From David Ruccio While Wells Fargo (whose CEO blamed employees for his bank’s failings) has put traditional banks in the news lately, the resurgence of the so-called shadow banking sector has largely gone unnoticed. Until now. The Dallas Fed (pdf) has issued an alarming report concerning the growth of financial activities that, while connected to traditional banks, remains largely unregulated—even under Dodd-Frank. “Shadow banking,” an almost sinister-sounding term that originated in 2007, describes large banks’ practice of constructing off-balance-sheet legal entities to circumvent regulatory oversight. These operations initially traded in instruments that repackaged bank-issued loans as bonds, selling them to investors. Shadow banking has since become a catchall for financial markets and intermediaries that perform bank-like activities—transforming the maturity, liquidity or credit quality of capital. True to the term’s origins, shadow banking remains lightly regulated, potentially harboring unique risks without the oversight and deposit insurance offered to more traditional counterparts.

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

While Wells Fargo (whose CEO blamed employees for his bank’s failings) has put traditional banks in the news lately, the resurgence of the so-called shadow banking sector has largely gone unnoticed.

Until now.

The Dallas Fed (pdf) has issued an alarming report concerning the growth of financial activities that, while connected to traditional banks, remains largely unregulated—even under Dodd-Frank.

“Shadow banking,” an almost sinister-sounding term that originated in 2007, describes large banks’ practice of constructing off-balance-sheet legal entities to circumvent regulatory oversight. These operations initially traded in instruments that repackaged bank-issued loans as bonds, selling them to investors.

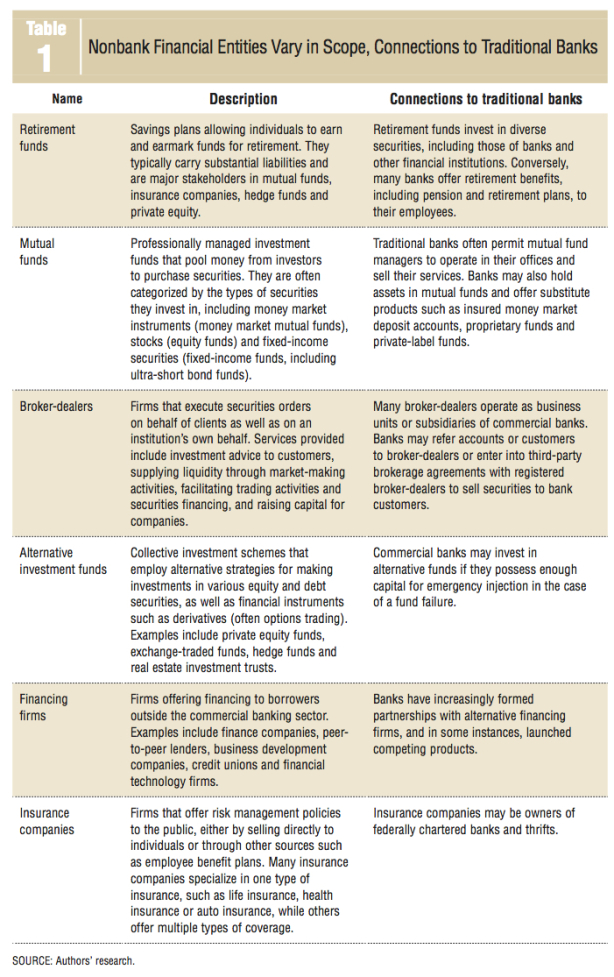

Shadow banking has since become a catchall for financial markets and intermediaries that perform bank-like activities—transforming the maturity, liquidity or credit quality of capital. True to the term’s origins, shadow banking remains lightly regulated, potentially harboring unique risks without the oversight and deposit insurance offered to more traditional counterparts.

The risk arises, not only from the size of shadow-banking activities, but also because of the “intricate and inextricable links to its regulated peers through lines of credit, derivatives, insurance, coinvestments, securitization and securities clearing, wealth management, counterparty arrangements and other bilateral services” and the fact that, given the multiple links before banks and nonbank intermediaries, a collapse in shadow banking can spread throughout the rest of the banking sector.

That’s exactly what happened in 2007-08.

Some nonbank intermediaries (such as money market mutual funds and securitization vehicles) were highly leveraged or had large holdings of illiquid assets and proved vulnerable to runs when investors withdrew large sums on short notice.

The forced sell-off led to fire sales of assets, reducing their value and propagating the stress onto traditional banks. Banks, facing their own financial difficulties and fearing heightened economic risk, tightened lending standards across the board, potentially impacting otherwise creditworthy borrowers and leading to a broad economic slowdown.

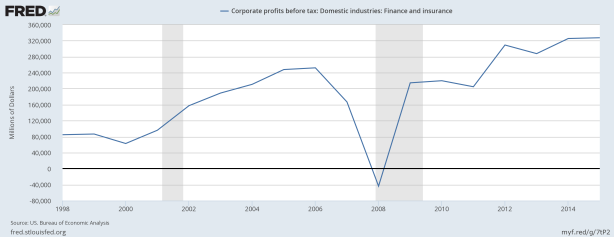

Clearly, Federal Reserve and taxpayer-financed bailouts worked for the financial sector—as profits quickly rebounded and have continued to soar since 2008. But the search for additional financial profits has recreated some of the same systemic risks that, just eight years ago, shook the world economy and took it to the brink of disaster.

Once again, the shadows of the financial institutions continue to lengthen.