From David Ruccio The problem of the growing gap between the small group of haves and all other Americans is (as I noted a week ago) so bad even the International Monetary Fund is sounding the alarm. Despite the ongoing expansion, the U.S. faces a confluence of forces that will weigh on the prospects for continued gains in economic well being. A rising share of the U.S. labor force is shifting into retirement, basic infrastructure is crumbling, productivity gains are scanty, and labor markets and businesses appear less adept at reallocating human and physical capital. These growing headwinds are overlaid by pernicious secular trends in income: labor’s share of income is around 5 percent lower today than it was 15 years ago, the middle class has shrunk to its smallest size in the last 30 years, the income and wealth distribution are increasingly polarized, and poverty has risen. So, what’s going on? According to new research by the IMF, the United States is suffering from both increasing inequality and increasing polarization.

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

The problem of the growing gap between the small group of haves and all other Americans is (as I noted a week ago) so bad even the International Monetary Fund is sounding the alarm.

Despite the ongoing expansion, the U.S. faces a confluence of forces that will weigh on the prospects for continued gains in economic well being. A rising share of the U.S. labor force is shifting into retirement, basic infrastructure is crumbling, productivity gains are scanty, and labor markets and businesses appear less adept at reallocating human and physical capital. These growing headwinds are overlaid by pernicious secular trends in income: labor’s share of income is around 5 percent lower today than it was 15 years ago, the middle class has shrunk to its smallest size in the last 30 years, the income and wealth distribution are increasingly polarized, and poverty has risen.

So, what’s going on? According to new research by the IMF, the United States is suffering from both increasing inequality and increasing polarization.

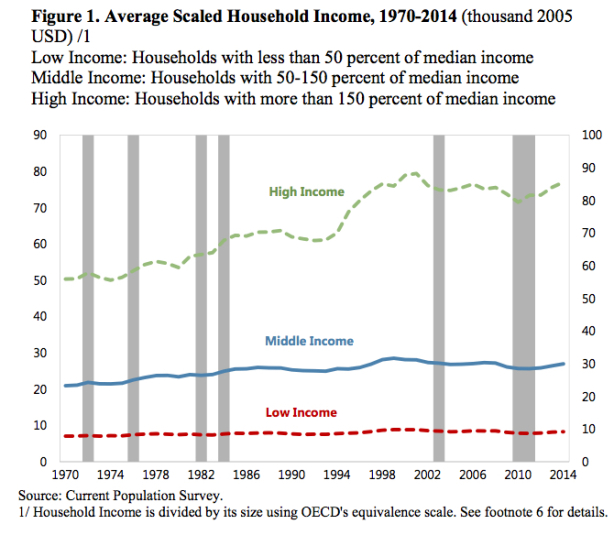

Inequality refers to the evolution of incomes (such as in Figure 1), revealing the fact that, since the 1970s, the real incomes of households in the low- to middle-income brackets have mostly stagnated, while real incomes of households in the highest brackets rose sharply (at least during the 1970–2000 period, though they have not changed considerably since 2000).

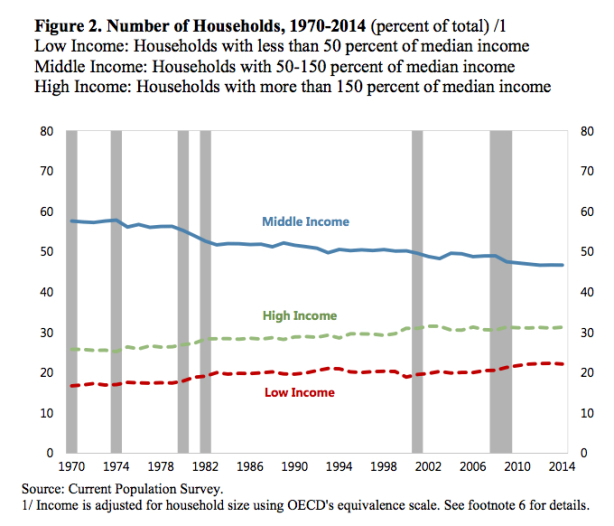

Polarization refers to something slightly different: the distributional changes of the households across different income brackets. Thus, for example (as in Figure 2), we can see that the population share of households whose incomes are within 50 to 150 percent of the median income—a proxy for the middle-class—has shrunk from about 58 percent of total in 1970 to 47 percent in 2014. This is the often-cited “hollowing out” of the middle-class.*

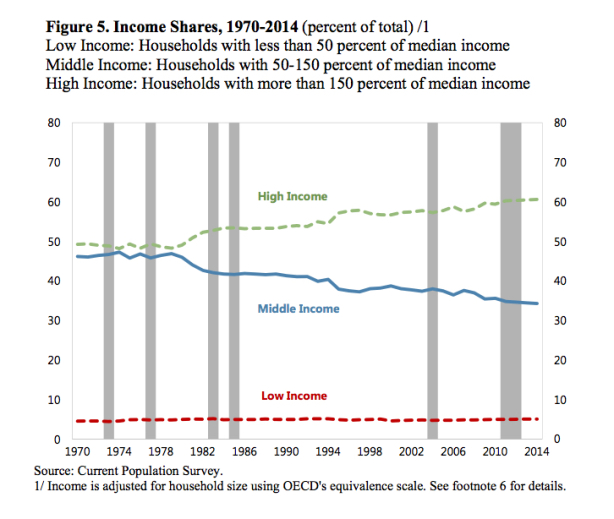

If we put them together, inequality and polarization, we end up with the chart at the top of this post (Figure 5). It shows that the income shares of the middle- and high-income classes were broadly similar, at levels slightly shy of 50 percent of total income, in the late 1970s. Since then, however, these shares have been diverging. Currently, the high-income class holds about 60 percent of total income, while the share of the middle-income class has fallen to only about 35 percent. The income share of the low-income class has been stable at about 5 percent of total for the entire sample of 1970 to 2014.

Clearly, the IMF is much more concerned about polarization (which focuses attention on the decline of the middle-class, especially the fall into the low-income class since 2000) than inequality (which highlights the runaway fortunes of those at the very top from the 1970s onward).

In my view, both inequality and polarization are important, since they are consequences of the same phenomenon: the accumulation of capital, that has worsened the lot of most workers (both middle- and low-income, and even many in the high-income bracket), and allowed a small group at the top (the uppermost portion of high-income earners) to capture a share of the increasing returns to capital.

The question right now is, has the combination of inequality and polarization become so extreme that it threatens the very survival of capitalism? The answer from the IMF is pretty clear:

If left unchecked, these forces will continue to drag down both potential and actual growth, diminish gains in living standards, and worsen poverty.

*The IMF divides this polarization into two periods: one (from 1970 to 2000), “when more of the middle-income households moved into high- rather than low-income ranks,” and the other (since 2000), during which “only a quarter of one percent of households have moved up to high income ranks, compared to an astonishing 3 1⁄4 percent of households who have moved down the income ladder (from middle to low income ranks).”