypothecation occurs when a lender loans or hypothecates an already hypothecated asset. Although rehypothecation is legal, the rehypothecation regulations differ among countries. In the United States (US), broker-dealers can rehypothecate the collateral up to 140% of the loan.

When a margin account is opened with a broker-dealer (any account that is opened is almost always a margin account, not a cash account, by default on Wall Street), the broker-dealer places any assets that are bought in this account. The significance of this is that the broker-dealer can legally loan the assets in the investor’s margin account to others, although the assets are legally that of the investor.

Suppose an investor bought some shares of a corporation and the broker-dealer loaned the investor’s shares to a hedge fund for short selling; and this hedge fund sold the shares to a third investor; this investor’s broker-dealer loaned the shares to a second hedge fund, and so on, so forth. And if this rehypothecation happens sufficiently many times, the number of short-sold shares of this corporation exceeds the number of its available shares or, in Wall Street parlance, short interest in the shares of this corporation as a percentage of float (SI % of Float) exceeds 100%.

The Week of 25 January

The layperson’s account of the events was that a bunch of bored young fellows disillusioned with capitalism and angry at the hedge funds since the Global Financial Crisis of 2007–08 organised an attack that started on 25 January 2021 on a bunch of hedge funds such as Melvin Capital that heavily shorted GameStop ($GME) shares. They did this through r/wallstreetbets, an online community in the social media platform Reddit, where they discussed stock trades, and financed this attack using the stimulus checks that the US government sent them, and some borrowing made through their margin accounts mostly on a no-commission online brokerage Robinhood, whose mission is “to democratize finance for all.”2

GameStop is a relatively small brick-and-mortar gaming retail store whose fortunes have been declining with the ongoing online-based “industrial revolution” and COVID-19 lockdowns. Shortly before the week of 25 January, GameStop was the most shorted stock in the US, with an SI % of Float hovering around 140%, making it the best short squeeze candidate. Other candidates included AMC Entertainment ($AMC), another brick-and-mortar establishment, a movie theatre chain, and several smaller ones.

As the story goes, the r/wallstreetbets participants started their attack by buying not only the shares of, but also call options on the stock in large amounts. A call option on a stock is a right, but not the obligation, to purchase some shares (100 shares, if the option is listed on an exchange) of the stock on or until a future date (called the strike date), at a specified price (called the strike price). If the current price is equal to the strike price, the option is called at-the-money; above the strike price, in-the-money; and otherwise, out-of-the-money.

However, although the public thought that the GameStop debacle was only about a short squeeze in conjunction with a “gamma” squeeze that we will describe later, it was so only in appearance. As Thomas Peterffy, the founder and chairman of Interactive Brokers Group, also involved in this debacle, stated on CNBC on 17 February,

[w]e have come dangerously close to the collapse of the entire system and the public seems to be completely unaware of that, including Congress and the regulators.3

And this debacle ended with a triumph of finance capital because they managed to avoid this potential systemic collapse, at the heart of which was the Depository Trust and Clearing Corporation (DTCC). We will describe how the DTCC brought the entire system to a near collapse later also. We note that the DTCC is the central clearing house responsible for clearing (the process of updating the accounts of the trading parties and arranging for the transfer of money and securities) and settling (the actual delivery of the shares to the buyer and cash to the seller) the stock trades in the US. The DTCC ensures that every trade settles in two business days.

Short and Gamma Squeezes

The short squeeze is simple. It is a stock market phenomenon that occurs when most short-sellers are forced to buy the shares back after a large increase in the stock price that triggers margin calls, usually resulting from either unexpected good news or simply a steadily growing buying pressure. As the short sellers begin to exit their positions, buying shares they short sold, the stock price further increases, causing more short sellers to exit their positions, and potentially bankrupting some of the highly levered ones among them.

The gamma squeeze is a bit more complicated. It is about the so-called option Greeks, the relevant two of which are delta and gamma. The delta of an option is the sensitivity of the option price, whereas the gamma of the option is the sensitivity of its delta to the changes in the underlying stock price. The delta of a call option increases from 0 to 1, and it is about 0.5 when the underlying stock price is close to the strike price. Further, the gamma is large when the underlying stock and strike prices are close, and it gets larger in that neighbourhood as the remaining time to strike decreases.

Investors usually trade the options with market-makers, who are the liquidity providers to the market. And since the market-makers are not in the business of making directional bets on market prices but profit from bid/ask spreads, they hedge their positions in the options as follows.

