Over 30 years ago, Kunibert Raffer (University of Vienna) was first to propose a fair and transparent arbitration process between debtors and creditors for resolving sovereign insolvency, by analogy with Chapter 9 US Bankruptcy Code that provides for an orderly resolution in cases of municipal bankruptcy. (See his paper “What’s good for the United States must be good for the World – Advocating an International Chapter 9 Insolvency”). He is a long-standing critic of the IMF in its lending policies for low and middle income countries. In this present paper, looking at the most recent events in Argentina, he argues that the IMF’s and other public lenders’ (“public vultures”) practices are more rapacious and damaging than those of private sector creditors – who have in Argentina’s case now

Topics:

Kunibert Raffer considers the following as important: Argentina's Debt, Article, Long Read, sovereign debt

This could be interesting, too:

Jeremy Smith writes UK workers’ pay over 6 years – just about keeping up with inflation (but one sector does much better…)

T. Sabri Öncü writes Argentina’s Economic Shock Therapy: Assessing the Impact of Milei’s Austerity Policies and the Road Ahead

T. Sabri Öncü writes The Poverty of Neo-liberal Economics: Lessons from Türkiye’s ‘Unorthodox’ Central Banking Experiment

Ann Pettifor writes Global Economic Governance: What’s “Growth” Got to Do with It?

Over 30 years ago, Kunibert Raffer (University of Vienna) was first to propose a fair and transparent arbitration process between debtors and creditors for resolving sovereign insolvency, by analogy with Chapter 9 US Bankruptcy Code that provides for an orderly resolution in cases of municipal bankruptcy. (See his paper “What’s good for the United States must be good for the World – Advocating an International Chapter 9 Insolvency”). He is a long-standing critic of the IMF in its lending policies for low and middle income countries. In this present paper, looking at the most recent events in Argentina, he argues that the IMF’s and other public lenders’ (“public vultures”) practices are more rapacious and damaging than those of private sector creditors – who have in Argentina’s case now agrees to take into account the need to ensure resources for social and economic development. You can download the paper here in pdf format.

Lessons from Argentina[1]

Argentina’s recent debt problems have quite clearly highlighted the difference between private commercial and public lenders, or the market, and bureaucracies. Even though one must not overlook the behaviour of some few so-called vultures making it their business model to buy financially suffering debts on the cheap to demand full repayment plus interest, refusing to participate in any debt relief agreement, the official sector is worse than those “normal” vultures. Inappropriately stipulated contracts as well as a doubtful predilection for one jurisdiction had made this possible, as well as changes of law, in particular in one jurisdiction. Sometimes vultures had created great problems, but their business model has lost importance due to changes in contracts, sometimes also the law.

Most private lenders have been bona fide, though understandably not eager to lose money, nevertheless willing to help debtors by accepting haircuts. With the notable exceptions of HIPC and the MDRI, official lenders insist on repayment with interest, making borrowers even pay for damage done by lenders. This dichotomy became absolutely clear during Argentina’s recent debt troubles. Commercial landers may be no angels, but official creditors seem to be best characterised by a former IMF Managing Director describing his institution: “Many Argentinians see the IMF as the devil, and they are right.”[2] Who but the boss of the IMF should know how to describe his institution?

Both the central government struggling with creditors, including the IMF, a large creditor owed over roughly $45 billion, and provinces recently had talks and agreements with creditors. The best known case is the economically important province of Buenos Aires, which had struck a breakthrough deal after long-running talks with key creditors and postponing deadlines to restructure $7 billion of its international debt. When Golden Tree Asset Management finally joined, which controlled around half of all bonds, the deal was secured, even though several other creditors in the committee objected. The province followed the strategy of postponing the deadline in order to gain more creditor support. In early August the province announced that it would expect the launch of its $7 billion bond restructuring “shortly”. 98 per cent of the Province’s foreign creditors agreed to restructure – no doubt a success of patient but determined negotiations, but also a merit of bona fide commercial creditors willing to agree.

It should be added that several provinces, as well as the central government, had to restructure their debts.

What is pathbreaking and new, putting debt negotiations on a totally new level of respect for human rights and economic development, if followed by other sovereign debtors, is that the need to secure resources for social expenditures was stressed and demanded by debtors, and accepted by (private) creditors. Nota bene, we speak of private professional, not public creditors. For the latter human rights, human dignity and the Rule of Law remain what they have been over decades: a practical joke. This paper elaborates the difference between profit seeking (private) lenders – usually defending their claims tooth and claw, the legitimate right of bona fide creditors – and profiteering Paris Club members and International Financial Institutions (IFIs) at the outstanding example of the IMF. It compares what private creditors accepted with what official creditors keep demanding, even though they – in contrast to private creditors – usually influence or determine borrowers’ policies. Flops of IMF programmes are thus not entirely (if at all) due to borrower behaviour, but often rather flops caused by the IMF.

Restructuring the Province’s Foreign Debts

The Province of Buenos Aires started negotiations with holders of bonds in foreign currency on 6 April 2020. The provincial government clarified that its statement “was not an offer”, but “information on the outlines of the sustainability of public debt” which would be followed by “talks with bondholders”[3]. This move started negotiations lasting over one year.

The provincial government repeatedly pointed out that its debt problem resulted from the former Macri government, more specifically the policies of ex-governor Vidal. In a press conference on 30 August 2021, governor Kicillof summed up the result “today, we are solving the problem created by Maria Eugenia Vidal”.[4] Announcing the agreement with creditors, Governor Kicilloff stated that “Debts of the Province increased from 2016 to 2019 by some 68 per cent”.[5] Obviously, there is little if anything to show that could justify this steep increase. Proper borrowing usually can show values created by loans.

From the start the provincial government aimed at reconciling debt service – or a sustainable level of foreign debts – with the financial needs for economic and social development, including funds necessary for economic recovery.[6] Also, clarifying that the first proposal was not an offer but information underlines that the government has always wanted a process of negotiations with its foreign creditors, hoping that this would lead to a solution acceptable to and just for all. With 98 per cent acceptance, one cannot but call this a success.

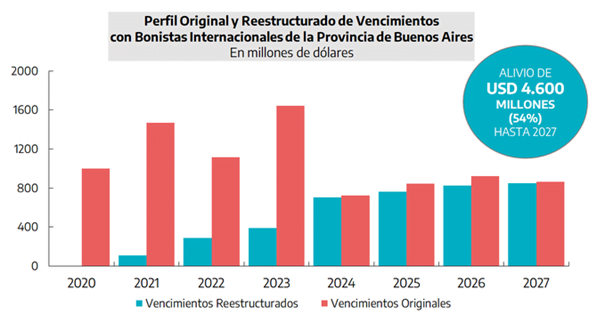

The provincial government was able to change the structure of debt service enormously, a relief of US$ 4.600 billion until 2027 according to government sources. The graph shows the original (orange) and the new debt service structure (turquoise) of the Province of Buenos Aires in billions of US$[7].

