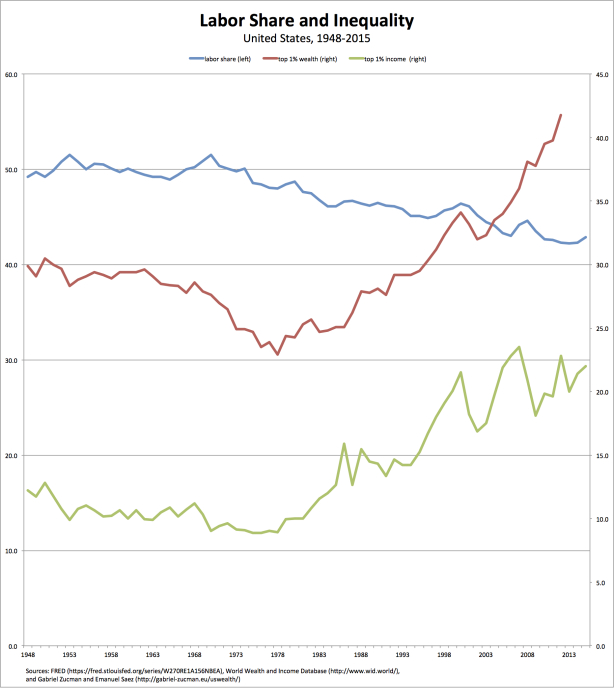

From David Ruccio For decades now, the labor share of U.S. national income (the blue line measured on the left-hand vertical axis in the chart above) has steadily declined, while the shares of income and wealth captured by the top 1 percent (the red and green lines on the right-hand axis) has increased. And in recent years, even as employment has mostly recovered from the Second Great Depression, the wages paid to the majority of workers have continued to stagnate (even while incomes of workers at the very top, especially CEOs and other corporate executives, have risen). Might it be the case that employers are conspiring to keep workers’ wages down? The idea that employers often try and ultimately succeed in keeping workers’ wages lower than they otherwise would be has been recognized seen at least the end of the eighteenth century—an observation made by none other than Adam Smith: What are the common wages of labour, depends every where upon the contract usually made between those two parties, whose interests are by no means the same. The workmen desire to get as much, the masters to give as little as possible. The former are disposed to combine in order to raise, the latter in order to lower the wages of labour.

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

For decades now, the labor share of U.S. national income (the blue line measured on the left-hand vertical axis in the chart above) has steadily declined, while the shares of income and wealth captured by the top 1 percent (the red and green lines on the right-hand axis) has increased. And in recent years, even as employment has mostly recovered from the Second Great Depression, the wages paid to the majority of workers have continued to stagnate (even while incomes of workers at the very top, especially CEOs and other corporate executives, have risen).

Might it be the case that employers are conspiring to keep workers’ wages down?

The idea that employers often try and ultimately succeed in keeping workers’ wages lower than they otherwise would be has been recognized seen at least the end of the eighteenth century—an observation made by none other than Adam Smith:

What are the common wages of labour, depends every where upon the contract usually made between those two parties, whose interests are by no means the same. The workmen desire to get as much, the masters to give as little as possible. The former are disposed to combine in order to raise, the latter in order to lower the wages of labour.

It is not, however, difficult to foresee which of the two parties must, upon all ordinary occasions, have the advantage in the dispute, and force the other into a compliance with their terms. The masters, being fewer in number, can combine much more easily; and the law, besides, authorises, or at least does not prohibit their combinations, while it prohibits those of the workmen. We have no acts of parliament against combining to lower the price of work; but many against combining to raise it. In all such disputes the masters can hold out much longer. . .

We rarely hear, it has been said, of the combinations of masters, though frequently of those of workmen. But whoever imagines, upon this account, that masters rarely combine, is as ignorant of the world as of the subject. Masters are always and every where in a sort of tacit, but constant and uniform combination, not to raise the wages of labour above their actual rate. To violate this combination is every where a most unpopular action, and a sort of reproach to a master among his neighbours and equals. We seldom, indeed, hear of this combination, because it is the usual, and one may say, the natural state of things which nobody ever hears of. Masters too sometimes enter into particular combinations to sink the wages of labour even below this rate. These are always conducted with the utmost silence and secrecy, till the moment of execution, and when the workmen yield, as they sometimes do, without resistance, though severely felt by them, they are never heard of by other people.

