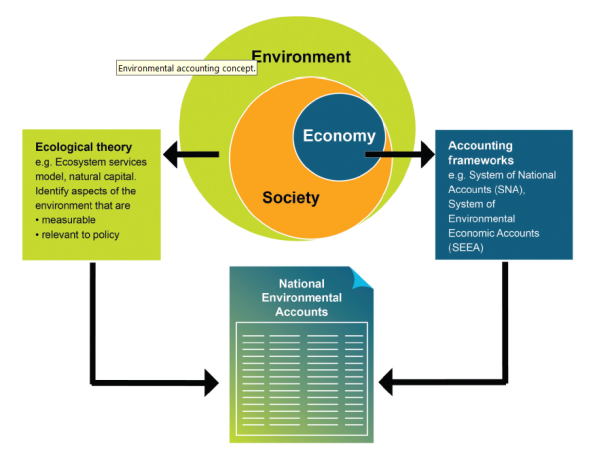

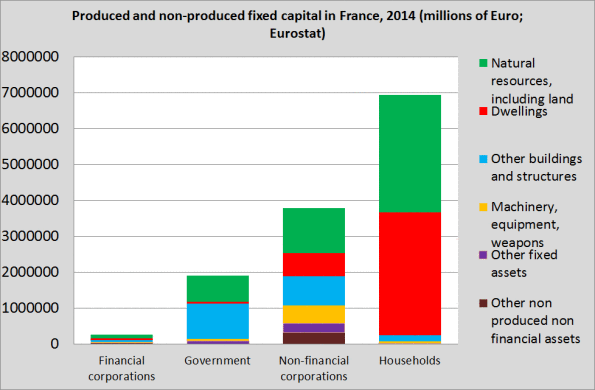

1) What is capital? The national accounts define capital as a monetary variable. Many people however also talk about ‘natural capital’, ‘The stock of living and non-living components of the earth that provide a flow of valuable ecosystem goods or services‘. That’s from the Australian Bureau of Meteorology, which has issued a very good report ‘The environmental accounts landscape‘. They may underestimate the extent to which laws and regulations shape ‘capital’. But here’s an interesting graph from the report: 2. And here a graph of economic capital in France. Note the preponderance of households, dwellings and land (mainly land underlying dwellings): capital is not what you think it is. 3. Imagine there’s no capital. And no debts, too. A farmer who makes plans – without taking regard of the stock of cattle or the land he owns or rents. That is what many (not all) neoclassical macro-models assume. It is fun when neoclassical economists introduce capital in the models: you get a class of capital owners (called ‘entrepreneurs’, but one might also call them: ‘capitalists’) and a class of households who have nothing to sell but their labour… (sounds familiar), as in this ECB report.

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

1) What is capital? The national accounts define capital as a monetary variable. Many people however also talk about ‘natural capital’, ‘The stock of living and non-living components of the earth that provide a flow of valuable ecosystem goods or services‘. That’s from the Australian Bureau of Meteorology, which has issued a very good report ‘The environmental accounts landscape‘. They may underestimate the extent to which laws and regulations shape ‘capital’. But here’s an interesting graph from the report:

2. And here a graph of economic capital in France. Note the preponderance of households, dwellings and land (mainly land underlying dwellings): capital is not what you think it is.

3. Imagine there’s no capital. And no debts, too. A farmer who makes plans – without taking regard of the stock of cattle or the land he owns or rents. That is what many (not all) neoclassical macro-models assume. It is fun when neoclassical economists introduce capital in the models: you get a class of capital owners (called ‘entrepreneurs’, but one might also call them: ‘capitalists’) and a class of households who have nothing to sell but their labour… (sounds familiar), as in this ECB report. Also, from the Stackexchange site (where economists can pose questions to other economists, the answer is much longer and sophisticated than just this excerpt):

Question: In New Keynesian models, like the ones in Gali’s simple New Keynesian model or even Mankiw-Reis NK model on sticky information, capital is often not included. Now people do say that there are modeling difficulties and that’s why capital (K) is not included, but is there another justifiable reason other than modeling difficulties?

Answer: Capital is included in all the big estimated New Keynesian models (Smets-Wouters, Christiano-Eichenbaum-Evans), etc. But you’re absolutely right that the stylized core NK model does not have capital – which is hard to defend on empirical grounds, since capital investment is a very important part of business cycle fluctuations and the response to monetary policy. Ultimately, the reason does basically boil down to the “modeling difficulties” that you mention. First, there is an obvious way in which capital makes the NK model more complicated: at an absolute minimum, it introduces at least one additional backward-looking state variable. In contrast, the two core equations (the intertemporal Euler equation and New Keynesian Phillips curve) of the ordinary log-linearized NK model are completely forward-looking. Adding capital to the mix eliminates this nice analytical feature.