It is easy to see that restructuring was immensely helpful, reducing the immediate debt service burden enormously. Especially under present circumstances (COVID-caused economic problems) this is a great and necessary relief.

One notices that what Buenos Aires achieved is wholly similar to a corporation seeking insolvency protection. One first starts to explore whether an agreement with creditors is possible. Also, the negotiating process, including quite a few postponements of the deadline for acceptance, mirror debtor-creditor negotiations under insolvency law.

Parallels and Differences to Central Government Debt Negotiations

Very much like the provincial government of Buenos Aires the federal minister of finance, Guzmán, also emphasised that debts were “excessively onerous, considering the urgency of meeting critical social necessities”[8]. The Finance Minister underlined the necessity of “social inclusion”[9]. This is no different from what is usual practice within OECD countries, but denied to Southern people by these very countries gathering in Paris. Do as I say, not as I do.

The federal government, too, saw social problems as a major issue regarding debt service. Drawing attention to the well documented and steep increase of debts by the former government, money for which there is nothing to show, the Minister spoke of an economic crisis “in which a dramatic social situation” existed.

There are strong parallels regarding debt negotiations of Argentina’s central government with private creditors, who are often prepared to accept reality, unlike public creditors. The private sector finally agreed to what the Wall Street Journal [10] called “significant debt relief”. According to Guzmán, Argentina saved $ 37 billion[11] by sharply reduced interest rates, and longer maturities.

Naturally, negotiations on all debts were more complicated, involving the Paris Club, and multilaterals – mala fide creditors for short, or simply public vultures. Like with professional private vultures, their less considerate and uncooperative behaviour makes a new start more difficult or impossible. This is all the more unjustified as public creditors usually monitor if not determine the use of money. Public creditors often at least co-responsible for the crisis, make money from debtors dependent on them in various ways, reducing the payments bona fide private creditors can receive. Thus, they not only cause poor people in debtor countries to die, they also – economically speaking – wrongfully expropriate bona fide private creditors. They are much worse than private vultures.

The Paris Club’s behaviour in relation to Argentina is one outstanding example. Although demanding “comparable treatment” whenever in its self-interest, this Club of vultures refused to be treated according to its own demand by granting relief even faintly comparable to that accorded by private creditors. All Argentina got was a postponement linked to the condition that the country reach an agreement with the IMF. Apparently, there is quite a bit of solidarity among public vultures.

As agreed with the PVC (Paris or rather Public Vulture Club) the country will pay US$ 430 million in two instalments, extending the bulk of a USD2.4 billion payment. Technically this is helpful to Argentina, easing immediate stress, avoiding insolvency.

Tim Jones, Policy Officer at the Jubilee Debt Campaign, pointed out absolutely correctly already years ago: “Rich countries have condemned the profiteering of so-called vulture funds in debt crises around the world, but this is vulture-like behaviour from the Paris Club themselves. Trying to double their money from Argentina’s default after private lenders accepted a two-thirds write-down is extraordinary hypocrisy.”[12]

Jones pointed out that part of the amount then claimed by the UK was debt from loans to the military junta in the 1970s to buy military equipment (later used to attack the Falklands), including helicopters. Helicopters were used to lift victims of the junta into the sky to be thrown out above the Atlantic, usually after torturing the victims. Official Argentinian sources document this in great detail. Referring to the Tribunal Criminal Federal N° 2 de San Martín regarding the Batallón de Aviación 601, an official website writes “Death Flights, ‘One had to clean helicopters and there was blood on the floor’”[13]. Another source provides all details down to soldiers involved with their ranks and names, and types of helicopters used.[14] It would be interesting to investigate, whether any part, and if so, how much of the sums demanded by the PVC now is still blood money in Argentina or elsewhere, or has been so in the past.

It is hoped that colleagues are encouraged to search whether other demands for repayment with interest on products used for torture exist in Argentina and in other countries. It seems unfortunately likely that there might be quite a few cases.

Quite important, Argentina – both her federal government as well as the Province of Buenos Aires – presented arguments that have rarely if ever be brought forward in the past by public debtors. This mirrors decent insolvency laws obeyed and honoured by all bilateral official creditors within their own countries, but always denied to people in the South. Argentina has thus to be recommended for breaking a race ceiling, stating and demanding that her citizens are as much human beings as citizens in creditor countries. Regarding public vultures this is unheard of.

One must acknowledge that Argentina has moved quite a bit on the way to international justice, to equal treatment of people of whatever their nationality, race or colour, even if living in the South. This is very necessary, but extremely courageous, considering attitudes in the North.

Thus, finally, Argentinian public debtors, including on the national government level, have explicitly demanded taking social issues into account – a far cry from when public debt crises started. Unfortunately, there is a far cry still between legitimate demands and reality, as in particular the IMF’s actions in Argentina prove.

The IMF – an Outstanding Mala Fide Creditor

In March a staff-agreement was reached between the IMF and Argentina as requested by the PVC. In her letter of intent Argentina states “We intend to treat the IMF financing as budget support, specifically (i) to meet the outstanding obligations to the IMF arising from the 2018 SBA as they fall due”[15] – in other words: IMF flops once again created IMF income[16] rather than damage claims as they should under the Rule of Law and ethically.

Finally, the victim country requested confirmation “that, if at any time during the duration of the extended arrangement, the Fund were to create a new facility with better financial terms and for which Argentina were to be eligible, Argentina would have the opportunity to make use of the new facility, in accordance with IMF policies and procedures.”[17] Considering that the IMF had generously supported a government it liked, this falls quite short of legitimate and legally necessary damage compensation. In any normal case criminal charges would be made. Of course, the country cannot do more without risking reprisals by the Fund and its supporting PVC co-perpetrators. Civil society must do so. Making the IMF finally accountable for damages resulting in deaths caused unlawfully, in violation of its own statutes, even knowingly and in order to get more profit, will be a very difficult fight. NGOs and civil society do not seem to engage in it – they really should.

On 25 March 2022 the IMF’s Executive Board approved a 30-month US$44 billion extended arrangement under the Extended Fund Facility.[18] As required by domestic law, Argentina’s Congress had on this occasion approved the arrangement with the IMF on 18 March. Internal law has not always been respected by the IMF.