However, it wasn’t until 1932 that we got the modern term for exercising market power on the purchasing or demand side of a market: monopsony. It should come as no surprise that it was invented by Joan Robinson (with help from classicist B. L. Hallward) and first utilized in her Economics of Imperfect Competition.

It is necessary to find a name for the individual buyer which will correspond to the name monopolist for the individual seller. In the following pages an individual buyer is referred to as a monopsonist.

Still, within mainstream economics, the idea that employers would operate as monopsonists—and therefore exercise power in setting workers’ wages—was mostly considered irrelevant, either overlooked or considered to be a minor exception (as, e.g., in the stereotypical “company town”) to the rule of perfectly competitive markets.

Now, however, that seems to have changed. The combination of slow wage growth, obscene and still-increasing inequality, and growing concentration among corporations in the production and selling of commodities (the classical case of monopoly) has put monopsony back on the agenda—at least for the President’s Council of Economic Advisers (pdf).

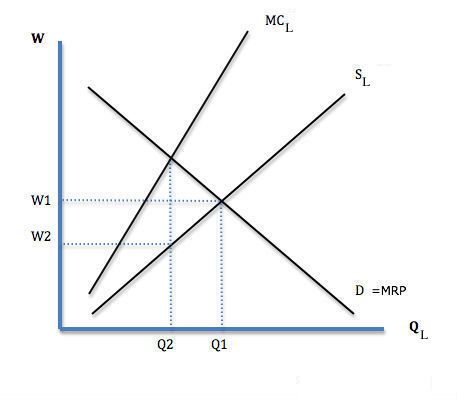

Monopsony in the labor market serves an important explanatory role for Jason Furman and the other members of the Council because it creates a situation in which both wages (W2) and employment (Q2) are lower than they would be in perfect competition (W1 and Q1, respectively). In consequence, as a result of the shifting of the balance of bargaining toward employers, the wage share declines and both employers’ profits and the incomes of high-level corporate employees increase.*

What this means, in terms of policy, is a series of reforms designed to move markets closer to mainstream economists’ ideal of perfect competition: anti-trust enforcement as well reforms to labor markets (such as modernizing non-compete clauses, pay transparency, and affordable health care) that enhance the ability of workers to move between employers and move closer to “normal” wages.

The problem, of course, is that the theory of labor market monopsony, which pertains to individual employers, also serves to obscure the power wielded by employers as a class. When, as the result of a complex historical process, the labor market itself is created, a large group of people is forced to have the freedom to sell their ability to work to a small group of employers, who own or have access to the financial resources to hire those workers. Under such conditions (as they are first created and then reproduced over time), even if individual employers exercise no market power at all (and take the wage as given by the market), workers’ wages are still only equal to the value of their labor power, which is less than the value workers create. Workers are, in other words, exploited—even in the absence of individual monopsony.

What monopsony does, initially, is lower the wage to a level below the value of labor power (thus making it difficult for workers to continue to sell their ability to work under customary conditions). Then, if such a condition persists, the value of labor power itself falls (as the value of the basket of goods that make up the workers’ customary standard of living declines), thus increasing the level of exploitation. That, of course, is exactly what has happened in the United States since the mid-1970s.

Enforcing anti-trust laws and reforming the labor market might lower the amount of individual employers’ power in the labor market, thus raising the price (and, perhaps eventually, the value) of labor power. But it would not eliminate the monopsony of the group of employers as a whole in relation to the working-class.

The only way to abolish that class monopsony and build a more equitable economy is to eliminate the central role and regulating principle of the labor market—by creating the conditions whereby workers are not excluded from participating in the appropriation of their surplus labor.

*It is also the case that, if there is significant monopsony in the labor market, an increase in the minimum wage (at least up to W1) will actually lead to an increase in employment (toward Q1).