Say, a market-maker sold or, in Wall Street parlance, took a short position in a call option for 100 shares of some stock. For the out-of-the-money call options, the delta is much smaller than 0.5. Suppose it was 0.1 initially. The usual way to hedge this position for the market-maker is to buy, that is, take a long position in 10 (= 0.1×100) shares of the underlying stock with the hope that the underlying stock price changes will be small so that the price changes in the short and long positions will offset each other.4

However, if the underlying stock price change is large and the underlying price approaches the strike price, the increase in the gamma—the speed with which the delta increases—forces the market-maker to buy more shares (say, 40 more shares if the delta rapidly becomes .5) of the underlying stock to keep its short position in the option hedged. And if the market-maker initially took large positions in out-of-the-money options, this further exacerbates the increase in the underlying stock price, worsening the short squeeze. This is what the gamma squeeze is, and it gets stronger if the employed options are short-dated.

What happened to the GameStop stock in the week of 25 January was just similar to this. Fuelled by some good news and excessively bullish views of some participants such as Keith Gill — also known as @roaringkitty, as well as some other colourful names — on r/wallstreetbets, simultaneous short and gamma squeezes shot the GameStop stock price through the roof. From the closing price of $62.01 on 22 January to an intraday high of $483.00 on 28 January. And the sky started falling as the closing price of 28 January went down to $193.60 from the 27 January closing price of $347.51.

On 28 January

Although Charles Schwab — a seasoned American multinational financial services company also offering no-commission online stock trades — already made the GameStop stock non-marginable (that is, made the initial margin of the stock 100% so that only cash purchases became possible) on 13 January, the first major trading restrictions in the week of 25 January came on 27 January from another online brokerage, TD Ameritrade.5 On 27 January, TD Ameritrade said:6

In the interest of mitigating risk for our company and clients, we have put in place several restrictions on some transactions in $GME, $AMC and other securities. We made these decisions out of an abundance of caution amid unprecedented market conditions and other factors.

Shortly after TD Ameritrade released its statement, the chief securities regulator in Massachusetts, Massachusetts Secretary of the Commonwealth William Galvin, told CNBC:7

The marketplace should be a place where risk is taken, but not reckless risk and not a situation that undermines the system, and that’s what we’re looking at here.

He then argued that the New York Stock Exchange should place a 30-day trading halt on GameStop shares while the Biden administration announced that they were monitoring the situation at about the same time.

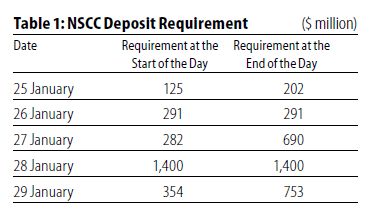

All hell broke loose on 28 January after the DTCC, or rather its subsidiary the National Securities Clearing Corporation (NSCC), moved early in the morning. The NSCC requires the brokers to deposit some amount of cash in the morning and may change the amount during the day as new trades come in for clearing the stock trades, presumably, to mitigate the risks in the settlement.8 Table 1 shows the amounts the NSCC required Robinhood to deposit in the week of 25 January. Although the NSCC required Robinhood to deposit $3 billion in the morning of 28 January, they later negotiated the amount down to $1.4 billion.9

Similar margin calls happened to other brokers, and Robinhood and several brokers, such as Interactive Brokers and Webull Financial, halted the purchases of GameStop, AMC Entertainment, and several other stocks. And almost immediately after Robinhood restricted the trades, a Robinhood customer filed a class action lawsuit in the United States District Court for the Southern District of New York, accusing Robinhood of

purposefully, willfully, and knowingly removing the stock “GME” from its trading platform in the midst of an unprecedented stock rise thereby deprived retail investors of the ability to invest in the open-market and manipulating the open-market.10

Other class action lawsuits followed. Although Robinhood was not the only online broker that removed the GameStop stock from its trading platform, what set Robinhood apart from other brokers that imposed similar restrictions were perceived Citadel-Robinhood and Melvin Capital-Citadel relationships.

Democracy or Not?

Ken Griffin founded both Citadel LLC and Citadel Securities in 1990 and 2001, respectively. Citadel LLC is a hedge fund and Citadel Securities, a subsidiary of Citadel LLC, is a market-maker. And the confusion came from there. Citadel Securities is Robinhood’s largest “payment for order flow” market-making partner, not Citadel LLC. Citadel LLC is the hedge fund that injected $2 billion into Melvin Capital.

Melvin Capital had been hard hit by a series of short bets even before the week of 25 January. This was why another hedge fund, Point72 Asset Management, added $750 million, and on 25 January, Citadel LLC and Point72 collectively injected $2.75 billion to Melvin Capital. This capital injection can hardly be a coincidence because Melvin Capital founder Gabriel Plotkin started his career at Citadel LLC and later worked for Steve Cohen who founded Point72 in 2014, not to mention that these three hedge funds had working relationships.