Stiglitz and Weisbrot consider the present agreement a positive change, because the Fund “has eschewed austerity.”[19] The authors even think that the “IMF will need to adopt similar changes to its policies elsewhere”. They point out that “The IMF made its largest loan ever to the Macri government in 2018, without even imposing conditions to prohibit the money from being used to finance capital outflows or service unsustainable debts to private creditors. What happened next was no surprise: capital flight, economic contraction, and soaring inflation, which reached 53.8% in 2019.” In other words, the IMF violated its own statutes gravely. Bohoslavsky and Zendejas[20] also hope that this IMF-agreement may offer information on what to do to other countries. This is quite likely to be a vain hope. As long as the IMF is allowed to profiteer on its own errors, knowingly and thus intentionally inflicted damages, and malpractice, things will not change for the better. Considering that the PVC has no problem cashing in on equipment used to torture and kill, even demanding interest, they will never make the IMF accountable. The IMF is not prepared to accept responsibility for damage done, as this would radically change its present business model.

It clearly shows in Argentina. The IMF financed once again capital flight, as its programmes usually have done. The IMF formulates “persistent exchange rate pressures arising from high FX debt rollover needs and capital flight in turn undermined monetary and fiscal adjustment”[21]. Or, “in the absence of policy alternatives (debt reprofiling and CFMs), the program ended up with a procyclical policy stance, arguably worsening capital flight rather than boosting confidence”.[22] In plain English: as the IMF facilitated capital flight, making things worse, while IMF prospects of more profits grew because of IMF dolus. Argentine authorities whose analysis is formally and officially part off the IMF’s EPE document find clearer words. “The Program achieved nothing for Argentina other than massively aggravating the balance of payment problem. Due to its front loaded nature, the US$44 billion effectively disbursed helped the Administration to sustain an open capital account during 2018 and most of 2019. By misusing IMF resources, the SBA allowed capital flight at convenient rates and the payment of unsustainable public debt, effectively postponing the adoption of capital controls and the debt restructuring process.”[23]

As habitual, the IMF’s predilection for open capital accounts led to catastrophic outflows illegitimately financed by the IMF. The Fund immediately found a culprit:” Government ownership was given high priority and, with that, potentially critical measures—notably a debt operation and reintroduction of capital flow management measures—were ruled out from the beginning.”[24] In contrast to all other cases, according to the IMF Argentina had the IMF under her thumb, not the usual way round. Whoever believes this surely also believes the earth to be flat.

According to the Banco Central de la República de Argentina[25] capital flight of over US$ 86 billions, facilitated after December 2015 created the conditions for a new debt crisis. This source spells out that this was due to a profound change of paradigm by Macri and the deregulation he enforced.

Article VI(1)(a) of the IMF’s statutes states that a “member may not use the Fund’s general resources to meet a large and sustained outflow of capital except as provided in Section 2 of this Article [referring exclusively to reserve tranche purchases], and the Fund may request a member to exercise controls to prevent such use of the general resources of the Fund”.[26] Its statutes command the IMF to do exactly the opposite of what it is doing. Naturally, obeying its own statutes (thus the Rule of Law) would mean less profits, but also less misery of the poor.

Also “accepting” a member’s wish for unrestricted capital movements (inverted commas because after studying the IMF over decades this author cannot believe that the Fund just gave in to Argentina), is an open violation of the IMF’s Statutes of Agreement. Pursuant to Art.VI(3) every member has the right to impose any capital controls, it may consider necessary, unless they restrict payments for current transactions. These norms clearly show that the IMF is not supposed to press for liberalisation of capital movements in the way it has actually done in order to bail out speculators or even creditors. It is prohibited from financing outflows saving speculators in Argentina and elsewhere.

Violating its statutory obligation to “to meet a large and sustained outflow of capital”, and saving speculators based in some member-countries is common IMF-practice. Conveniently, it makes new IMF-“help” necessary, meanwhile at usurious rates. A perfect business model if one ignores human rights and the Rule of Law. The IMF forced Asian countries having the right to control capital outflows to abstain from capital controls. Insisting on her membership right to capital controls, Malaysia was attacked severely. Grudgingly, the IMF finally had to admit that Malaysia had only exercised her membership right, successfully so.[27] Mechanisms to control speculation established under Bretton Woods, legally still in place, have been gravely and purposefully violated.

Not for the first time the IMF financed capital flight in Argentina. The Independent Evaluation Office’s (IEO) Report[28] found “intensified capital flight”[29] In a meeting of selected senior staff a “clear majority” concluded “the IMF might not be spared from blame in any case. The additional few billion dollars would not buy enough time to make a difference, but would be more likely to disappear in capital flight, leaving Argentina more indebted to the IMF.”[30] Also the IEO recommended other policies “Instead of financing capital flight and letting Argentina endure another six months of deflation and output loss”.[31] Of course the IMF did not change its business practices, which would have meant loosing unlawful and unethical profits. Thus it once again knowingly and intentionally inflicted damage on a member, profiteering from its own malpractice.

As many other members, Argentina has again to pay for the Fund’s malpractice, intentionally inflicting damages, knowing it would increase its profit doing so. Regarding austerity it remains to be seen what the IMF will be demanding once the focus of the international community will have shifted to other problems. Economically, the large amount of money owed to the IMF must finally be squeezed out of the poor, cutting subsidies anywhere but the IMF cafeteria in Washington. Unlike in a real Ponzi scheme, the IMF can wait for its pound of flesh to be enforced with interest.

The IEO Report 2004 regrets: “if the IMF had called an earlier halt to support for a strategy that, as implemented, was not sustainable and had pushed instead for an alternative approach”[32] the crisis would have been less pronounced. In other words, the strategy then lacked robustness very much as the latest IMF intervention in Argentina. But calling an earlier halt would also have meant less income.

Another finding of the 2004 IEO-Report fits the present strategy as well like a glove: “Given the probabilistic nature of any such decision, the chosen strategy may well have proved successful if the assumptions had turned out to be correct (which they were not).”[33] Not written by the IEO, the Ex-Post Evaluation (EPE) is less clear. Nevertheless, one headline calls the staff’s macroeconomic framework “subject to important caveats”[34]. The victim has to pay for these caveats. The IMF admits: “The Fund did not convey the extent and urgency of the fiscal consolidation required”.[35]

Once again there was a “fragility” of the Programme. The Financial Times quoted from an IMF document: “Ultimately, the programme’s strategy proved too fragile for the deep-seated structural challenges and the political realities of Argentina . . . as a result the programme did not succeed in improving confidence and delivering on its objectives.”[36]

The FT quotes “An internal IMF report by deputy director Odd Per Brekk published late on Wednesday said the Fund had accepted over-optimistic government projections when agreeing the programme.”[37] Even though the IMF has never accepted its members’ opinions nor allowed members to produce forecasts it would take into account, in contrast to a well-documented record of IMF-overoptimism, this is surprising considering that the “feasible macroeconomic framework … has not been agreed with the Argentine authorities.”[38]

According to the IMF itself its forecasts were once again “overly optimistic”[39] . This formulation is used roughly a dozen times in this document. The IMF has been “optimistic”, not caring about facts, which is easy if one’s own repayments can be and are enforced contrary to anyand even the most basic legal principles – and even easier if one’s malpractice just increases one’s profits.

