From David Ruccio Right now, after Donald’s Trump surprising victory and in the midst of the messy transition, everyone is curious about how the U.S. economy will change if and when the president-elect’s economic policies are enacted.* But first things first. We need to have a clear understanding of what the U.S. economy looks like now, during the uneven recovery from the Second Great Depression. In particular, it’s important to analyze the class dimensions of that recovery, even before the new administration takes action. Why class? One reason to focus on class is because it played such an important role in Trump’s victory. Not alone, of course, but class interests, resentments, and desires did—in different ways—affect Trump’s ability to beat out his rivals in both the Republican primaries and the presidential election. The other reason is that Trump made a whole host of class promises during the course of his campaigns—promises both to working-class voters and to members of the tiny group at the top, which gave him the win (at least in the electoral college). We don’t know, of course, if Trump will keep those class promises. A lot depends on the balance of power inside and among the administration, the Republican Congress, and the Democratic opposition, not to mention the debates and struggles by groups and movements outside the corridors of power.

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

Right now, after Donald’s Trump surprising victory and in the midst of the messy transition, everyone is curious about how the U.S. economy will change if and when the president-elect’s economic policies are enacted.*

But first things first. We need to have a clear understanding of what the U.S. economy looks like now, during the uneven recovery from the Second Great Depression. In particular, it’s important to analyze the class dimensions of that recovery, even before the new administration takes action.

Why class? One reason to focus on class is because it played such an important role in Trump’s victory. Not alone, of course, but class interests, resentments, and desires did—in different ways—affect Trump’s ability to beat out his rivals in both the Republican primaries and the presidential election. The other reason is that Trump made a whole host of class promises during the course of his campaigns—promises both to working-class voters and to members of the tiny group at the top, which gave him the win (at least in the electoral college).

We don’t know, of course, if Trump will keep those class promises. A lot depends on the balance of power inside and among the administration, the Republican Congress, and the Democratic opposition, not to mention the debates and struggles by groups and movements outside the corridors of power. But, even before the new alliance assumes control, we need to make sense of the class dynamics that at least in part have defined the U.S. economy during the two terms of the Obama administration.

What is most striking about the economic situation over the course of the past eight years is that, while economic policymakers managed to created the conditions for capitalism to recover from its worst set of crises since the First Great Depression, it has otherwise been pretty much business as usual. What I mean by that is the economic recovery has mostly assumed the same shape and features that characterized the U.S. economy before the crash of 2007-08.**

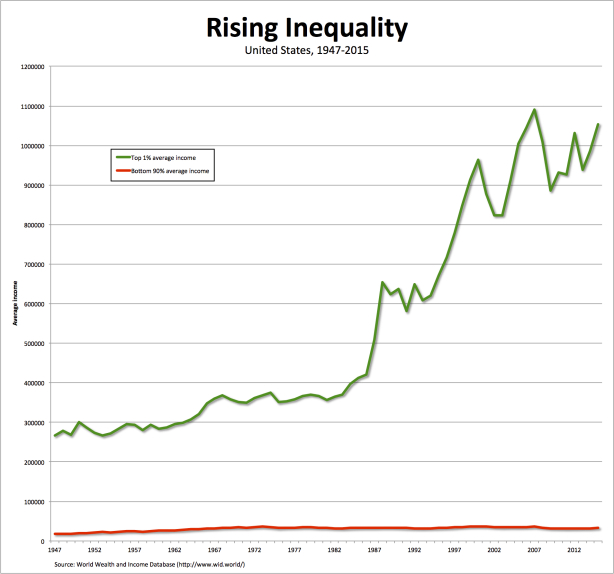

That’s not to say nothing has changed (a point to which I will return in a future post). But the fact that the benefits of the recovery have been captured mostly by those at the top, and left pretty much everyone else behind, is exactly what was happening prior to the crash.

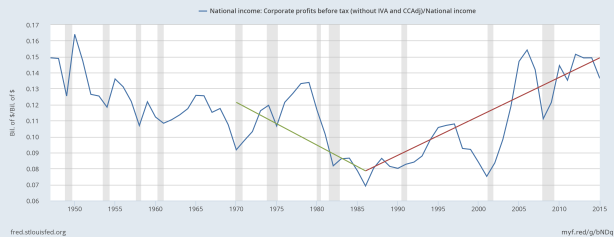

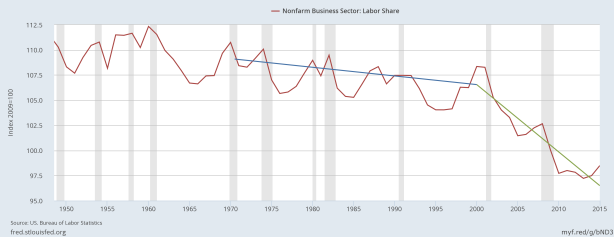

One way to see this in particularly class terms is to examine the relationship between the “two great classes,” capital and labor. Underlying the growing gap between the top 1 percent and everyone else, which is now well known (and which I have written about many times on this blog), is the much-less-remarked-upon divergence in the capital and wage shares of national income. After the recovery began in 2009, the share of income going to corporate profits increased dramatically, from 12 percent to 15 percent (in 2014, falling slightly in 2015 to 13.7 percent). Meanwhile, the share going to workers declined by 4 percent (between 2009 and 2014, increasingly slightly in 2015 by about 1.5 percent). As readers can see from the charts above, those short-term trends represent a continuation of longer-term dynamics. The profit share had reached a low of 7 percent (in 1986)—and therefore has just about doubled (by 2015). The labor share has moved in the opposite direction for an even longer period of time, declining by about 12 percent (from 1980 to 2015).

In other words, the so-called recovery, just like the thirty or so years before it, has meant a revival of the share of income going to capital, while the wage share has continued to decline. That, in my view, is the overall class dynamic within the U.S. economy of both the decades leading up to the crash and the years of post-crash recovery prior to the elections of 2016. During both periods, U.S. corporations managed to capture the growing surplus that was being produced by the working-class—both American workers and, importantly, workers around the world.***

But that general trend isn’t the whole picture. In a future post, I will analyze some of the salient details with respect to the contrasting fortunes of both capital and labor.

*In a future post, I will look forward, to the changes in the U.S. economy that may come from the president-elect’s economic policies.

**As I see, that’s the major reason Hillary Clinton and the Democrats lost the elections—not FBI Director James Comey’s late announcement about Clinton’s emails, but their decision to embrace Obama’s economic legacy.

***Loukas Karabarbounis and Brent Neiman have documented the fact that “the global labor share has significantly declined since the early 1980s, with the decline occurring within the large majority of countries and industries.”