The Securities and Exchange Commission of the US defined the payment for order flows in 2000 as “a method of transferring some of the trading profits from market making to the brokers that route customer orders to specialists for execution,” and many brokerages had been using this method since 1999 to reduce commissions.11

When Robinhood disrupted the industry in 2015 by opting to rely only on payments for order flow to make money and eliminated the commissions, other brokerages followed, and a major consolidation in the industry started in early 2019.12 This consolidation has been going on since then. The top four brokerages—TD Ameritrade, Robinhood, E*Trade and Charles Schwab—have a collective market share of roughly 90% based on payment for order flow revenues. Further, all market-makers involved in the US retail stock-trading are invariably high-frequency trading (HFT) firms, and a major consolidation has been going on in the HFT industry also. Citadel Securities and Virtu Financial are the two largest market-makers in the US retail stock-trading with respective market shares of about 41% and 32%.13

What a great democracy! Both markets are heavily oligopolistic. There may be no-commissions but the oligopolistic rents the market-makers and brokers extract from the retail traders are huge. Bloomberg reports that Citadel Securities and Virtu Financial roughly doubled their revenues for 2020 respectively to $6.7 billion and $3.2 billion compared to those for 2019. And Yahoo! reports that the top four brokerages almost tripled revenues from payments for order flow to the total of about $2.5 billion in 2020 compared to those in 2019.

Is it not evident from this that Robinhood is not Robin Hood, but the Sheriff of Nottingham?

Congressional Hearing

On 28 January, the House Financial Services Committee of the US House of Representatives announced that it will hold a hearing investigating the r/wallstreetbets, GameStop, short squeeze. The remote hearing titled “Game Stopped? Who Wins and Loses When Short Sellers, Social Media, and Retail Investors Collide?” took place on 18 February. The committee invited the CEOs of Citadel, Melvin Capital, Reddit and Robinhood, as well as r/wallstreetbets user and investor Keith Gill who made millions of dollars from his trade. However, rather than questioning the skewed nature of financial markets towards finance capital, the committee grilled these individuals. The objective of the hearing was to look for ways to ensure that another GameStop will not happen so that the business can continue.

Who Won the Battle of GameStop?

There is no doubt, finance capital did not lose the battle of GameStop. The business is still as usual. But finance capital did not win the battle either. Because the attackers have brought into light that democracy in financial markets is just a myth. Whoever controls the valves, controls the flow.

Further, the attackers now have a better understanding of the plumbing of the stock market, and they do not seem to have given up. And what they do not know yet is that if they bring the entire financial system to collapse, as they came very close to, it will collapse on them also.

There is no doubt that an overwhelming majority of them were not against capitalism or the financial system. Almost all of them were profit seekers. However, it is evident from their exchanges on r/wallstreetbets and other platforms that many of them were motivated by ethical concerns as well. They truly wanted to punish the hedge funds.

While this was neither a revolutionary movement nor a reincarnation of Occupy Wall Street, it is still a novel form of collective action. And the youths of other countries are watching. If what has been going on after the week of 25 January is any indication, one can be certain that more battles will be fought.

Ahmet Öncü ([email protected]) is a professor at Sabancı Business School, Sabancı University, and T. Sabri Öncü ([email protected]) is an independent economist, both in İstanbul, Turkey.

Notes

1 https://www.theverge.com/tldr/22268952/gamestop-stock-stonks-reddit-wall….

2 https://robinhood.com/us/en/support/articles/our-mission/.

3 https://www.cnbc.com/2021/02/17/interactive-brokers-chairman-thomas-pete….

4 The assumption is that your delta is reasonable, which hardly ever is the case. If you change your model, not only delta but also gamma changes. However, this does not change the process.

5 Robinhood made the GameStop stock non-marginable on 27 January.

6 https://www.cnbc.com/2021/01/27/gamestop-speculation-is-danger-to-whole-….

7 Same as note 6.

8 Describing how the NSCC calculates this amount is beyond our scope. We only note that one major factor is the market volatility of the share prices in the submitted trades.

9 Robinhood raised $1 billion from existing investors a few hours after it halted purchases of GameStop and an additional $2.4 billion a few days later to meet the regulatory requirements.

10 https://thehill.com/policy/healthcare/536320-class-action-lawsuit-filed-….

11 https://www.sec.gov/news/studies/ordpay.htm.

12 https://finance.yahoo.com/news/payments-for-order-flow-exploded-in-2020-….

13 https://www.livemint.com/companies/news/gamestop-frenzy-puts-spotlight-o….