While the IMF claims having accepted over-optimistic government projections when agreeing the programme, the macroeconomic framework was not agreed. Sounds like a sad practical joke all the more so as the Macri government’s structural reforms were described “as ‘unaspiring’ [sic] and fiscal consolidation as ‘low quality’”[40]. Apparently even a minimum of good governance is lacking at the IMF. As this increases the Fund’s income, this is of no concern to it.

This “optimism”, sometimes called “over-optimism” is not a singular case. The IMF’s Independent Evaluation Office[41] criticised in 2004 that “assumptions were overly optimistic”

Argentina is not the only victim member of an “optimistic” IMF- rightly so, considering its income – as many IMF documents prove over decades[42] this happened more than once. Thus the IMF’s recent failure in Argentina was not a singular and deplorable incident. Though it be madness, there is (profiteering) method in it.

There were once again “no contingency plans” incorporated in the programme early on.[43] This document quotes the IEO Report of 2004 that had stated that earlier arrangements with Argentina had lacked contingency plans, and “recommended that such plans be included … at the outset of any future programs.”[44] Although this recommendation has also been made in other IMF documents, not related to this case, as well as repeatedly for this programme, it was simply again ignored. The IMF admits: “The staff reports for the SBA request and each of the program reviews laid out risks associated with the program”. A scapegoat was quickly found: “but it proved difficult to engage the authorities in contingency planning.” All people working on the IMF are “aware” that the statement that the IMF is unable to overcome a member’s objection is not a highly credible explanation. Claiming the earth to be flat is much more credible.

The IMF has a long history of making errors that the poor (in this case in Argentina) have to pay for. Suffice one example. In its report on Argentina, the IMF’s Independent Evaluation Office (IEO) concluded: “The September 2001 augmentation suffered from a number of weaknesses in program design, which were evident at the time. If the debt were indeed unsustainable, as by then well recognized by IMF staff, the program offered no solution to that problem”[45]. Thus, the IMF knowingly aggravated the problem severely, profiteering from its own errors, assuming they were errors, and not intentional and deceitful profit seeking.

This is not all. An internal memorandum of 26 July 2001, clarified: “staff estimates that a haircut of between 15 and 40 per cent is required, depending on the policy choice.”[46]. The “‘program was also based on policies that were either known to be counterproductive … . . . or that had proved to be ‘ineffective and unsustainable everywhere they had been tried’….[A]s expressed by FAD [Fiscal Affairs Department] at the time.” Or: “‘Nor did the program address the now clear overvaluation of the exchange rate”[47]. The Board supported “a program that Directors viewed as deeply flawed”[48]. Economically there is an incentive to do so. According to its own documents,[49] the IMF knowingly damaged its member Argentina, as always especially affecting the poorest. The result: Argentina had to pay, the Fund profiteered once again.

While no equally frank IMF-document on the present crisis exists, bad expertise is once again at its root. Argentina’s Minister of Finance, M. Guzmán, declared quite frankly that “The majority of debt sustainability analyses by the IMF during the last decades were not impartial, not based on facts and solid theories”.[50] Why should they be? The IMF always gets its pound of flesh with interest, even more pounds if it has caused the crisis itself or has allowed drawings by politically suitable governments, knowing or having to know that this would cause or delay bankruptcy, and the suffering of the poor. It has financed human rights violating regimes. By being optimistic the Fund maximises income. Many Argentinians believe the Macri government to have been considered such a “suitable” government. Anyone but the IMF would suffer. The Fund has an economic interest in crises. This also showed some years ago, when the IMF did not have enough clients, which caused financial worries at the Fund, or in Asia, where the building up of the crisis was watched as one watches a movie[51]. IFIs obviously did watch without warning but rather encouraging their members to go on towards crisis. They profiteered immensely from this behaviour.

Now a major creditor in quite a few countries, the IMF has produced and worsened debt crises over many decades, always profiteering from its wrongdoing by violating its own statutes. The Fund charges an additional fee to cover losses, even though it has never had any nor is likely – if allowed by its main shareholders to go on – to have any. The Highly Indebted Countries Initiative (HIPC) and the Multilateral Debt Relief Initiative (MDRI) – where the IMF tried to cover its losses by additional funds from its main shareholders – are the big exceptions confirming the rule, These were due to civil society pressure. At Cologne, the G7 wanted to stop HIPC. Jubilee 2000 stopped that.

So-called “creditor countries” establishing a majority in 1945 have supported the breach of law and the contempt for human rights and human lives by the IMF and the IBRD, which calls itself World Bank, though actually this bank is controlled by very few countries, and the US President nominates the person to be “elected”. “Freely elected” heads of the IBRD depend on the goodwill of one person. Europeans determine who is heading the IMF, and they have appointed a number of people either facing public prosecutors or already convicted.

Practically since its founding the IMF has fought the intentions of its founders in order to profiteer from misery and death. The first victory was in 1969, when the Second Amendment passed. Before the Second Amendment, the IMF’s Articles of Agreement “contained a provision suggesting that others would have preference on the Fund”[52] Martha refers to Schedule B, paragraph 3 on the calculation of monetary reserves on which repurchase obligations were based. Thus payments to the IMF were no longer subordinated to those due to other creditors. Still, they were not given preferred status after or by virtue of this change.

Conditionality – originally absent – was introduced, paving the way for the Fund to become a development dictator. Appropriate changes regarding legal immunity stipulated when the IMF could not dictate policies, were understandably not made. Legal immunity was unfortunately (or by design) not abolished. Tenaciously the IMF worked on transforming itself to what it has become now, especially being totally unaccountable.[53] Its main bondholders, too occupied with preaching human rights saw no problems in IMF programmes killing – through their policies – children and poor people. Now the IMF violating its own statutes is rewarded, applauded by OECD governments.

The demand to protect human rights was first brought up at a Conference at the University of Zagreb in 1987[54]. Immediately ridiculed as impossible and pure phantasy, meanwhile the Bretton Woods Twins were forced by NGO-pressure to take social impacts into account, as documents on both HIPC-Initiatives and the MDRI (which was foisted on them by the G7 yielding to pressure by the Jubilee campaign) prove. Still not sufficiently so, but the principle is nevertheless recognized, though more in the breach than the observance.

Argentina has made an important contribution, declaring social protection important even for poor people in the South. She thus set a new landmark beyond which it seems difficult to return, unethical as public creditors might be. It would be great if Argentina were supported by civil society. Unfortunately, this is a big if.

IMF Surcharges: Taking Two Pounds of Flesh Instead of One

The really important coup happened in 1997. So-called surcharges were introduced, and usurious profiteering started. Surcharges are additional interest payments the IMF imposes on countries with large, outstanding debts to it. “Surcharges have become the IMF’s largest source of revenue and have added billions to the debt of states struggling to respond to Covid-19 pandemic.”[55] A trick that paid off. “These [surcharges] could reach as much as US$ 7.9 billion over” the period 2021-2028, when over 60 per cent of IMF income from these members would be the result of surcharges.[56] Economically understandably, “The Executive Board decided to lower the threshold for level-based surcharges from 300 percent of quota to 187.5 percent.”[57] In plain English this means even more profiteering by “surcharging” drawings not subject to surcharges before. One may expect further lowerings of thresholds resulting in even larger profiteering.

The IMF’s argument – if one did not shy away from calling a blatant untruth an argument – is that these surcharges would secure the existence of the IMF. This statement conveniently “forgets” facts. The IMF alone determines whether a member is allowed to draw. Thus, if the IMF actually decided on general economic principles –like private creditors rightly judging on their possibilities to create income unless they are sure to be bailed out – the IMF would be obliged to deny economically doubtful drawings. It is actually obliged to do so by its statutes, taking the members interest into account. It just does not do so in order to profiteer, in Argentina now, as once in Asia and elsewhere. Therefore, higher interest rates (surcharges) would be unheard of if the Fund obeyed its own constitution.

One has to qualify Kevin Gallagher’s verdict in the Financial Times “The IMF’s surcharges are unfit for purpose”[58] – right as it is in the way he argues. From the economically dubious point of view of ripping off debtor-members they do serve their purpose perfectly.

Valid arguments against these surcharges will not be taken into account. Honohan[59] or Stiglitz & Gallagher[60] arguing absolutely convincingly against this money making invention of the IMF: “They worsen potential outcomes for both the borrowing country and its investors, with gains accruing to the IMF at the expense of both. This transfer of resources to the IMF affects not just the level of poverty, health, education, and overall wellbeing in the country in crisis, but also its potential growth.” Right as they are, all this is irrelevant to an IMF only looking at its own profits. Arguments or ethics will go nowhere if addressing an institution which seems to accept death and penury if only profits increase.

IMF-surcharges must be abolished. Officially they act as disincentives to large drawings. It is the microeconomic argument that increasing prices reduces demand. Regarding the Fund it is utterly wrong. The Fund is not obliged to grant drawings amounting to a multiple of the quota – well above 1,000 % in Argentina’s case. The IMF still is – and clearly was before the era of profiteering – not supposed to make extra profits from members in grave difficulties. If drawings are unlikely to help, let alone make things worse, the IMF has the obligation not to grant them. On the other hand increasing surcharges with increasing drawings are highly lucrative, especially so as the normal economic disincentive to lose money if lending negligently or even while knowing that this would destroy the borrower does not apply to the IMF. Higher rates are thus no compensation for higher risk. As the IMF always gets paid with interest and surcharges – some HIPC cases excepted – bad programmes are lucrative for the Fund. They create additional income, increase the Fund’s importance and make new jobs necessary – a classic moral hazard situation. This logical mechanism might be described somewhat cynically as “IFI-flops securing IFI-jobs.”[61] It fosters lending without any regard for the real needs of debtors, even against members’ interest. It rewards knowingly inflicting damage on the poor.

Argentina undertook pioneering efforts to change this sick system. Bloomberg reported that Argentina had insisted on bringing up the surcharges problem at the G-20: the “G-20 draft has a sentence on a discussion on surcharges”.[62] Considering the reaction by Northern G-20 members, Bloomberg’s title seems unfortunately nearly as overoptimistic as IMF-programmes. But Argentina has stood up against injustice against all odds. The only debtor country so far. She must be strongly supported by civil society

This absurd incentive structure, irreconcilably inimical to the very idea of the market mechanism and to any principle of sound management, human rights or the Rule of Law, produces a systemic bias towards accommodating other goals. The present surcharge system is logically explained by the IMF’s attempts to increase its income, even while and because of damaging its clients.

Finally official creditors, including IFIs must be treated in the same way as commercial banks during an insolvency. Particularly so as they – in contrast to commercial banks – have routinely taken decisions as to how their loans were to be used. It is the most basic precondition for the functioning of the market mechanism that economic decisions must be accompanied by (co)responsibility: whoever takes entrepreneurial decisions must also carry entrepreneurial risks. If this link is severed – as it was in Centrally Planned Economies, even though non-economic consequences such as the gulag may have worked as a disincentive – Market efficiency is severely disturbed.

Just reading IMF documents gives support to the present Argentinian government’s accusation that this drawing was politically motivated – whatever it costs to its victims.

The Only Decent and Rule-of-Law Based Way Out in the Short Run

As the problem of debtor countries often boils down to IFIs violating their own constitutions, a way out is theoretically easy. Practically, however, it is not. Given the fact that lives and human rights of people in the South are of no concern to the IMF’s main shareholders – in their defence, Greek victims of austerity were equally of no concern – there is little chance that the majority of votes will be prepared to hold the Fund accountable.

Therefore there is only one way forward. One has to “sue” the IMF. The verb is in inverted commas because Art. IX.3 of the IMF’s Articles of Agreement seems to grant it total immunity “except to the extent that it expressly waives its immunity for the purpose of any proceedings or by the terms of any contract”. Obviously, this immunity is explained by the fact that conditionality was not originally foreseen. It would be difficult to perceive any need for legal procedures and redress in the case of an emergency helper, inconditionally giving relatively small amounts of money. Nevertheless, its founders did not wish to exclude proper legal dispute settlement totally, but inserted this option. Payments such as “criminal debts” (drawings routinely allowing dictators to embezzle funds, or drawings financing capital flight as in Argentina) might be one logically possible case in which waiving might have been seen as necessary. Evidently, its founders wanted to subject the Fund fully to the Rule of Law – in contrast to what rules nowadays.

The IMF may not only submit to arbitration or courts, but contractual clauses stipulating this are expressly allowed. Nothing in its statutes prevents the IMF from applying proper legal standards. On the contrary, the existence of this waiver may be seen as an encouragement to do so if and when appropriate. The IMF could be party in any insolvency court or insolvency proceeding by arbitration, as well as in any legal proceeding on its other failures. No right to preference of any kind exists in its statute (as in the IBRD’s). This has just been falsely claimed. The loan loss reserves the IMF has established – officially called precautionary reserves – allow haircuts from an economic point of view. These reserves have been paid for by its clients via higher spreads. But paid for relief is refused. There is no reason why these reserves should not be used for their unique purpose, to cover losses.

The problem is that so far no member has dared use the rights enshrined in the IMF’s statutes – quite similar to the International Bank for Reconstruction and Development, whose legal norms also offer relief.[63] However this has never been used by victims of the Bretton Woods Twins.

Argentina should ask the IMF to agree to arbitration on their politically motivated and failed programmes. The IMF, of course, may refuse, which would put it in a very delicate position, as all openly available evidence – including the IMF’s own documents – shows that the Fund is the main culprit, knowingly inflicting damages on one of its members it has the statutory obligation to protect. But for financial gain it does not do so. So, if it refused its loss of credibility would be large. But Argentina would illegally and illegitimately suffer even more.

If it is agreed, the outcome is clear. The Fund’s failures are so well documented that the result of any arbitration process – unless done by the PVC – is obvious. The only and real problem is to find a member willing to demand its membership right to ask the IMF to abide by its own statutes. But as with Mafia cases: people do not dare. No member of the IMF is willing to testify and to exercise their membership rights. Maybe, the Mafia can learn from the IMF.

Protecting human dignity and the poorest, civil society must demand that the IMF abide by its own constitution that in glaring contrast to IMF-practice protects the Rule of Law and human rights. Unfortunately, such legal issues have not gained NGO-attention so far.

A Rule of Law and Human Rights Based Long-Term Solution

As the record of attempts so far to solve the debt problem prove, a long-term solution to recurring debt crises can only be achieved by finally introducing the time tested and Rule-of-Law based solution that practically any civilised jurisdiction introduced long ago, and after testing alternatives from debt prisons to debt slavery (which is where Southern debtors are de facto till held): insolvency. In 1987 Raffer[64] proposed emulating the US Chapter 9, a special insolvency law for debtors with governmental power. This proposal fits sovereigns like a glove.

Section 904, Title 11 US Code states with outmost clarity that the court must not interfere with any of the debtor’s political and governmental powers, nor its property and revenues. Sovereignty does not protect more. The Raffer Proposal of an International Chapter 9 (called Fair Transparent Arbitration Process, FTAP, by the Jubilee movement) is thus easily applicable to countries.

As in any proper insolvency, impartial decision making is absolutely necessary. Raffer proposed independent arbitration. This is particularly inacceptable to public creditors used to be judge and party all in one while eagerly preaching the importance of the Rule of Law and human rights.

This Proposal also protects debtors and democracy. Human rights and human dignity enjoy inconditional priority, even though insolvency only deals with claims based on solid and proper legal foundations. Dubious and fraudulent claims are early on dismissed. All insolvency laws guarantee insolvent debtors humane standards of living (i.e. exempt resources to finance social minimum standards, e.g., by creating a Poverty Action Fund[65], and usually a “fresh start”, exempting resources that otherwise could be seized by bona fide creditors – in other words: Argentina’s demands , both by the provincial and the federal governments.

The population has a Right to be Heard. Affected people can oppose the solution. This democratic principle has been ridiculed by public vultures. In the US both the indebted municipality’s employees and tax payers expected to pay more have the opportunity to object. However, objecting to payments with interest for helicopters used to torture and kill people would be against the human rights obeying guidelines of the PVC. Credits have to be serviced, unlike them blood on the floor can be mopped away.

Finally, the fair and equal treatment of all creditors is demanded: IFIs and PVC-members are to lose the same amount as private creditors. This demand made in the 1980s would no longer be voiced by its author. Meanwhile public vultures should be treated differently, getting as appropriate less of their demands. As Argentina proves so convincingly once again, this is absolutely necessary. It is not only a matter of fairness to debtors as well as other non-public creditors, but unavoidable to get the market mechanism working again. Public vultures must be grounded. Debt reduction must discriminate between bona fide creditors and public vultures. The latter must be held financially accountable.

Recalling the objections against my proposal during the 80s, most forcefully made by IFI-staff, one notes significant, though still insufficient changes. After Krueger[66] called for an orderly framework, echoing Raffer,[67] the IMF immediately turned from a fierce enemy to an ardent advocate of sovereign insolvency, even though the proposed SDRM is no real insolvency procedure, but rather a trick to get new privileges for the IMF. Nevertheless, arbitration (though not on IMF claims) was proposed.

Verification,[68] previously often called impossible in discussions with IMF-staff, was eventually demanded by the IMF[69]. “Agreements between debtor and creditors would need the confirmation of the arbitrator,(s) in analogy to Section 943”.[70] Stays or standstills became all of a sudden quite possible, even though the IMF backtracked under criticism. Debt arbitration has become quite popular meanwhile. Creditors use ICSID and BITs to sue debtor nations. Only when it comes to fair and efficient solutions of sovereign debt distress, arbitration is shunned by the same governments eagerly pushing it anywhere else.

The first HIPC Initiative recognised debt relief by IFIs, however, in a too limited way, unduly favouring these public vultures. Nevertheless the “dam” broke. HIPC II already practices NGO-participation. Transparency and NGO-participation in debt issues are meanwhile facts.

Summing up: change is painfully slow and still insufficient by far, but it exists. More speed is urgently needed. Some features once ridiculed when proposed by Raffer in 1987 have become acceptable.[71] Change occurs, but more NGO-pressure is urgently needed.

Conclusion

In a very important move Argentina has paved the way for change. But this courageous act needs support. She needs support by civil society internationally. Anyone wishing for a just or just a better world order has to support her against those over-powerful and self-serving public vultures. Unfortunately, based on experience this author is highly sceptical whether such strong support to improve present relations will happen. He would be delighted if proved wrong on this occasion. Do not leave Argentina alone!

Footnotes

[1] I am grateful to Pedro Lopez for information kindly made available to me, to Jeremy Smith for his helpful comments, and to J.P. Bohoslavsky.

[2] Dominique Strauss-Khan, “Declaraciones del francés Dominique Strauss-Khan”, Clarín, June 9, 2007, https://www.clarin.com/ediciones-anteriores/argentinos-ven-fmi-diablo-razon_0_HJLxbp1yAFx.html

[3] “Deuda: Axel Kicillof informó a los bonistas sus lineamientos“, infocielo, 28 August 2021, https://infocielo.com/axel-kicillof/deuda-axel-kicillof-informo-los-bonistas-sus-lineamientos-n116755

[4] El Economista, 30 August 2021, https://eleconomista.com.ar/2021-08-anuncio-de-kicillof-buenos-aires-logro-aval-para-canjear-su-deuda/

[5] Pagina 12, 31 August 2021, https://www.pagina12.com.ar/364920-kicillof-desactivo-la-bomba-que-dejo-vidal

[6] cf. the statement by Finance Minister Pedro Lopez, Gobierno de la Provincia Buenos Aires, “Reestructuración de la Deuda”, 30 August 2021, https://www.gba.gob.ar/comunicacion_publica/gacetillas/la_provincia_alcanz%C3%B3_el_nivel_de_aceptaci%C3%B3n_para_canjear_el_98_de_la

[7] Graphic from https://twitter.com/PabloJ_LopezOK/status/1432402242825510919?s=08

[8] Martin Guzmán, “Nuestra estrategia apunta a poner a la deuda argentina en un sendero sostenible”, https://www.argentina.gob.ar/noticias/martin-guzman-nuestra-estrategia-apunta-poner-la-deuda-argentina-en-un-sendero-sostenible

[9] Martin Guzmán, “Nuestro Gobierno jamás hubiese acudido al FMI”, https://eleconomista.com.ar/economia/martin-guzman-nuestro-gobierno-jamas-hubiese-acudido-fmi-n44876

[10] WSJ, “Argentina Agrees Restructuring Deal With Bondholders” (by Ryan Dube and Andrew Scurria) Aug. 4, 2020, https://www.wsj.com/articles/argentina-nears-65-billion-restructuring-deal-with-bondholders-11596502192

[11] El País, “Argentina logra reestructurar el 99% de su deuda bajo legislación extranjera” (by Enric González) 1 sept 2020, https://elpais.com/economia/2020-08-31/argentina-logra-reestructurar-el-99-de-su-deuda-bajo-legislacion-extranjera.html

[12] Jubilee Debt Campaign, “Unfair debt deal agreed for Argentina”, 30 May 2014, https://jubileedebt.org.uk/news/unfair-debt-deal-agreed-argentina

[13] “Vuelos de la Muerte: ‘Hubo que limpiar el helicóptero y había sangre en el piso’”, https://www.gba.gob.ar/derechoshumanos/juicios_lesa_humanidad/vuelos_de_la_muerte_hubo_que_limpiar_el_helic%C3%B3ptero_y_hab%C3%ADa

[14] Ministerio de le Defensa, Presidencia de la Nación, “Relevamiento y Análisis Documental de los Archivos de las Fuerzas Armadas 1976-1983”, no year, https://www.argentina.gob.ar/sites/default/files/publicacion-investigacion-15-12-10_0.pdf Helicopter types named are produced in PVC-members.

[15] Argentina, “Letter of Intent”, March 3, 2022; https://www.imf.org/en/Countries/ARG

[16] cf .the formulation “IMF flops securing IMF jobs” by Kunibert Raffer, “International Financial Institutions and Accountability: The Need for Drastic Change”, in: S.M. Murshed & K. Raffer (eds) Trade, Transfers, and Development, Problems and Prospects for the Twenty First Century, Elgar, Aldershot 1993, p. 158

[17] Argentina, „Letter of Intent“

[18] IMF 2022, „IMF Executive Board Approves 30-month US$44 billion Extended Arrangement for Argentina and Concludes 2022 Article IV Consultation,” https://www.imf.org/en/countries/arg?selectedfilters=Article%20IV%20Staff%20Reports#

[19] Joseph Stiglitz & Mark Weisbrot (2022), “The IMF’s Agreement with Argentina Could Prove a Game-Changer”, Project Syndicate, https://www.project-syndicate.org/commentary/imf-argentina-agreement-growth-instead-of-austerity-by-joseph-e-stiglitz-and-mark-weisbrot-2-2022-03

[20] JP Bohoslavsky & JF Zendejas, “FMI, Argentina y el mundo. La historia no está escrita en una piedra”, https://www.revistaanfibia.com/la-historia-no-esta-escrita-en-una-piedra/

[21] IMF, Argentina, “Ex-Post Evaluation of Exceptional Access under the 2018 Stand-by-Agreement, Press release and Staff Report, IMF Country Report no 21/279, December 2021”,(below: EPE) p.14. https://docs.publicnow.com/1A6900CBD1C7B438AFD6D3911A8843A7A42097B

[22] ibid., p.62; CFMs: Capital Flow Management Measures

[23] ibid., p.103

[24] ibid., p.1. Regarding the IMF’s insistence on free capital flows during the Asian Crisis v. Kunibert Raffer & HW Singer, The Economic North-South Divide: Six Decades of Unequal Development, Elgar, Cheltenham (UK)/ Northampton (US) 2001 [Paperback: 2002, second printing 2004] in particular pp.156ff.

[25] “Mercado de cambios, deuda y formación de activos externos 2015-2019” http://www.bcra.gov.ar/PublicacionesEstadisticas/Informe-mercado-cambios-deuda-formacion-activos-externos-2015-2019.asp

[26] cf. Kunibert Raffer, Debt Management for Development, Protection of the Poor and the Millennium Development Goals, Elgar, Cheltenham (UK)/ Northampton (US) 2010 [paperback 2011], pp.34f

[27] Raffer and Singer 2001, p.157

[28] IMF, IEO 2004, p.6

[29] ibid., p.13

[30] ibid., p.53

[31] ibid., p.68

[32] IMF (IEO) 2004, p.3

[33] ibid., p.5.

[34] IMF “Argentina: Technical Assistance Report- Staff Technical Note on Public Debt Sustainability”, IMF Country Report No. 20/83, 2020, https://www.imf.org/en/Publications/CR/Issues/2020/03/20/Argentina-Technical-Assistance-Report-Staff-Technical-Note-on-Public-Debt-Sustainability-49284, p.4.

[35] IMF, EPE, p.86

[36] Financial Times, “IMF says Argentina bailout programme was ‘too fragile’ to succeed”, (by Michael Stott) December 23, 2021

[37] ibid.

[38] IMF, Country Report No. 20/83, p.5

[39] IMF, EPE, p.2.

[40] FT, Dec 23, 2021

[41] IMF (Independent Evaluation Office). 2004. Report on the Evaluation of the Role of the IMF in Argentina, 1991–2001, p.44; at http://www.imf.org/external/np/ieo/2004/arg/eng/pdf/report.pdf

[42] For a brief overview of indestructible IMF-optimism over decades cf. Raffer, 2010; Chapter 12: “Problems of overoptimism and ownership”, pp. 204ff. Other examples of glaring IFI-“optimism” are found in many parts of this book.

[43] IMF, EPE 2020, p. 14

[44] ibid., p.15, Footnote 8 helpfully informs “This was also a recommendation in a 2003 IMF Independent Evaluation Office report on the role of the IMF in capital account crises.“

[45] IMF, IEO , pp.54f

[46] ibid., p.90, fn 95

[47] ibid, p. 55

[48] ibid., p.50

[49] IMF (2004) Report on the Evaluation of the Role of the IMF in Argentina, 1991–2001, Independent Evaluation Office. http://www.imf.org/external/np/ieo/2004/arg/eng/pdf/report.pdf

[50] “Las 5 frases clave de Martín Guzmán sobre la deuda argentina con el FMI”, 6 de octubre, 2021, https://www.bloomberglinea.com.mx/2021/10/06/las-5-frases-clave-de-martin-guzman-sobre-la-deuda-argentina-con-el-fmi/

[51] For proves v. Raffer & Singer 2001, p.151

[52] Rutsel S. J. Martha, 1990. “‘Preferred Creditor Status under International Law: The Case of the International Monetary Fund”’, International and Comparative Law Quarterly 39, no. 4, p. 825.

[53] On IFI damages done to “member” countries and the way this resulted in rewards to the malfeasants v. Kunibert Raffer, 1993, pp.151-166, also K Raffer & HW Singer,2001, pp.246f.

[54] Kunibert Raffer, “International Debts: A Crisis for Whom?” in: H.W. Singer & S. Sharma (eds) Economic Development and World Debt, Macmillan/ St. Martin’s, London & Basingstoke/ New York, 1989, pp. 51-63. The usually quoted locus classicus is K Raffer, “Applying Chapter 9 Insolvency to International Debts: An Economically Efficient Solution with a Human Face”, World Development, vol.18(2), pp. 301-313. The last updated version published is “Debts, Human Rights, and the Rule of Law: Advocating a Fair and Efficient Sovereign Insolvency Model”, in: Martin Guzman, José Antonio Ocampo, Joseph E. Stiglitz (eds) Too Little, Too Late, The Quest to Resolve Sovereign Debt Crises, Columbia University Press, New York 2016, pp.253-269; Pre-publication paper at http://policydialogue.org/files/publications/Debts_Human_Rights_and_the_Rule_of_Law_Advocating_a_Fair_and_Efficient_Sovereign_Insolvency_Model.pdf

[55] “CSPF: IMF surcharges: A necessary tool or counter-productive obstacle to a just and green recovery?, Oct 05, 2021, https://www.imfconnect.org/content/imf/en/annual-meetings/calendar/open/2021/10/05/1608421.html?calendarCategory=T2ZmaWNpYWwvQnkgSW52aXRhdGlvbg==.UHJlc3M=.V29ybGQgQmFuaw==.T3Blbg==

[56] Daniel Munevar, “A guide to IMF surcharges”, Eurodad 2021, https://www.eurodad.org/a_guide_to_imf_surcharges

[57] IMF, “Press Release: IMF Executive Board Reviews Access Limits, Surcharge Policies, and Other Quota-Related Policies”, Press Release No. 16/166, April 11, 2016 https://www.imf.org/en/News/Articles/2015/09/14/01/49/pr16166

[58] Kevin P. Gallagher, “The IMF’s surcharges are unfit for purpose”, March 3 2021, https://www.ft.com/content/cc82f5bf-36c6-454f-b7f0-a4a18576ff2b

[59] Patrick Honohan, “The IMF should suspend interest rate surcharges on debt-burdened countries”, PIEE 2022, https://www.piie.com/blogs/realtime-economic-issues-watch/imf-should-suspend-interest-rate-surcharges-debt-burdened?utm_source=emailmarketing&utm_medium=email&utm_campaign=bretton_woods_news_lens_3_february_2022&utm_content=2022-03-15

[60] J. Stiglitz & Kevin P. Gallagher, “IMF surcharges: A lose-lose policy for global recovery”, 2022, https://voxeu.org/article/imf-surcharges-lose-lose-policy-global-recovery

[61] Kunibert Raffer 1993, p.158, or at http://homepage.univie.ac.at/kunibert.raffer/ifiacc.pdf; cf. also Kunibert Raffer & HW Singer (1996; paperback: 1997) The Foreign Aid Business: Economic Assistance and Development Co-operation , Elgar, Cheltenham (UK)/Brookfield (US), pp.199ff

[62] Patrick Gillespie & Samy Adghirni “In Win for Argentina, G-20 Statement Mentions IMF Surcharges”, 30 October 2021, https://www.bloomberg.com/news/articles/2021-10-30/in-a-win-for-argentina-g-20-statement-to-mention-imf-surcharges

[63] cf. Kunibert Raffer, “Preferred or Not Preferred: Thoughts on Priority Structures of Creditors”, Paper prepared for the Meeting of the ILA [International Law Association] Sovereign Insolvency Study Group in Washington DC, 16 October 2009, https://homepage.univie.ac.at/kunibert.raffer/net.html; or Raffer 2010, pp.99f

[64] Raffer 1987; for details on the Raffer Proposal v. Kunibert Raffer (2005) “Internationalizing US Municipal Insolvency: A Fair, Equitable, and Efficient Way to Overcome a Debt Overhang’, Chicago Journal of International Law 6(1), pp.361-380, or Raffer 2016

[65] Similar to or as it was proposed by Ann Pettifor, “Concordats for debt cancellation, a contribution to the debate”, Jubilee2000 Coalition UK, (18 March 1999) mimeo

[66] Anne Krueger, “International Financial Architecture for 2002: A New Approach to Sovereign Debt Restructuring”, 2001, http://www.imf.org/external/np/speeches/2001/112601.htm On this proposal of an SDRM, understood as Simply Disastrous Debt Management by this author see Kunibert Raffer, “The Final Demise of Unfair Debtor Discrimination? – Comments on Ms Krueger’s Speeches”, Paper prepared for the G-24 Liaison Office to be distributed to the IMF’s Executive Directors representing Developing Countries https://homepage.univie.ac.at/kunibert.raffer/net.html

[67] This idea was first proposed by Raffer 1989, cf. also Raffer 1990

[68] Raffer 1990, p.309

[69] e.g., IMF 2002, p.68

[70] Raffer 1990, p.305; similarly Ann Krueger (2002) “Sovereign Debt Restructuring and Dispute Resolution”, http://www.imf.org/external/np/speeches/2002/060602.htm, p.7

[71] For more details on this evolution v. Raffer 1990, 2016